Best Payment Options For Small Business

Choosing the right payment options for a small business is essential for success. The proper payment methods improve customer satisfaction, streamline operations, and increase cash flow.

In today’s fast-moving market, offering flexible, secure, and convenient payment options for small businesses sets you apart from competitors.

For small business owners who desire expansion, effectiveness, and satisfied clients, this guide examines the finest payment choices.

Payment Options For Small Businesses

Understanding the range of traditional and digital payment methods helps businesses choose options that suit their customers, sales channels, and operational needs—balancing convenience, security, and cost for optimal transactions.

1. Traditional Payment Methods

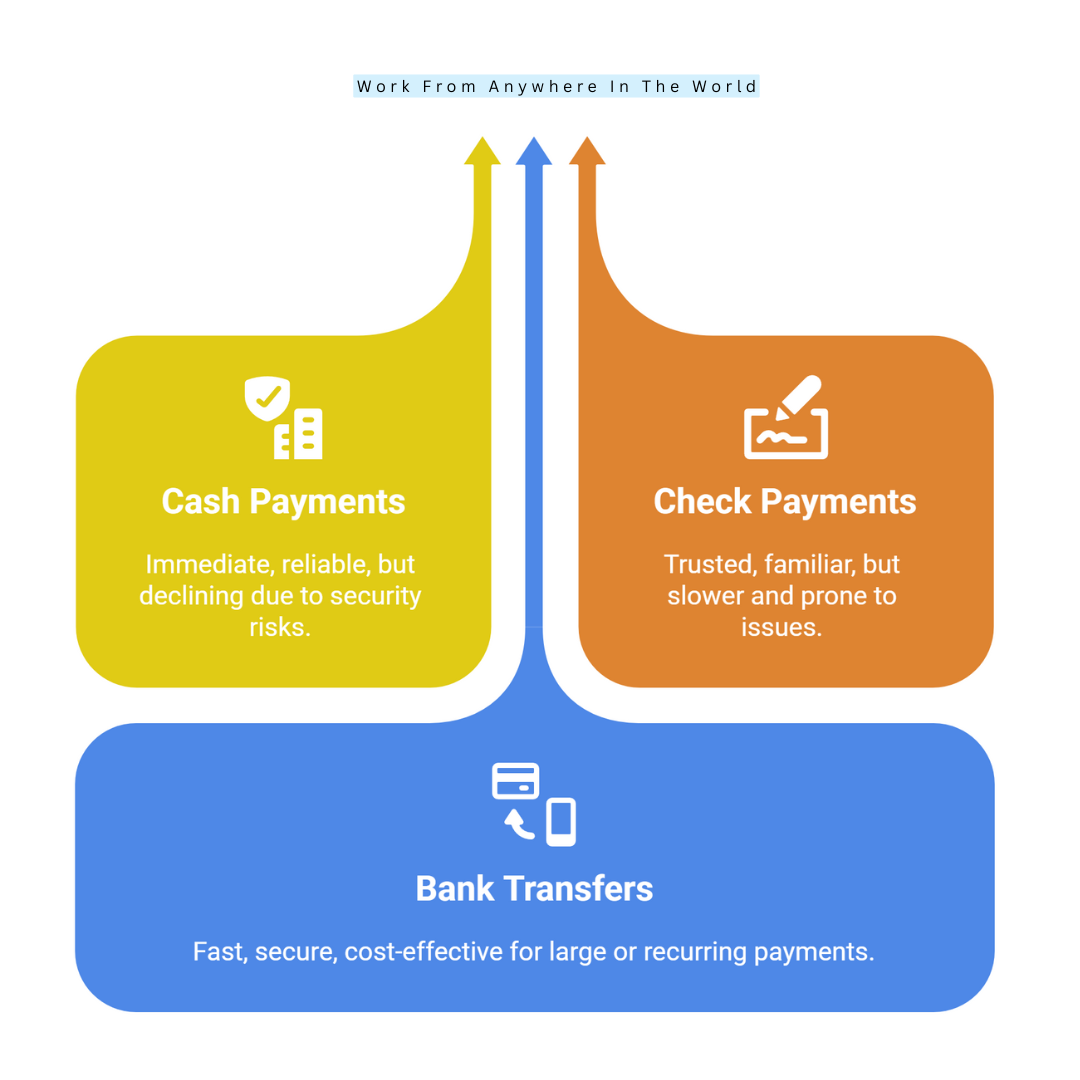

Cash

Cash payments involve customers physically handing over currency to the business. This method provides immediate payment with no processing fees, making it straightforward and reliable for small or local transactions.

However, cash poses security risks like theft or loss and offers no automatic digital record, which can complicate bookkeeping and reconciliation.

Its use is declining, especially in urban or tech-savvy markets, but it remains essential in rural or underserved areas. Setting up cash payments requires minimal equipment beyond a cash register or secure cash box and strict handling procedures to ensure accuracy and security.

Checks

Payment by check means the customer writes a paper check to the business, which is then deposited and cleared through the bank.

This method is familiar and trusted by certain customer groups, especially older generations and B2B clients. Checks, however, are slower to process and carry risks such as bounced payments due to insufficient funds.

Handling checks is manual and requires physical deposit trips or mobile check deposit apps to speed processing. To accept checks, businesses need a bank account and clear policies for verifying funds and recording payments to prevent delays or fraud.

Bank Transfers (Wire & ACH)

Funds can be electronically sent directly from the customer's bank account to the company's bank account. Fast and secure, wire transfers are best suited for significant or urgent payments, although they typically come with higher fees.

Although they can take a few days to clear, ACH transfers are economical and perfect for regular payments. Accurate bank details must be shared with customers to avoid delays or errors.

Businesses need to provide account and routing numbers and often use online banking portals or integrated accounting tools to track incoming transfers and reconcile payments efficiently.

2. Digital Payment Method

Credit And Debit Cards

One of the most widely used payment options for a small business is accepting credit and debit cards, offering speed, security, and global accessibility.

These methods are highly popular because they provide fast, convenient, and secure transactions accepted globally.

However, businesses face processing fees ranging from 1.5% to 3% per transaction and must be prepared for potential chargebacks, where customers dispute charges.

To accept card payments, businesses typically need a merchant account or payment processor like Square or Stripe, along with compatible POS hardware or eCommerce plugins.

Compliance with PCI-DSS standards is crucial to protect cardholder data and reduce fraud risk.

Mobile Wallets (Apple Pay, Google Pay, Samsung Pay)

Mobile wallets enable customers to pay using their smartphones or wearable devices through NFC technology, offering contactless, fast, and secure transactions.

These wallets often integrate loyalty programs and promote a seamless checkout experience, especially favoured by younger, tech-savvy shoppers.

However, businesses need updated POS systems compatible with mobile payments and staff familiar with the technology. Adoption may be slower among less tech-literate customers.

Setting up requires a POS terminal that supports NFC payments, and sometimes registering with payment providers that facilitate these wallet transactions.

Peer-to-Peer (P2P) Apps (Venmo, Cash App, Zelle)

Without requiring conventional merchant accounts, P2P payment apps enable instantaneous money transfers for both individuals and small enterprises.

These apps are ideal for freelancers, micro-businesses, and service providers who want fast payments without setup complexity.

However, they are designed primarily for personal use and may lack detailed reporting or invoicing features. Some platforms limit commercial usage or impose transaction caps.

To use P2P apps, businesses need only download the app, link a bank account, and share their payment handle with customers, making it a quick and low-cost payment option.

Online Payment Gateways (PayPal, Stripe, Square)

Online payment gateways facilitate eCommerce by securely processing credit cards and other digital payments on websites or apps.

They offer easy integration with shopping carts, built-in invoicing, and global reach, making them ideal for freelancers and online stores.

While setup is straightforward, fees typically start around 2.9% plus a small fixed amount per transaction. Funds may be temporarily frozen if disputes arise, affecting cash flow.

Setting up requires creating an account with the gateway provider, linking a bank account, and installing integration plugins or APIs on your website.

Cryptocurrency

Accepting cryptocurrency payments involves customers transferring digital currency like Bitcoin or Ethereum directly to a business’s crypto wallet.

This method offers low transaction fees and borderless payments, appealing to tech enthusiasts and international buyers.

However, crypto’s volatility means the value can fluctuate rapidly, posing financial risks. Regulatory uncertainty and limited mainstream adoption also limit usability.

Businesses need to set up a secure digital wallet and often use third-party payment processors that convert crypto to fiat currency instantly, simplifying acceptance while minimizing exposure to market swings.

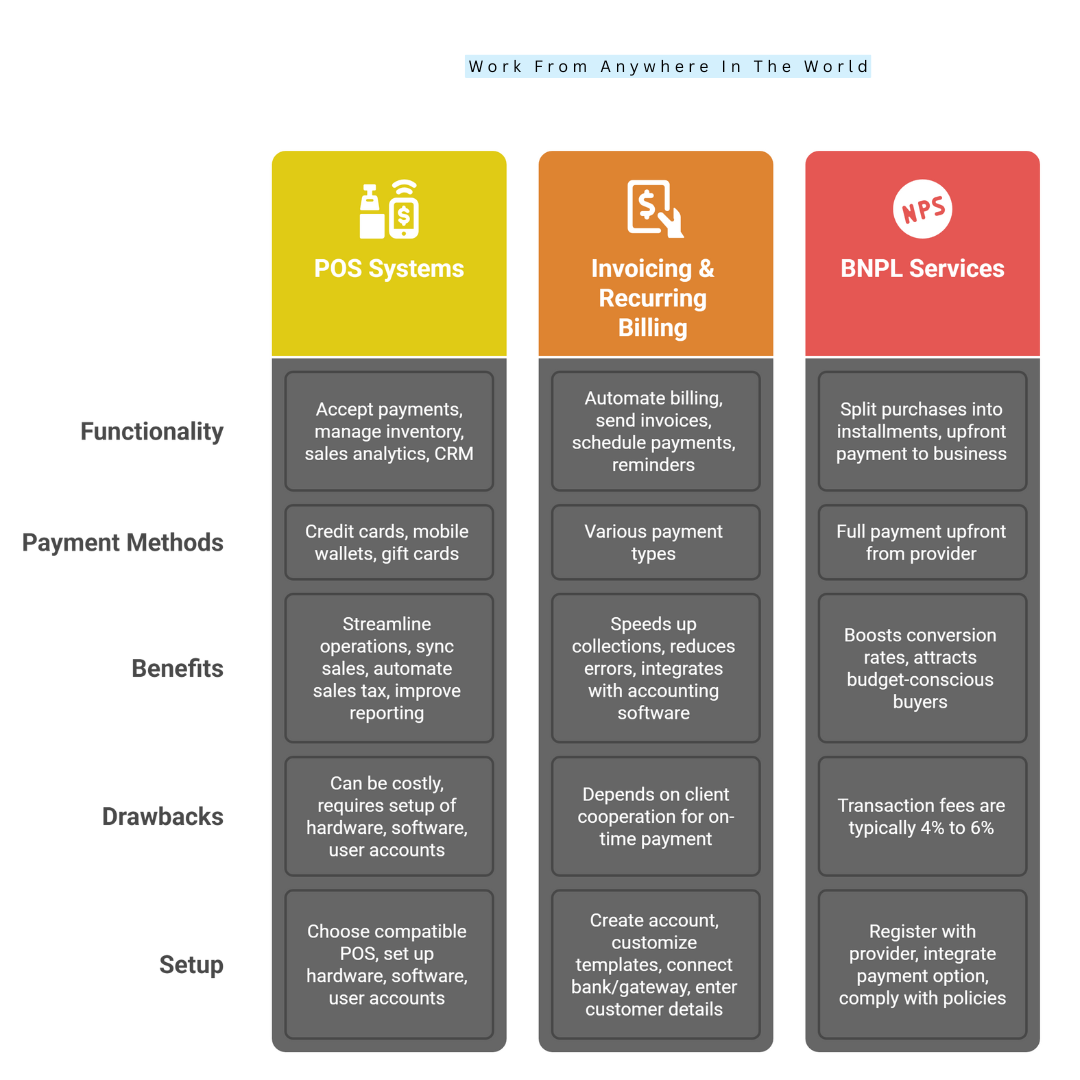

3. Point-of-Sale (POS) Systems

Modern point-of-sale (POS) systems combine hardware and software to handle inventory, sales information, and customer contacts. They also accept several payment methods, including credit cards, gift cards, and mobile wallets.

A modern POS system can enhance payment options for a small business by supporting diverse methods while streamlining sales, inventory, and customer management.

Entry-level plans may start free with a transaction fee of around 2.6% plus a fixed charge, while advanced options can cost up to $300 monthly, offering more features.

Businesses must choose a POS compatible with their needs and set up hardware, software, and user accounts to get started.

4. Invoicing & Recurring Billing Tools

Invoicing and recurring billing tools help service providers and subscription businesses automate billing by sending customized invoices, scheduling automatic payments, and sending payment reminders.

For smooth bookkeeping, these technologies interact with accounting software such as Wave or QuickBooks, speed up collections, and lower manual errors.

They can accept various payment types, enhancing flexibility. However, success depends on client cooperation, as automated reminders don’t guarantee on-time payment.

Setup involves creating an account with the invoicing platform, customizing invoice templates, connecting bank or payment gateway accounts, and entering customer details for recurring billing.

5. Buy Now, Pay Later (BNPL) Services

BNPL platforms like Afterpay, Klarna, and Affirm allow customers to split purchases into interest-free installments while the business receives full payment upfront from the provider.

This boosts conversion rates by attracting budget-conscious buyers who prefer manageable payments. Businesses bear no default risk but typically pay transaction fees ranging from 4% to 6%.

BNPL is especially effective in eCommerce but requires integration with the shopping cart or POS system. Setup involves registering with the BNPL provider, integrating their payment option at checkout, and complying with their policies and reporting requirements.

How To Choose The Right Payment Option For Your Small Business

Selecting the best payment options for a small business helps improve efficiency, boost customer trust, and support long-term growth. Understanding key factors ensures a smooth, secure, and scalable payment experience.

1. Understand Your Customers’ Preferences

Your customers’ payment preferences significantly impact their buying experience and willingness to complete purchases.

Younger demographics often favour mobile wallets like Apple Pay or Google Pay for their speed and convenience, while older customers might prefer credit/debit cards or cash.

Conduct surveys or observe transactions to learn what your customers prefer. Offering payment options aligned with their habits boosts customer satisfaction and sales.

Ignoring popular methods may lead to lost business. Paying customs might differ significantly by location and market segment, thus keep in mind cultural and regional differences.

2. Consider Your Business Model And Sales Channels

The nature of your business heavily influences suitable payment options. For brick-and-mortar stores, cash and card terminals are essential, while e-commerce businesses need secure online payment gateways such as Stripe or PayPal.

Omnichannel companies require systems that work seamlessly across in-store and online platforms. For subscription or service-based models, recurring billing features may be crucial.

Understanding where and how your customers shop allows you to select payment methods that integrate well with your sales process, providing a smooth, consistent experience across all touchpoints.

3. Evaluate Costs And Fees

Every payment method comes with associated costs, including transaction fees, monthly fees, and hardware expenses. Typically, card payments incur 1.5% to 3.5% per transaction plus a small fixed fee, while digital wallets and BNPL services may charge varying rates.

It is crucial to review the fee structures carefully and calculate how they affect your profit margins. Lower fees might save money upfront, but may come with trade-offs in speed or convenience.

Don’t forget to consider hidden costs like chargeback fees or currency conversion charges for international sales. Choose a cost structure that balances affordability with the value you receive.

4. Assess Security And Fraud Protection

Protecting your business and customers from fraud is critical in payment processing. We appreciate you reading! The secret to a small business's expansion and client satisfaction is selecting the appropriate payment methods.

Features like encryption, tokenization, and fraud detection tools help prevent unauthorized transactions and chargebacks. Fraud not only causes financial loss but can also damage your reputation.

Additionally, consider the provider’s dispute resolution policies and customer protection mechanisms. A secure payment system builds trust, encourages repeat business, and reduces stress related to payment-related risks.

Wealthy Affiliate – Mini Review (2025)

If you’ve ever thought about turning your blog, passion, or niche into an online business,

Wealthy Affiliate (WA) is one of the most beginner-friendly platforms I’ve used.

It combines step-by-step training, website hosting, SEO research tools,

and an active community all in one place.

What I like most: you can start free (no credit card needed),

explore lessons, test the tools, and connect with other entrepreneurs

before upgrading. WA isn’t a “get rich quick” scheme — it’s a platform where success comes

from consistent effort and applying what you learn.

5. Check Integration And Ease Of Use

Well-integrated payment options for a small business can streamline operations, enhance customer experience, and simplify financial management.

This includes integrating with your POS hardware, e-commerce platforms, inventory management, and accounting software.

User-friendly payment processes for both staff and customers reduce errors and speed up checkout times. Complex or clunky systems can frustrate customers and employees alike, leading to lost sales or mistakes.

Opt for payment solutions with intuitive interfaces, clear dashboards, and simple setup. Good integration also simplifies bookkeeping and reporting, helping you manage finances more effectively.

6. Think About Payment Speed And Cash Flow

The speed at which payments settle into your business account affects your cash flow management. Some payment methods deposit funds instantly or within the same day, while others may take several days to clear.

Faster payments enable you to restock inventory, pay suppliers, and meet payroll obligations on time. Slow settlements can strain operations, especially for businesses with tight cash flow.

When choosing payment options, consider the typical processing time and whether faster fund access justifies higher fees. Some providers offer expedited payouts for an additional charge, which can be valuable during busy periods.

7. Plan For Scalability And Flexibility

Scalable payment options for a small business ensure smooth growth, adapting to increased sales, new markets, and evolving customer needs.

As you increase sales volume, add new products, or expand into new markets, your payment methods need to handle increased transaction loads and additional features.

For instance, add recurring billing for subscriptions or international payment acceptance. Flexible payment providers allow easy upgrades, multi-currency support, and new payment method integrations without major disruptions or costs.

Choosing scalable solutions prevents the hassle and expense of switching providers later, helping you maintain a smooth payment experience for your customers as your business evolves.

8. Factor In Customer Experience

A smooth, quick, and reliable checkout experience encourages customers to complete their purchases and return in the future.

Offering popular payment methods like credit cards, mobile wallets, and buy-now-pay-later options provides convenience and choice.

Features such as saved payment details, one-click checkout, and guest payment improve ease and speed. Complicated or slow payment processes cause frustration and increase cart abandonment rates.

Consider the entire payment journey, from selecting the payment method to receiving confirmation. A seamless experience fosters trust and loyalty, which are essential for long-term business success.

9. Review Customer Support And Reliability

Reliable payment systems with strong customer support are vital for uninterrupted sales. Technical issues or payment failures can lead to lost revenue and unhappy customers.

Choose providers known for responsive, knowledgeable support through multiple channels like phone, chat, or email. Also, ensure the payment system has high uptime guarantees and backup options to minimize downtime.

Fast resolution of any problems maintains smooth operations and preserves your business reputation. Reading user reviews and seeking recommendations can help identify payment providers that excel in customer service and reliability.

10. Test Before Committing

Testing and refining payment options for a small business ensures smooth transactions, minimizes errors, and improves both customer and staff satisfaction.

This helps you understand the user experience from both the merchant’s and customer’s perspectives. Train your staff thoroughly on the payment system to reduce errors and delays.

Ask for customer feedback during the initial rollout to identify pain points or confusion. Piloting payment options on a small scale lets you assess costs, integration, and usability without risking major disruptions.

Based on feedback and performance, you can fine-tune your payment setup or explore alternative solutions if needed.

How To Implement Payment Options For Your Small Business

Implementing the right payment options is essential for smooth transactions and satisfied customers. Follow these practical steps to set up, test, and optimize payment methods tailored to your small business needs.

1. Assess Your Business Needs

Evaluating your operations and customer habits is key to choosing the most effective payment options for a small business.

Determine whether you primarily sell in-store, online, or both, and consider the typical transaction size and frequency. Understanding these factors helps identify the payment methods that best fit your operational style.

For example, a café might prioritize fast, contactless payments, while an online store needs secure gateways. Knowing your needs lays the foundation for selecting suitable payment solutions that support your business goals.

2. Research Payment Providers

Explore various payment providers based on your requirements. Compare their fees, features, supported payment methods, security measures, and customer reviews.

Some providers specialize in mobile payments, while others offer comprehensive OS systems or online payment gateways. Consider ease of integration, customer support quality, and scalability.

Don’t forget to check for hidden costs like setup fees or chargeback charges. Making an informed choice ensures you select a provider that aligns with your business size, budget, and growth plans.

3. Set Up Payment Infrastructure

Once you choose a provider, set up the necessary payment infrastructure. For physical stores, this may involve installing POS terminals or mobile card readers.

For online businesses, integrate payment gateways into your website or app, ensuring PCI compliance for security. Make sure hardware and software are compatible with your existing systems.

Proper setup includes configuring payment settings, such as accepted cards, currencies, and fraud filters. A well-executed setup prevents technical glitches and facilitates smooth, secure transactions from day one.

4. Test Transactions Thoroughly

Thorough testing ensures payment options for a small business run smoothly, preventing errors and enhancing both customer and staff confidence.

Test different payment types like credit cards, mobile wallets, and alternative methods you plan to offer. Check transaction speed, receipt generation, refunds, and cancellations.

Identify and fix any issues with hardware, software, or integration. Testing helps prevent customer frustration and lost sales due to payment errors.

It also builds confidence among your staff and ensures they are familiar with the process before handling real customer payments.

5. Train Your Staff

Train employees on how to operate payment systems confidently and handle common issues. Provide clear instructions on processing payments, refunds, and troubleshooting fundamental problems.

Emphasize security protocols like card data handling and PCI compliance. Well-trained staff reduce errors, speed up checkout times, and improve customer experience.

Additionally, train your team to communicate clearly with customers about available payment options and any issues during transactions. Regular refresher training keeps everyone updated on system changes and best practices.

6. Monitor Payment Performance And Feedback

After implementation, continuously monitor payment success rates, processing times, and fees. Use provider dashboards or accounting software for insights.

Listen to what customers have to say about how easy it is to pay and about any issues they may have had. Analyze trends like cart abandonment or payment declines to identify problems quickly.

Utilize this information to increase client satisfaction, streamline your payment processes, or bargain for lower costs from suppliers.

Frequent reviews guarantee that as your company expands, your payment system will continue to be effective, safe, and in line with your goals.

Conclusion

We appreciate you reading! The secret to a small business's expansion and client satisfaction is selecting the appropriate payment methods.

By embracing flexible, secure, and easy-to-use payment options for small businesses, you’ll set your venture up for success.

Implement these solutions now and watch your small business thrive. Stay tuned for more helpful tips to grow your business with confidence.

I trust you enjoyed this article on the Best Payment Options For Small Business. Please stay tuned for more insightful blogs on affiliate marketing, online business, and working from anywhere in the world.

Take care!

— JeannetteZ

💬 Your Opinion Is Important To Me

Do you have thoughts, ideas, or questions? I’d love to hear from you. Please leave your comments below or email me directly at Jeannette@WorkFromAnywhereInTheWorld.com.

📚 More Work From Anywhere Reads

🚀 Ready to Build a Business You Can Run from Home

or from Anywhere in the World?

Imagine creating income on your terms — from home, a cozy café, or wherever life takes you.

With the right tools, training, and community support, it’s entirely possible.

Start your own online business for free — no credit card needed.

Disclosure

This post may contain affiliate links. As an Amazon Associate and participant in other affiliate programs, I earn from qualifying purchases at no extra cost to you. Please read my full affiliate disclosure.