Everything You Need To Know About Financial Health

Everything You Need To Know About Financial Health

What Exactly Is Financial Well-Being?

The status of one's own financial affairs is referred to as financial health. The amount of money you have in savings, how much you're saving for retirement, and how much of your salary you spend on fixed or non-discretionary costs are all factors in your financial health.

Understanding Your Financial Situation

Although financial professionals have developed basic standards for each sign of financial wellness, each individual's circumstance is unique.

As a result, it's important to take the time to create your own financial plan to ensure that you're on track to meet your objectives and that you're not placing yourself in too much financial danger if anything unexpected happens.

Want to Start Making Money Online?

Try My #1 Recommendation Program!

Examine Your Financial Situation

To obtain a better understanding of your financial situation, ask yourself a few crucial questions—consider this a financial health self-assessment:

- How well prepared are you for unforeseen circumstances? Have you set up money for a rainy day?

- How much money do you have? Is it a good thing or a bad thing?

- Do you have all of the necessities in life? What about the items you desire?

- What percentage of your debt, such as credit cards, would you consider high interest? Is it more than half of them?

- Do you have a retirement savings plan in place? Do you think you'll be able to achieve your long-term goal?

- Do you have sufficient health and life insurance coverage?

What Factors Go Into Determining Financial Health?

A person's financial health may be assessed in a variety of ways. The monetary resources at a person's disposal for current or future usage are represented by their savings and total net worth.

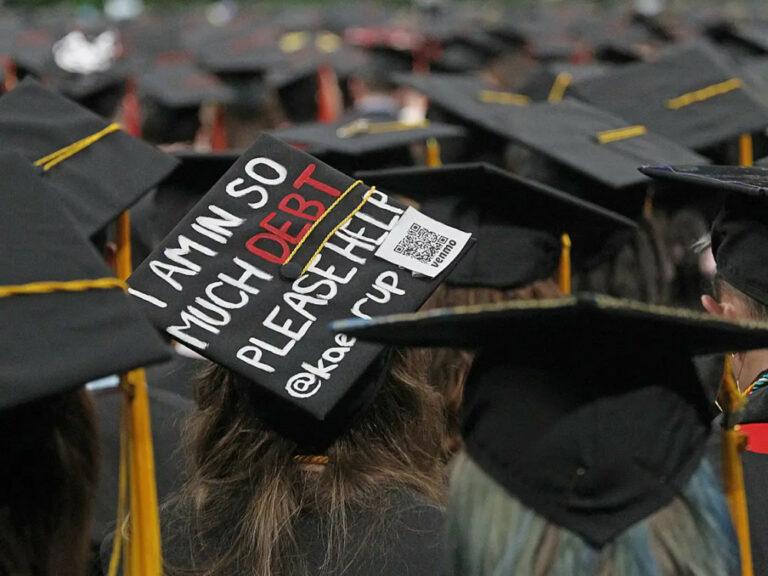

Debt, such as credit cards, mortgages, and vehicle and school loans, may have an impact on these. Financial well-being isn't a static metric. It fluctuates depending on a person's liquidity and assets, as well as the price of products and services.

For example, a person's wage may stay the same as the cost of transportation, food, mortgages, and college tuition rises. Regardless of their starting financial health, if companies do not keep up with the growing prices of products, firms may lose momentum and slide into decline.

A constant stream of income, little fluctuations in spending, great returns on previous investments, and an increasing cash balance are all hallmarks of good financial health.

Boosting Your Financial Fitness

Before you can improve your financial situation, you must first take a hard, honest look at where you are now. Determine your net worth and see where you stand. This involves removing any and all debts from whatever you possess, such as retirement accounts, automobiles, and other assets.

Budgeting

The next step is to develop a budget. It's not enough to prepare for where you'll be spending money in your budget; you also need to look at where you're actually spending money.

Are there any places where you might save money? Do you have any recurring subscriptions that you don't use, such as cable? It's fortunate that you can distinguish between your “needs” and your “wants.”

To assist with budgeting, use spreadsheets or mobile applications. Alternatively, you may utilize the tried-and-true envelope approach, which entails creating an envelope for each budget item, such as food, and storing the money in the appropriate envelope.

Sticking to your budget, regardless of whether you start producing more money or bringing in more revenue, is one of the most important aspects of budgeting and preserving your financial health.

Lifestyle creep, which occurs when you spend more money as you earn more, is bad for your financial health.

Want to Find Out How To Start Your Home-Based Business?

Try My #1 Recommendation Platform!

A Contingency Fund

Having an emergency fund may significantly improve your financial situation. The fund is intended to be money set aside and ready to use in the event of an emergency, such as auto repairs or job loss. The objective for your energy fund should be to have three to six months' worth of living expenditures.

Debt

Reduce your debt. Use the avalanche or snowball techniques. The avalanche strategy recommends paying as much as possible toward the loan with the highest interest rate while paying the bare minimum on the remainder.

Meanwhile, the snowball advocates starting with the lowest debt and working your way up to the highest debt. Each has advantages and disadvantages; choose the one that best suits your debt load and money management preferences.

Financial Health Rules And Advice

- Keeping your financial health in tip-top form isn't always straightforward when it comes to efficient personal finance. We get engrossed in the process of living. However, there are a few easy principles and ideas you may use to enhance or maintain your financial health.

- Automate your bill payment and savings—that is, set up automatic transfers to a savings account and have all of your payments paid automatically.

- Look for free checking and free accounts wherever possible.

- Comparison shop for insurance, cable, and other ongoing costs. If you already own these things, this does not apply.

- Use a budgeting strategy like 50/30/20, which states that you should spend 50% of your money on necessities, 30% on desires, and 20% on savings. If you have high-interest loans, this 20% might incorporate debt reduction.

- Try to keep your housing costs (rent or mortgage) to less than 40% of your total income.

- Invest frequently and early. To put it another way, attempt to deposit 10-15% of your salary into a retirement account.

Financial Health Of The Company

Comparable indicators may be used to examine a company's financial health in order to determine its viability as a going concern. For example, if a firm has cash on hand and income coming in, but is spending it on new production equipment, office space, new personnel, and other business services, it may raise concerns about the company's long-term financial health and viability.

If more money is spent on things that don't add to the business's overall stability and prospective development, it might lead to a downturn, making it harder to pay for necessities like electricity and staff wages. As a result, firms may be forced to freeze or reduce compensation in order to maintain operations.

Personal finance refers to how you manage your money and make financial plans for the future. Your financial health is influenced by all of your financial choices and actions. Specific rules of thumb, such as “don't purchase a home that costs more than two-and-a-half years' worth of income” or “always save at least 10% of your income toward retirement,” are often used to guide us.

While many of these adages are tried and true, it's also vital to think about what we should be doing to enhance our financial health and behaviours in general. We'll go over five major personal finance guidelines that may help you get on track to attaining your financial objectives.

1. Do The Math—Personal Budgets And Net Worth

Money comes in and money leaves. For many individuals, this is about as far as their grasp of personal money goes. Rather than neglecting your money and leaving them to chance, a little math may help you assess your present financial situation and figure out how to achieve your short- and long-term financial objectives.

Calculate your net worth, which is the difference between what you possess and what you owe, as a starting point. To figure out your net worth, make a list of your assets (what you possess) and liabilities (what you owe) (what you owe). To calculate your net worth, remove your obligations from your assets.

Your net worth reflects your financial situation at the time, and it is natural for it to vary over time. While calculating your net worth once might be beneficial, the actual benefit comes from doing so on a regular basis (at least yearly).

Tracking your net worth over time helps you to assess your progress, celebrate your victories, and pinpoint areas where you need to improve.

Creating a personal budget or spending plan is also crucial. A personal budget, which may be created weekly or annually, is an essential financial tool since it can assist you:

- Create a budget.

- Lower or eliminate costs

- Set aside money for future ambitions

- Budget carefully – Make contingency plans

- Set spending and saving goals.

There are many methods for building a personal budget, but they all require forecasting income and spending. Your budget's revenue and cost categories will vary depending on your circumstances, and they may alter over time. Examples of common sources of income are:

- Child support

- Benefits for disabled people

- Alimonies

- Bonuses

- Dividends and interest

- Royalties and rents

- Income from retirement

- Salaries and wages

- Social Security

- Tips

Examples of a general expenditure category:

- Child care

- Eldercare

- Payments on debt (car loan, student loan, credit card)

- Instruction (tuition, daycare, books, supplies)

- Recreation and amusement (sports, hobbies, books, movies, DVDs, concerts, streaming services)

- Consumption (groceries, dining out)

Subtract your costs from your income once you've completed the necessary predictions. You have a surplus if you have money left over, and you may choose how to spend, save, or invest it.

If your spending outweighs your income, you'll need to change your budget by either raising your income (working longer hours or taking on a second job) or lowering your expenses.

Do the arithmetic to properly grasp where you are financially and how to get to where you want to be: Regularly calculate your net worth as well as a personal budget.

Although it may seem self-evident to some, people's inability to plan and keep to a thorough budget is the primary cause of excessive spending and debt.

2. Recognize And Manage Inflationary Lifestyles

When people have more money, they are more likely to spend it. People's spending tends to grow as they progress in their jobs and earn larger wages, a phenomenon known as “lifestyle inflation.”

Even if you can pay your payments, lifestyle inflation may be detrimental in the long term since it restricts your potential to accumulate money. Every additional dollar you spend today means you'll have less money later in life and in retirement.

The drive to keep up with the Joneses is one of the primary reasons individuals allow lifestyle inflation to wreak havoc on their wallets. It's fairly unusual for individuals to feel compelled to spend in the same way as their peers and colleagues.

You may feel driven to drive BMWs, vacation at premium locations, and eat at high-end restaurants if your friends do. What's easy to overlook is that, in many cases, the Joneses are actually paying off a lot of debt over a long period of time in order to appear wealthy.

The Joneses may be living paycheck to paycheck and not saving a dollar for retirement, despite their financial “glow”—the boat, the nice vehicles, the pricey trips, the private schools for the kids.

Some rises in expenditure are inevitable when your career and personal circumstances change over time. You could need to improve your wardrobe to dress suitably for a new job, or you might require a home with extra bedrooms as your family expands.

With increased responsibilities at work, you may discover that hiring someone to mow the grass or clean the home makes sense, allowing you to spend more time with family and friends while also increasing your quality of life.

Are You Tired Of Scams?

Try The Most-Trusted Training Platform To Make Money Online!

3. Recognize The Difference Between Wants And Needs—And Spend Wisely

Unless you have an infinite budget, it's in your best interest to understand the difference between “needs” and “wants” so you can make more informed spending decisions.

Food, housing, healthcare, transportation, and a respectable quantity of clothes (many people consider savings as a requirement, whether it's a predetermined 10% of their salary or whatever they can manage to place away each month) are all necessities for survival. Wants, on the other hand, are things you'd want to have but don't need to survive.

It may be difficult to categorize spending as requirements or desires, and many people blur the lines between the two. When this occurs, it's simple to justify a needless or excessive purchase by claiming that it's a necessity.

An automobile is an excellent example. To go to work and transport the kids to school, you'll need a vehicle. You want the luxury edition SUV, which is twice as expensive as a more practical vehicle (and costs you more in gas).

You may attempt to justify the SUV as a “need,” since you do need a vehicle, but it's still a desire. Any price difference between a less expensive car and a luxury SUV is money you didn't have to pay.

In your personal budget, your requirements should take precedence. You should only spend discretionary cash on desires when your basic necessities have been addressed.

Again, if you have money left over after paying for the items you actually need each week or month, you don't have to spend it all.

4. Begin Saving As Soon As Possible

It is often said that it is never too late to begin planning for retirement. That is technically correct, but the sooner you begin, the better off you will be in your retirement years.

This is due to compounding's potency, which Albert Einstein dubbed the “eighth wonder of the world.” Compounding is the process of reinvesting profits and is most effective over time. The bigger the value of the investment and the larger the returns would (theoretically) be, the longer earnings are reinvested.

Consider the following scenario: you wish to save $1,000,000 by the time you age 60. To be a millionaire by the age of 60, you'd have to start saving when you're 20 years old and contribute $655.30 every month for 40 years—a total of $314,544.

Your monthly payment would increase to $2,432.89 if you waited until you were 40, for a total of $583,894 over 20 years. If you wait until you're 50, you'll have to come up with $6,439.88 every month, or $772,786 over ten years. (These calculations assume a 5% return on investment and no original investment.) Please bear in mind that they are merely for illustration and do not account for real returns, taxes, or other issues).

The sooner you begin, the more likely you are to achieve your long-term financial objectives. To achieve the same objective in the future, you will need to save less each month and contribute less total.

Want To Learn How To Create Your Own Website And Online Business?

Try My #1 Recommendation Training And Hosting Platform!

5. Create And Keep An Emergency Fund

An emergency fund is exactly what it sounds like: money put aside for unforeseen circumstances. The fund is meant to assist you in paying for items that would not generally be included in your own budgets, such as auto repairs or a dental emergency.

It may also assist you in meeting your usual costs if your income is stopped, such as if you are unable to work due to sickness or accident, or if you lose your job.

Although the typical recommendation is to save three to six months' worth of living costs in an emergency fund, many individuals may find that this amount is insufficient to meet a large expenditure or weather a loss of income.

Most individuals should attempt to save at least six months' worth of living expenses—more if possible—in today's unpredictable economic situation.

Including this as a regular expenditure item in your personal budget is the most effective strategy to guarantee that you are saving for emergencies rather than wasting money.

Keep in mind that creating an emergency backup is a long-term project. You'll probably need it for something as soon as it's financed. Rather than being depressed, be grateful that you were financially prepared and begin the process of re-building the money.

Final Thoughts

Personal finance rules may be effective strategies for financial success. However, it's critical to look at the larger picture and develop habits that will help you make better financial decisions and improve your financial health.

It will be tough to follow precise adages like “never withdraw more than 4% a year to ensure your retirement lasts” or “save 20 times your gross income for a pleasant retirement” if you don't have strong general habits.

I trust you enjoyed this article on Everything You Need To Know About Financial Health. Would you please stay tuned for more articles to come? Take care!

JeannetteZ

Want to Learn How to Build Your Own Home-Based Online Business & Start Making Money Online From Your Comfortable Couch?

Try Wealthy Affiliate!

Your Opinion Is Important To Me

Thoughts? Ideas? Questions? I would love to hear from you. Please leave me your questions, experiences, remarks, and suggestions about Everything You Need To Know About Financial Health, in the comments below. You can also contact me by email at Jeannette@WorkFromAnywhereInTheWorld.com.

You may also enjoy the following articles:

Best Ways To Improve Your Social Skills

How To Start A Business When You Have Literally No Money

Job Burnout – How To Spot It And Take Action

How To Choose A Financial Advisor