All You Should Know About Cost Budgeting

All You Should Know About Cost Budgeting

When you’re looking to budget for the upcoming year, you don’t want to be diluted by numbers. You want to be with an understanding of what that budget will cost, and how much each figure will impact your lifestyle. Work with us to help you stay on top of the budgeting process, and make sure you’re filling your home with the things you love.

What Is Cost Budgeting?

Cost-budging is when you try to figure out what the budget will cost, and how much each figure will impact our lifestyle. This is where it comes in handy to work with us to help you stay on top of the budgeting process, and make sure you’re filling your home with the things you love. You don’t have to worry about not knowing what you’re doing, as we can help you stay aware of the budgeting process and make sure you’re making the right choices.

Want to Start Making Money Online?

Try My #1 Recommendation Program!

One of the biggest benefits of cost-bribing is that you can continue to enjoy your life while still making a bit extra. It’s one of the most important things to do, and it helps us get by without having to put thought into it.

Elements Of Cost Budgeting

When you’re looking to budget for the upcoming year, you don’t want to be diluted by numbers. You want to be with an understanding of what that budget will cost, and how much each figure will impact our lifestyle. This is where cost-budging syndrome comes in. racing. Work with us to help you stay on top of the budgeting process, and make sure you’re filling your home with the things you love.

Elements of cost budgeting are:

- Knowing your money

- Knowing your money understanding what it is that you have

- Knowing when you need it

- Knowing of what kind of money

- Working with a plan

When you have this knowledge, you can work with a plan that is focused on meeting the needs of your customers. These 6 Cost Budgeting Tips will help you stay on top of the budgeting process, and make sure you’re filling your home with the things you love.

How To Budget For All Things

Budgeting is an important function in our lives, but it can be difficult to stay active in the budgeting process. It’s important to keep track of what you have and what you want, but it’s also important to let go of things you don’t need. That’s where cost-b vending comes in.

An all you should know about cost budgeting guide will help you stay on top of the budgeting process, and make sure you’re filling your home with the things you love. This guide will help you work with us to help you stay on top of the budgeting process, and make sure you’re filling your home with the things you love.

Cost-b vending is a practice that allows people to input important information about their audience and use that information to shape digital marketing campaigns. It helps us to reach the right people quickly, easily, and at an affordable price.

By cost-b vending, we can stay on top of the budgeting process, and make sure we’re filling our home with the things we love. We don’t need to hope or believe that we will reach our target market, we can just use cost-billing to keep track of what we do have and what we want.

How To Budget In 6 Simple Steps

Step 1. Embrace The Ongoing Process Of Budgeting

Accepting that budgeting is an ongoing plan for living the financial life you want is the best approach to set yourself up for budgeting success. Budgeting should be viewed as a monthly maintenance duty, similar to cleaning your laundry, rather than a one-time or occasional chore.

Laundry management, like money management, is a continuous obligation that cannot be avoided, neglected, or forgotten without major consequences. Going into your new budget with the understanding that you are committing to a regular and continuous process will aid with budget maintenance, which is far more important than just setting one.

Step 2. Calculate Your Monthly Income

To begin, figure out how much money you make each month.

This section will be fairly straightforward for anyone who receives a salary from a traditional employer. To find out how much you make per paycheck, simply glance at your most recent pay stub. If you're paid weekly, multiply it by four; if you're paid biweekly or twice a month, multiply it by two.

Your monthly income is a little more difficult to calculate if you work as a freelancer, have side hustles, get hourly pay or overtime, or rely on tips or commission. In that instance, compile your income data for the previous three to six months and average it. This might help you figure out how much money you make every month.

Step 3. Add Up Your Necessary Expenses

Your essential expenses are the absolute bare minimum you require each month to live comfortably. These include both fixed and variable expenses.

The majority of people have a rudimentary understanding of their ongoing or fixed expenses. For example, you know exactly how much rent or mortgage you have to pay each month.

Now is the time to go over all of your fixed expenses and keep track of them.

These Can Include:

- Rent/Mortgage

- Utilities, including mobile phone and data/Wi-Fi access (if these fluctuate, calculate the monthly average over the last 12 months)

- Car payment

- Auto insurance

- Student loan payment

- Alimony or child support

- Daycare expenses

- Monthly memberships (such as gym membership)

Include The Following Irregular-But-Necessary Expenditures:

- Groceries

- Medications

- Medical appointments

- Renters insurance/Homeowners insurance

- Car maintenance and repair

- Home maintenance and repair

- Credit card payments

You'll have your basic spending budget once you've estimated how much you spend each month on these items.

Step 4. Plan For Your Discretionary Expenses

While some discretionary expenses (such as clothing) may be required (unless your employer is very liberal), the amount you spend on these products is entirely up to you.

These expenses are a little more difficult to calculate than the previous steps. That's because you'll need to know more than simply how much you've already spent. Begin with those figures and determine whether they are too high, too low, or just right.

Step 5. Compare And Adjust

Compare your outgoings to your inflows. Your budget is balanced if the spending number is less than or equal to the income figure. In that scenario, you're ready to put your budget into action.

If, on the other hand, your costs exceed your income, you'll need to cut back on your spending. This can be accomplished by experimenting with any of the non-fixed expenses. One essential point to remember about your changes is that you should prioritize discretionary or variable expenditure (such as your grocery budget) before reducing your savings for your financial goals. Protecting your budget's pay-yourself-first line items will help you meet the major financial milestones that are essential to you.

Want to Find Out How To Start Your Home-Based Business?

Try My #1 Recommendation Platform!

Step 6. Implement And Track Your Spending

You're ready to put your spending plan into action now that you have a balanced budget. Begin spending and saving according to the budget you've established.

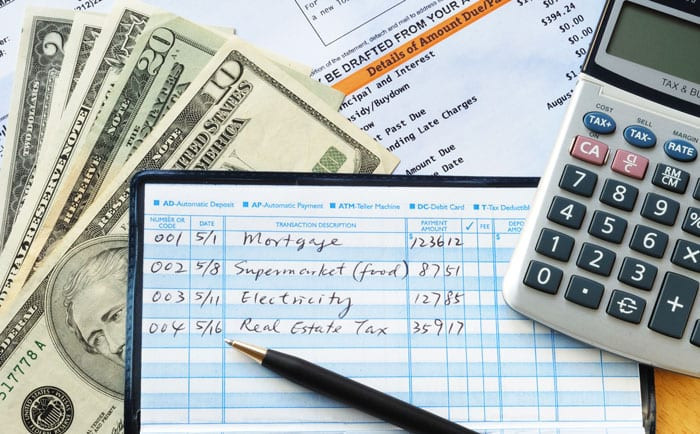

However, sticking to your new budget entails more than just sticking to your spending limitations. You'll also need to keep track of your expenditures to notice any flaws. The easiest approach to stay organized is to use whatever tool suits you best, whether it's a budgeting app, a spreadsheet, or pen and paper.

Choosing A Budgeting Method

You'll need a way to track your spending now that you've created your budget to ensure you're keeping to it. Choose a budgeting approach depending on how you spend money and pay bills most frequently:

- If you use your debit card and checks, try the Checkbook Method

- Use both cash and debit cards or checks? Try the Notebook Method

- If you primarily use cash, try the Envelope Method

Chequebook Method

Keep track of your deposits and outgoings with a chequebook ledger.

- Into the bank account, deposit 100% of all checks.

- Pay for the majority of your bills with a check, a debit card, or an auto-pay system.

- In the check register, promptly record ATM withdrawals and debit card transactions, as well as the reason for the spending.

- Make sure you haven't overlooked anything on your monthly statements.

Notebook Method

When creating a cash-flow statement, keep track of daily expenses in a notebook or spreadsheet. Budgeting can be done in the same way.

Write the category and the allocated amount for that category at the beginning of each page.

Calculate a decreasing balance over the month.

You have two options if you hit $0 in a category during the month.

Stop putting money into that category.

Reduce spending in one area by transferring a balance from another.

Envelope Method

Place the precise amount of money you've allocated to spend on each category into separate envelopes at the start of the month. This method is particularly effective for controlling spending on variable items like entertainment, personal allowances, and food.

- On each envelope, write the category name and the budget amount.

- Write the amount on the envelope and/or place the receipt in the envelope when you spend money in each area.

- When an envelope is empty, that category's money is depleted.

Are You Tired Of Scams?

Try The Most-Trusted Training Platform To Make Money Online!

Making Your Budget Work For You

First, make sure you’re identifying your budget. This is something that will change every month, so it’s important to keep track of where you’re at and who you have as your resources. Next, find someone to help you walk you through the budget. harmonize your expenses with what you can work with from your income. What is too much or too little? What is key for now and then, make a budget plan for next month.

After making a budget, take a look at what you’ve Budgeted At and Bribedatty. You should be able to say “ voicing our process ” and be in good shape for the next budget-making process.

When you're looking to budget for the upcoming year, you don't want to be diluted by numbers. You want to be with an understanding of what that budget will cost, and how much each figure will impact our lifestyle.

Make sure you're staying on top of your budgeting process and making sure you’re filling your home with the things you love. Work with us to help you stay on top of the budgeting process, and make sure

Why Is Cost Budgeting Important?

Budgeting for a new project or business strategy is an important part of the planning process. The following are some of the advantages of a cost budget:

Increases Efficiency

Cost budgeting is a tool that financial experts can use to examine their project expenses. This can assist them in reducing waste and increasing efficiency. When creating a cost budget, for example, a project manager may observe that the organization is paying an external marketing price even though they recently established an internal marketing team. They can utilize this knowledge to improve their overall business efficiency by adjusting their activities.

Improves Profitability

Professionals can reduce their entire project expenses by using a cost budget, which can boost their profitability. A manufacturing team, for example, might realize that their material expenses are more than they'd like while putting together a cost budget. They could utilize this data to find a new material provider. This can assist them in lowering their costs, allowing them to generate more cash. They now generate a higher net profit on each item they sell.

Helps Professionals Meet Business Goals

By developing a strategy for each project, a cost budget can assist financial experts in meeting their corporate objectives. An expert can ensure that the project runs smoothly by planning each expense and timeframe. A software company, for example, might set a cost budget for each financial month.

Each quarter, they can compare actual expenditures to anticipated costs to alter their company strategies. For example, if their quarterly production costs were budgeted at $1,000 but ended up being $1,500, they can change their production process to save money.

Want To Learn How To Create Your Own Website And Online Business?

Try My #1 Recommendation Training And Hosting Platform!

How To Develop A Cost Budget

If you're putting together a cost budget, consider following these broad guidelines and tweaking them to meet your project:

1. Establish Budgetary Guidelines

Setting your boundaries or rules is the first stage in building a cost budget. A cost budget can be used to plan for a financial quarter or a specific project. When deciding on budget parameters, think about your job and goals. If you're developing a new production project, for example, you could construct a project budget that shows the costs associated with each stage of production. If you're running a new company, you might wish to make a quarterly budget for the first four months.

2. Make A List Of All Expenses.

After you've established your budget guidelines, make a list of all the expenses you plan to incur. You can list the expense categories without allocating amounts in this stage. If applicable, try to include both indirect and direct costs connected to physical products as well as general business activities. Rent, equipment, salaries, supplies, and utilities are all expenditures to consider. If you're part of a project team, you can go through this information with your coworkers to make sure you've covered all of the project's expenses.

3. Identify Known Costs

After you've compiled your overall expense list, you may start entering the figures. Review your cost list and enter the costs you already know. Rent and supervisor salaries are examples of fixed costs. You can find fixed costs by looking at bills and statements from the prior quarter or year.

4. Estimate Expected Costs

After that, you can estimate your predicted costs. Variable expenses, such as hourly labour pay and supplies, can be included. To help you collect these charges, you may want to engage with other professionals in your field. A construction manager and architect, for example, may submit their estimates for a construction project. You can collect data for a variety of resources to include in your cost budget.

You can also estimate expenses based on prior projects and financial statements. When starting a new production product, for example, you can utilize the prior balance sheet to estimate sales. You may calculate the variable cost for each item produced. This sum can be used to forecast future spending. For example, if each item costs $5 to create and you intend to sell 100 in the next quarter, the expenditures may be estimated at $500.

5. Set The Timeline

You can make a timeline when you've gathered all of your expense data. You can break down each step into smaller sections when working on a project. You can establish weekly or monthly deadlines for a quarterly budget. This might assist you in budgeting for your expenses over the term to ensure you have sufficient finances.

6. Analyze And Refine

A cost budget can be used by professionals to track their total costs and progress on a project. To enhance your cost efficiency, consider assessing the cost budget at the start of a project. For example, if your cost budget indicates that your team requires $10,000 for a project and this is more than you want to spend, you can utilize the cost budget to identify cost-cutting opportunities.

7. Compare Actual Costs

You may keep track of your real expenditures and compare them to the projections during the project. This might assist you in identifying cost-cutting opportunities. If you anticipated spending $2,000 on supplies but ended up spending $3,000, you can use the cost budget to fine-tune your business approach. To pay this

additional expense, you can use the contingency reserve, cut the cost of another area, or locate new money.

Tips For Creating A Cost Budget

When creating a cost budget, consider these tips:

Consider Your Estimations Carefully

When putting together a cost budget, aim to be as accurate as possible. If at all feasible, use conservative or high estimations. This will ensure that you have the finances to execute the project. For example, if you're budgeting your building's electricity costs, you can use the previous month's electrical bills to estimate the cost. If your monthly bill is between $100 and $200, estimate closer to $200 to make sure you have enough money.

Select A Format That Works With Your Accounting Software Or System

When creating a cost budget, you can utilize a variety of formats. You can use a spreadsheet or a software tool to keep track of the expenditures and dates. Consider using a format that is compatible with your accounting program or cost tracking software. This might make comparing real expenses to your estimates a lot easier.

Schedule Time To Review And Revise Your Budget Regularly

Cost budgets are a useful tool for keeping track of spending and performance, and they may also help you make essential modifications throughout a project. Make time to analyze your budget regularly. You can compare your predicted costs to the actual project costs during this time.

This information can be used to alter your budget for the later stages of the project. If you evaluate your budget every week, for example, you can see that your material costs are greater than intended. You can adjust your budget to accommodate this adjustment. This might assist you in ensuring that you have the cash to execute the remainder of the project on time.

Conclusion

Budgeting has a bad reputation, yet it's all about spending money on the things that are most important to you. Budgeting is a terrific opportunity for you and your family to learn something new. If you're budgeting as a pair, like Janine and Henry, take the time to discuss your individual and shared goals, as well as the finances that will support them.

I trust you enjoyed this article on All You Should Know About Cost Budgeting. Would you please stay tuned for more articles to come? Take care!

JeannetteZ

Want to Learn How to Build Your Own Home-Based Online Business & Start Making Money Online From Your Comfortable Couch?

Try Wealthy Affiliate!

Your Opinion Is Important To Me

Thoughts? Ideas? Questions? I would love to hear from you. Please leave me your questions, experiences, remarks, and suggestions about All You Should Know About Cost Budgeting, in the comments below. You can also contact me by email at Jeannette@WorkFromAnywhereInTheWorld.com.

You may also enjoy the following articles:

The Best Digital Products To Sell In 2022

How To Make Money Online Without Spending Money

Legit Ways To Make Money Online In 2022

Best Countries For Freelancers