How To Use The Envelope Budgeting Method

How To Use The Envelope Budgeting Method

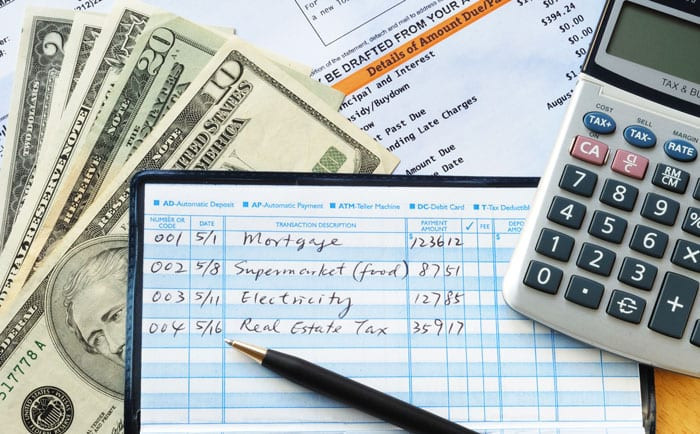

The envelope budgeting method asks you to allocate cash into separate envelopes based on a spending plan you create ahead of time. You can go ahead and pay your mortgage, utilities and other regular bills with another form of payment, but you’ll rely on actual cash in envelopes — or their digital equivalent — to pay for discretionary expenses like groceries, gas and entertainment.

Want to Start Making Money Online?

Try My #1 Recommendation Program!

What’s the benefit of envelope budgeting? According to financial coach Steven Donovan, money management is 80 percent psychology and only 20 percent math. So, the big idea is to help users build positive financial habits.

“Our eyes see the cash coming out from the envelope and we understand mentally that money is not coming back in our wallets or purses,” Donovan says. “We actually feel the money leaving our possession.” That’s much different than with a debit card or credit card, he says, since you don’t watch the money leave your possession and you may not realize the impact of your spending until later on.

Envelope budgeting is a popular budgeting method used by many business owners. This method allows you to track your spending and grow your budget by writing out your monthly expenses in envelopes. After you have set up your budget, you then use the envelope budgeting method to track your spending and see how much money you have leftover each month. This will help you to identify areas in which you need to make changes or tighten your budget.

Envelope budgeting is a simple way to manage your money. It’s a great way to predict your spending and track your progress. You can use envelope budgeting to:

- Eliminate surprises

- Make better financial decisions

- Improve your productivity

- Reduce stress

Envelope budgeting is simple: you simply create an envelope with your monthly expenses and put it in your “bring-forward folder. Once a month, you open the envelope and look at the expenses for that month. You can see where you’ve increased or decreased your expenses by using the following tracking tools:

- The Envelope Budgeting Method tracker

- EliminateSpending app

- Google Sheets.

When you start budgeting, it can be difficult to know where to start. After all, your goal is to save money, not spend more than you need to. But the envelope budgeting method can be a great way to get started. This method involves creating a budget using a simplified outline of your spending and income.

Then, using the envelopes that you receive in the mail, you will track your spending and compare it to your budgeted amount. By doing this, you will quickly see how much money you have left over after expenses have been deducted.

If you want to lose weight, you need to keep track of your food intake and Expenditure. But how do you do that in an easily-digestible way? The envelope budgeting method is a great way to do just that. By tracking your food and beverage intake, you can determine how much you’re eating and how much you’re spending. This information will help you develop a plan that fits your lifestyle and weight goals.

Envelope budgeting is one of the most popular budgeting methods used by people of all ages. It’s simple, it’s effective, and it can help you save money on your grocery bill. Here are five ways to use envelope budgeting to improve your grocery budget:

- Estimate your grocery costs and then track them over time to see how much you’ve saved.

- Use envelope budgeting to plan your weekly groceries and make grocery shopping a less stressful experience.

- Create a grocery list that uses pre-made meals or items from your pantry or fridge instead of spending hours cooking or shopping for individual items.

- Use envelope budgeting to keep track of your profits and losses in your business and make informed strategic decisions about how to grow your business.

- Use envelope budgeting as a tool for finance and accounting purposes.

What Is Envelope Budgeting?

Envelope budgeting is a budgeting method that uses envelopes to track your spending. This helps you to see how much money you have leftover each month and make changes or adjustments to your budget based on that information.

Envelope budgeting is a popular budgeting method used by many business owners. This method allows you to track your spending and grow your budget by writing out your monthly expenses in envelopes.

After you have set up your budget, you then use the envelope budgeting method to track your spending and see how much money you have leftover each month. This will help you to identify areas in which you need to make changes or tighten your budget.

Envelope budgeting is a simple yet powerful way to manage your money. It’s a simple technique that asks you to allocate specific cash into separate envelopes based on your spending plan, which can then be used to pay for discretionary expenses like groceries, gas and entertainment.

The idea is to help users build positive financial habits; by helping them set specific boundaries for their spending, they can be more mindful of how their money is being spent and make more informed decisions about where to allocate it. Easelbound offers an envelope budgeting tool that helps you manage your finances in a more effective way.

How Does Envelope Budgeting Work?

Envelope budgeting is a popular budgeting method used by many business owners. This method allows you to track your spending and grow your budget by writing out your monthly expenses in envelopes. After you have set up your budget, you then use the envelope budgeting method to track your spending and see how much money you have leftover each month. This will help you to identify areas in which you need to make changes or tighten your budget.

Envelope budgeting works by setting up a budget for the month and then using the envelope system to track your spending. You put all of your expenses in one envelope and then use the budget to track your spending. This will help you to identify areas in which you need to make changes or tighten your budget.

Envelope budgeting is a popular way to manage your finances. It asks you to allocate a certain amount of money into separate envelopes based on an agreed-upon spending plan. Envelope budgeting allows you to pay for discretionary expenses with cash, instead of relying on other forms of payment. This helps you stay on track and keep your finances in check.

How To Use The Envelope Budgeting Method To Track Your Spending

To use the envelope budgeting method to track your spending, you will need to create a budget and follow it. Once you have set up your budget, you will need to use the envelope budgeting method to track your spending. This will help you to see how much money you have leftover each month and identify areas in which you need to make changes or tighten your budget.

To use the envelope budgeting method, you need to have a budget, set up your monthly expenses, and then use the envelope budgeting method to track your spending. The following steps will help you to do this:

1. Set Up Your Budget

This is the first step in using the envelope budgeting method. You need to set up a budget so that you can track your spending. This can be done by creating a simple spreadsheet or by using an online budgeting tool.

2. Use The Envelope Budgeting Method

Once you have set up your budget, you will want to use the envelope budgeting method to track your spending. This means that you will write out your monthly expenses in envelopes and then track how much money you have leftover each month. Once you have tracked your spending and saved enough money each month, you will be able to make changes to your budget and grow your finances automatically.

To use the envelope budgeting method, you first need to create a spending plan. This plan will help you track your spending and identify any areas that need more attention. Next, you need to transfer the money into separate envelopes based on your spending plan.

You can use this money to pay for groceries, gas, and entertainment using a variety of methods, but it's important to always keep an eye on your envelope budget. If you start seeing any extra expenses coming in over your budget, make sure to adjust your spending plan and add more cash into the envelopes.

Want to Find Out How To Start Your Home-Based Business?

Try My #1 Recommendation Platform!

How To Grow Your Budget Using The Envelope Budgeting Method

- Set up your budget

- Use the envelope budgeting method

- Track your spending and see how much money you have leftover each month

- Use the results of your tracking to make changes or tighten your budget.

The envelope budgeting method is a great way to grow your budget. You can use this method to track your spending and see how much money you have leftover each month. This will help you to identify areas in which you need to make changes or tighten your budget. Additionally, this method is easy to use and can be used for any type of business.

The Benefits Of Envelope Budgeting

One of the advantages of using the envelope budgeting method is that it allows you to track your spending and grow your budget without having to go through the hassle of setting up a budget and tracking everything. Additionally, this method is very easy to use. All you need is a regular old envelope and some writing utensils. You can start tracking your spending right away.

The benefits of envelope budgeting are numerous. One benefit is that it allows you to track your spending and see where your money is going. This can be helpful in identifying areas where you might need to make changes to your budget or tighten up your spending habits. Additionally, using the envelope budgeting method can help you grow your budget by comparing your current spending against what you think you could afford in the future.

One benefit of envelope budgeting is that it helps users manage their money. By setting aside specific funds for discretionary expenses, users are more likely to stick to a budget and stay within their financial means. Additionally, using envelope budgeting can also help users develop better financial habits. For example, by setting aside money each week for groceries, people are more likely to stick to a grocery budget and not spend unnecessary money on other items. This will help you save money and make better choices about what to buy.

Setting Up Your Budget

The first step in using the envelope budgeting method is setting up your budget. You will need to know what you plan to spend each month and how much money you have leftover from the previous month. You can use this information to create your envelope budget, which will help you track your spending and grow your budget.

The first step in using the envelope budgeting method is setting up your budget. This will help you to determine how much money you need to make each month in order to reach your monthly expenses. Next, you need to create your monthly expenses.

This can be a difficult task, but it can be helped by using budgeting software such as Mint or Excel. Once you have created your monthly expenses, it's time to use the envelope budgeting method. This will help you track your spending and see how much money you have leftover each month.

Once you have seen how much money you have leftover each month, it's important to make changes or adjust your budget. You can make changes to your spending goals or adjust the amount of money that you spend. By doing this, you will be able to increase your budget and grow your business.

Evaluate your spending habits and learn what items you spend the most money on. Divide that number by the number of months in a year, and that’s your budget. Now let’s look at what you budget for discretionary expenses. For example, if you budget $100 per month for groceries, but you only eat out once a month, then divide that figure by 12 months and that’s your budget for groceries. If you budget $500 per month for entertainment, but you only watch movies once a month, then divide that figure by 12 months and that’s your budget for entertainment.

Are You Tired Of Scams?

Try The Most-Trusted Training Platform To Make Money Online!

Tracking Your Spending

One of the most important steps in using envelope budgeting is tracking your spending. Once you have set up your budget and tracked your spending, it's easy to see where your money is being spent and where it could be used more effectively. You can use this information to make informed decisions about where to allocate your money next month.

To begin, open an envelope and write out your monthly expenses for the month. For example, if you spent $100 on groceries and you have a monthly budget of $50, you would write “Grocery” on one side of an envelope and “Monthly Expenses” on the other side of the envelope.

Once you have written out all of your expenses for the month, add them together and divide that amount by 12 (that is how many months in a year). When you have calculated your monthly income and expenditure, compare that figure against your planned monthly expenses. If there are any areas where you need to change or tighten your budget, then make those changes or tighten up your budget accordingly.

One of the most important aspects of envelope budgeting is tracking your spending. This will allow you to see where your money is going and make necessary adjustments. You can also use this information to develop a plan for how to spend less money in the future. Tracking your spending will help you stay on track and make informed financial decisions.

How To Use Envelope Budgeting In Your Business

Once you have set up your budget, you will need to use the envelope budgeting method to track your spending. This will help you to identify areas in which you need to make changes or tighten your budget. One way to do this is to create a monthly expenses list.

Once you have a list of all of your monthly expenses, you can use the envelope budgeting method to track your spending and see how much money you have leftover each month. This will help you to identify areas in which you need to make changes or tighten your budget.

To use the envelope budgeting method in your business, you will need to create a budget and then use the envelopes method to track your spending. This will help you to identify where your money is going and where you can cut back on your expenses. You can also use this method to figure out how much money you have leftover each month and then grow that amount by writing out additional expenses in envelopes.

One of the best ways to use envelope budgeting in your business is to use it as a way to manage your spending. This way, you can better track where your money is going and make decisions about how much to spend on different projects based on those findings. For example, if you know that you’re spending more than your allotted budget, you can start to lower your spending in order to save money.

Another great way to use envelope budgeting is for it as a tool for goal setting. By knowing what your top expenses are, you can create a plan for reducing or eliminating them so that you have more money left over each month. And finally, envelope budgeting can be used as a tool for stress relief. When people use envelope budgeting as a way to manage their finances, they tend to feel better overall.

One benefit of envelope budgeting is that it helps you to manage your spending more effectively. You don’t have to worry about where the money is going or how it will be spent. In fact, you can even set up a budget so that all your expenses are funded automatically based on your spending plan. This way, you won’t have to worry about anything except making sure you’re spending the right amount of money on the right things.

Want To Learn How To Create Your Own Website And Online Business?

Try My #1 Recommendation Training And Hosting Platform!

Disadvantage Of The Envelope Budgeting Method

One of the disadvantages to using envelope budgeting is that it can be difficult to track your spending. You may have to constantly remember where each penny went in order to find the relevant envelope. Additionally, it can be difficult to see how much money you’ve saved each month by using this method.

There are a few disadvantages to envelope budgeting, but the biggest one is that it can be difficult to track your spending. You need to keep track of what you spend and when you spend it, but this can be difficult to do effectively. Additionally, it’s not as efficient as using a regular bank account or debit card.

One of the biggest disadvantages of envelope budgeting is that it can be difficult to track spending. You won’t know how much money you’ve spent on something until you get a bill in the mail, and you may not have time to examine your receipts. Another disadvantage is that it can be hard to remember what you paved the way for by setting up this system in the first place.

Conclusion

Envelope budgeting is a great way to track your spending and grow your budget, but it has its own set of challenges and benefits that can be best managed by those who use it.

With envelope budgeting, you can track your spending and grow your budget in a single step! By using the envelope budgeting method, you can grow your business while keeping track of your spending so you can identify where the money is going and grow your budget accordingly.

I trust you enjoyed this article on How To Use The Envelope Budgeting Method. Would you please stay tuned for more articles to come? Take care!

JeannetteZ

Want to Learn How to Build Your Own Home-Based Online Business & Start Making Money Online From Your Comfortable Couch?

Try Wealthy Affiliate!

Your Opinion Is Important To Me

Thoughts? Ideas? Questions? I would love to hear from you. Please leave me your questions, experiences, remarks, and suggestions about How To Use The Envelope Budgeting Method, in the comments below. You can also contact me by email at Jeannette@WorkFromAnywhereInTheWorld.com.

You may also enjoy the following articles:

Practical Ways To Make Extra Money In Retirement

The Ultimate Guide To Earn Money Online

Best Personal Finance Software

All You Should Know About Cost Budgeting