How To Build A Personal Budget

How To Build A Personal Budget

Even if you don't use a budget spreadsheet, you'll need the means to keep track of where your money goes each month. Using a template to create a budget might help you gain control over your finances and save money for your objectives. The key is to find a method of keeping track of your money that works for you.

You'll need a budget if you want to keep track of your spending and achieve your financial objectives. A personal or household budget is a breakdown of your income and spending for a certain time period, usually one month. While the term “budget” conjures up images of controlled expenditure, it is not necessary for a budget to be efficient.

Want to Start Making Money Online?

Try My #1 Recommendation Program!

A budget will show you how much money you plan to receive in, as well as your mandatory costs (like rent and insurance) and discretionary spending (like entertainment or dining out). Rather of seeing a budget as a hindrance, think of it as a tool for accomplishing your financial objectives.

A monthly budget is a written financial planning tool that helps you to plan how much money you'll spend or save each month. You may also keep track of your spending patterns. Making a budget may not seem like the most thrilling activity (and it is for some), but it is an essential element of keeping your financial home in order.

Because budgets are based on balance, this is the case. Spending less in one area allows you to spend more in another, save for a significant purchase, develop a “rainy day” fund, boost your savings, or participate in wealth creation.

A monthly budget is a strategy for balancing your income and spending in order to meet your long-term financial objectives. When you make a personal budget, you divide your monthly costs into areas that will help you better understand your spending habits—and how to change them to achieve your objectives.

A personal budget that you examine on a regular basis is an important aspect of financial literacy and the most effective approach to avoid overspending. A budget may help you get out of the red and into the black if you've ever found yourself in the difficult position of overdrawing your accounts or borrowing money.

Making a budget is an excellent method to keep track of where your money goes each month and is an essential step in putting your finances in order. A budget may help you meet financial goals like saving for an emergency fund or a down payment on a property.

While creating a budget may seem to be a challenging undertaking, it is not. Plus, once you have one, you've completed most of the work and may make small adjustments when your spending habits or income change. To begin started, there are a plethora of websites and budgeting tools to choose from, or you may make your own spreadsheet.

Step 1: Make A Record Of Your Net Income

Identifying the amount of money, you have coming in is the first step in developing a budget. Keep in mind, though, that if you think of your overall pay as what you have to spend, it's easy to overestimate what you can afford.

When establishing a budget spreadsheet, remember to remove your Social Security, tax, 401(k), and flexible spending account amounts. The amount you should use to create a budget is your net income, which is your ultimate take-home pay.

Want to Find Out How To Start Your Home-Based Business?

Try My #1 Recommendation Platform!

Step 2: Keep Track Of Your Expenses

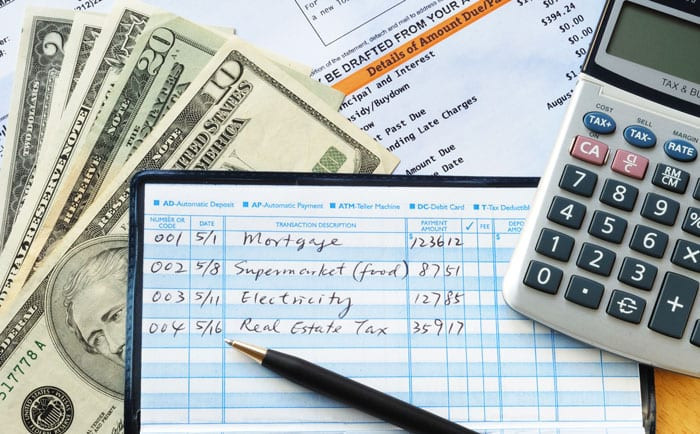

Keeping track of and categorizing your expenditures will help you figure out where you can save money. This can help you figure out where you spend the most money and where you can save the most money. To begin, make a list of all of your fixed costs. These are monthly bills such as rent or mortgage payments, utility bills, or automobile payments.

Although it's doubtful that you'll be able to eliminate them, knowing how much of your monthly money they consume may be useful. Next, make a note of all your variable costs, such as food, petrol, and entertainment, which might fluctuate from month to month. This is an area where you may be able to save money. Credit cards and bank statements are fantastic places to start since they itemize and classify your monthly expenses.

Step 3: Make A List Of Your Objectives

Make a list of all the financial objectives you want to achieve in the short and long term before you start sorting through the data you've collected. Short-term objectives should be completed in less than a year. Long-term objectives, such as retirement savings or your child's education, might take years to achieve. Remember that your objectives don't have to be carved in stone, but determining your priorities before beginning to build a budget can assist you. For example, if you know your short-term aim is to pay off credit card debt, it may be simpler to curb spending.

Step 4: Make A Strategy

Use the list of variable and fixed costs to estimate how much you'll spend in the following months. You can estimate how much money you'll need to budget based on your fixed costs. When attempting to forecast your variable expenditures, use your previous spending patterns as a reference.

You might further divide your costs into necessities and desires. If you drive to work every day, for example, fuel is almost certainly a must. A monthly music subscription, on the other hand, can be considered a wish. When it comes to making modifications, this distinction is critical.

Are You Tired Of Scams?

Try The Most-Trusted Training Platform To Make Money Online!

Step 5: Make Any Required Changes To Your Behaviors

After you've completed all of this, you'll have everything you need to finish your budget. You may start to identify where you have money leftover or where you can cut down so that you have money to put toward your objectives now that you've recorded your income and expenditures.

The first place to look for savings is on want-to-have costs. Can you watch a movie at home instead of going to the movies? Adjust the data you've been tracking to discover how much money you can save. Evaluate your spending on necessities if you've previously altered your spending on desires.

You may need internet access at home, but do you require the quickest connection available? Finally, if the figures still don't match up, consider altering your fixed costs. It will be far more difficult and demand more discipline to do so, but a “need” may simply be a “hard to part with” on closer scrutiny. Such selections have significant trade-offs, so carefully consider your alternatives.

Step 6: Continue To Check In

It's critical to examine your budget on a frequent basis to ensure that you're on track. You may also compare your monthly costs to those of folks who have similar spending habits as you. Few aspects of your budget are fixed in stone: you may receive a raise, your spending could rise, or you might have met your goal and want to establish another one.

A monthly budget is a strategy for balancing your income and spending in order to meet your long-term financial objectives. When you make a personal budget, you divide your monthly costs into areas that will help you better understand your spending habits—and how to change them to achieve your objectives.

A personal budget that you examine on a regular basis is an important aspect of financial literacy and the most effective approach to avoid overspending. A budget may help you get out of the red and into the black if you've ever found yourself in the difficult position of overdrawing your accounts or borrowing money.

In Eight Simple Steps, Learn How To Make A Personal Budget

Step 1: Calculate Your Projected Monthly Income

Determine how much money you earn each month as the first step in budgeting. This information may be seen on your paystub if you just have one salaried job—it's the amount you take home each paycheck. You just double your paycheck amount by two if you get paid on the 15th and 30th of each month.

If you are paid monthly, multiply your paycheck amount by 26 and then divide by 12 to get the total. If you have many jobs, have inconsistent income, or are self-employed, the procedure for calculating your net income (which differs from your gross income) is somewhat different. Our comprehensive tutorial will teach you how to calculate net income.

Step 2: Make A List Of All Of Your Recurring Costs

Fixed costs are those that do not change month to month. Rent, vehicle payments, student loan payback, internet and phone bills, credit card debt payments, automated contributions into a savings account, and insurance are just a few examples. Whatever method seems most comfortable to you, write them all down on a piece of paper, fill out a budget worksheet, or create a budget spreadsheet.

Step 3: Add Up All Of Your Fixed Costs

Calculate how much you spend each month on fixed costs by crunching the figures. You may use this amount as a basis for your monthly budget since it won't fluctuate significantly from month to month. To figure out how much money you have leftover for variable expenditures, subtract your total fixed expenses from your net income.

Want To Learn How To Create Your Own Website And Online Business?

Try My #1 Recommendation Training And Hosting Platform!

Step 4: Make A List Of All Of Your Variable Costs

Groceries, restaurants, shopping, exercise courses, and presents are examples of variable costs that differ from month to month. Check your receipts, internet banking, and credit card statements to estimate your variable spending (and don't forget about applications like Venmo and PayPal!).

Make a list of everything you spent money on in the last month that wasn't a fixed expenditure. Even though these figures can fluctuate month to month, beginning with last month's purchases should provide you with a good idea of your spending patterns.

Step 5: Add Up All Of Your Variable Costs

Add together all of your variable expenditures and divide by the entire amount of money you spend on fixed expenses. Is that figure higher or lower than your overall net income? You're living above your means if it's more.

Step 6: Organize Your Monthly Spending By Category

Sort your fixed and variable costs into categories now that you have your lists. To discover more about your individual spending patterns, you may utilize both broad categories, such as “food,” and specific subcategories, such as “restaurants,” “groceries,” and “coffee.”

Step 7: Examine Your Purchasing Patterns

Total your expenditures in each category. Divide your total expenditure per category by your net income and multiply by 100 percent to find out what percentage of your income you spent on each. Calculating percentages might help you figure out how much of your money is going where.

Step 8: Review And Revise Your Financial Objectives

Now that you have your expenditures in front of you, it's time to review your financial objectives and make any necessary budget adjustments. Identify places where you may save money if you're spending more than you earn.

Constant expenditures are simpler to eliminate than variable expenses; nevertheless, if you are significantly overpaying on fixed expenses, it may be difficult to compensate.

Consider a less costly housing alternative, such as living with roommates, if you are overpaying on rent. Discover how living in a Bungalow shared house may help you save money month after month. Congratulations if you have money left over at the end of the month! As a result, you'll be able to put more money into savings.

Make a new target for next month's expenditure next to each category's total. Congratulations! You now have a monthly budget that you may use to plan your expenditures for the next month.

There are three budgeting tactics that might assist you in saving money. Don't panic if you've calculated your net income and typical expenditure but aren't sure how to transform that information into a budget. There are several budgeting methods available. Here are some of the most well-known:

- The rule of 50/30/20: One of the most common budgeting approaches is the 50/30/20 rule. This budgeting strategy divides your expenses into three categories: necessities, non-essentials, and savings. Then it recommends allocating 50% of your budget to necessities, 30% to non-essentials, and 20% to savings.

- Zero-based budgeting: Unlike conventional budgets, which are based on an estimate of how much money you'll earn each month, zero-based budgeting uses the revenue from the previous month to cover all of your expenses for the current month. The “zero” refers to the concept of assigning a particular duty to each dollar, resulting in a total of zero dollars at the end of the month.

- The envelope method: For persons who have trouble keeping to a budget, the envelope system may be a useful solution. Every time you are paid, you take out cash using the usual envelope approach. The money is divided into envelopes for each budget category. That's it when an envelope runs empty. If cash isn't an option for you, there are programs like Goodbudget that convert this approach to the digital world.

6 Financial Techniques That Can Help You Succeed

You can't use a budget if it's sitting in a drawer. Here are some tips for making your budget work for you rather than against you.

- Make a list of objectives. If your objectives are precise, rather than merely “save money,” you'll be far more likely to adhere to your budget. To monitor your progress, create separate savings accounts for each financial objective, and if you're attempting to cut down in some areas, assign yourself a specific dollar amount to work with.

- Make little adjustments. If reviewing your expenditures from the previous month has convinced you that you need to make significant cuts in certain areas, don't attempt to do it all at once. Instead, gradually reduce your expenditure in that area month by month to smooth the adjustment.

- Determine what is most important to you. Budgeting is a terrific opportunity to assess what's important to you and make sure you're spending your money on those things. Spend your money guilt-free on those things, and cut down on the things you don't need. It will be simpler to keep to your budget if it reflects your principles.

- Make use of the tools that are most effective for you. Choose a budgeting tool that works for you, whether it's a pen-and-paper ledger that you write in every day, a personalized budget spreadsheet, or an app that keeps track of everything for you, to set yourself up for success. The tools are supposed to assist you; if they annoy you more than the budgeting process itself, it's time to switch.

- Automate and monitor. Setting up automatic payments to your savings and retirement accounts is the greatest approach to ensure you don't spend the portion of your income set aside for savings. Automating payments is an excellent strategy to avoid falling behind on critical expenses. Every month, review your automatic invoices and payments to ensure you aren't being overcharged.

- Examine your financial situation. Setting aside time each week to review your finances will allow you to make adjustments to your expenditures as the month progresses. It also eliminates the issue of purchases you don't recall making. Because your budget is a live document, review it at the end of each month and make any required modifications.

I trust you enjoyed this article on How To Build A Personal Budget. Would you please stay tuned for more articles to come? Take care!

JeannetteZ

Want to Learn How to Build Your Own Home-Based Online Business & Start Making Money Online From Your Comfortable Couch?

Try Wealthy Affiliate!

Your Opinion Is Important To Me

Thoughts? Ideas? Questions? I would love to hear from you. Please leave me your questions, experiences, remarks, and suggestions about How To Build A Personal Budget, in the comments below. You can also contact me by email at Jeannette@WorkFromAnywhereInTheWorld.com.

You may also enjoy the following articles:

Investing For Beginners – How To Save Millions For Future

Everything You Need To Know About Financial Literacy