How Can I Build Business Credit

Building business credit is an essential step in growing your company’s financial foundation. It helps you secure funding, build trust with lenders, and keep your personal and business finances separate.

If you’ve ever asked yourself, “how can I build business credit?”, you’re not alone. Many entrepreneurs overlook it at first, but a strong business credit profile can open doors to better loan terms, higher credit limits, and new opportunities.

In this guide, we’ll explain how you can build business credit step by step. You’ll learn simple, practical ways to establish credit, strengthen your financial reputation, and set your business up for long-term success.

What Is Business Credit & Why Does It Matter?

Business credit is like your company’s financial reputation—it shows how responsibly your business handles money. Just as individuals have personal credit scores, businesses have credit profiles that reflect their ability to manage debt, pay bills on time, and maintain financial stability.

This credit history is tracked by agencies like Dun & Bradstreet, Experian Business, and Equifax Business, helping lenders, suppliers, and investors decide whether they can trust your company.

Why does it matter? Because strong business credit opens doors. It can assist you in being approved for vendor accounts, credit lines, and loans without the need for personal guarantees.

You’ll likely get better interest rates and more flexible payment terms, freeing up cash flow for growth. Good credit also boosts your business’s credibility with partners and clients—showing that you run a stable, trustworthy operation.

On the flip side, poor or nonexistent business credit can limit your options, making it harder to secure funding or negotiate favourable deals.

That’s why it’s essential to start building business credit early, maintain good payment habits, and monitor your credit reports regularly. In short, business credit isn’t just a number—it’s your ticket to financial strength and long-term business success.

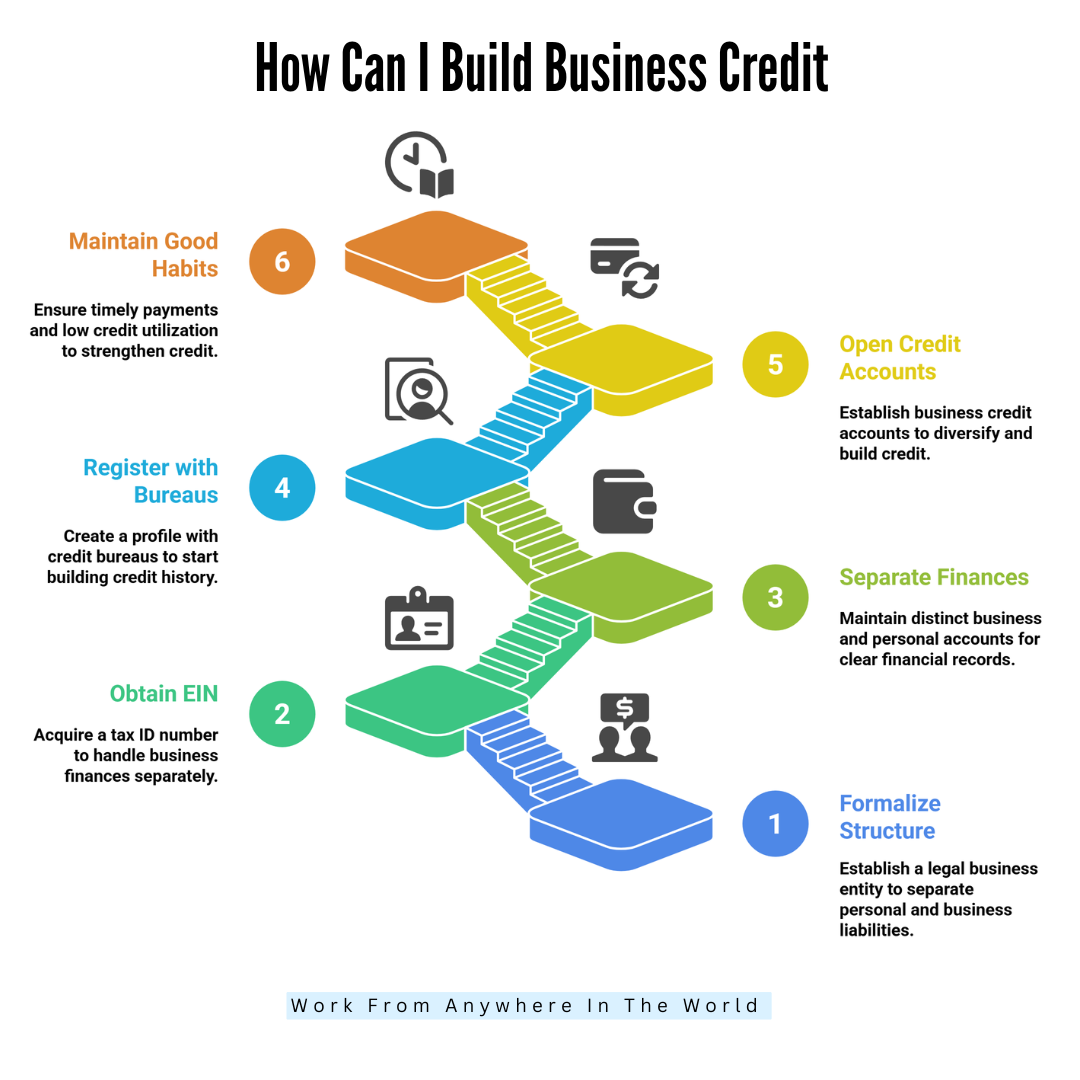

How Can I Build Business Credit?

Step 1: Formalize Your Business Structure

Before you can build business credit, you must officially establish your business. Operating as a sole proprietorship keeps you personally tied to all business liabilities, which can affect your personal credit.

To avoid that, choose a legal structure such as an LLC or corporation, depending on local regulations. Register your business name, complete necessary filings, and obtain required permits.

This formal setup creates a clear line between you and your company, making your business a separate legal entity. It also gives lenders and vendors confidence that your business is legitimate, trustworthy, and ready to build its own credit history.

Pro Tips

- Pick the proper legal structure

- File documents correctly and promptly

- Keep business licenses current

- Use consistent business information everywhere

Step 2: Obtain An EIN (Employer Identification Number) (Or Local Equivalent)

After setting up your business, the next step is getting a tax ID number. In the U.S., this is called an Employer Identification Number or EIN. Other countries have similar identifiers.

This number acts like a social security number for your business. It allows your company to open bank accounts, apply for credit, and handle taxes separately from your personal finances.

Having an EIN strengthens your business’s credibility. Think of your business as its own financial “person.” Using this number correctly ensures your personal credit stays protected while your business builds its own history.

Pro Tips

- Apply for an EIN immediately after registration

- Keep EIN documents securely stored

- Use EIN for all business accounts

- Never mix personal and business finances

Step 3: Separate Business And Personal Finances

Building credit requires keeping personal and corporate expenses separate. Make a dedicated bank account for your company and use it for all business-related transactions. Avoid mixing personal expenses with business spending.

This creates a clear record for lenders and credit bureaus. Also, get a business phone number, professional email, and business address, even if it’s virtual. Consistency matters when vendors or lenders verify your business.

Keeping finances separate protects your personal credit and helps your company establish its own credit history. Clear separation signals professionalism and reliability, making it easier to grow and access funding.

Pro Tips

- Always use dedicated business accounts

- Maintain consistent business contact information

- Track expenses with accounting software

- Avoid personal spending through business accounts

Step 4: Register With Business Credit Bureaus & Get Your D-U-N-S Number

To build business credit, you need a profile with credit bureaus. Dun & Bradstreet (D&B) is a major bureau that tracks business credit. Apply for a D-U-N-S number, which acts as a unique identifier for your company.

Once registered, your payment activity, such as invoices and vendor payments, can be reported to D&B and other bureaus like Experian Business or Equifax Business.

This reporting builds your business credit history. Without it, lenders and suppliers may not recognize your business. A registered profile makes your business visible and credible for credit opportunities.

Pro Tips

- Apply for D-U-N-S early

- Ensure business information is consistent

- Encourage vendors to report payments

- Monitor credit reports regularly

Step 5: Open Business Credit Accounts

Opening business credit accounts is a key step in building credit. First, use your EIN to apply for a company credit card. Use the card responsibly and pay balances on time.

You can also establish vendor accounts with terms like net-30 or pay-in-30-days, but ensure they report your payment history to credit bureaus. Accounts that don’t report won’t help your credit profile.

Multiple accounts diversify your credit history and show reliability. Consistent, on-time payments build trust with lenders and suppliers, helping your business grow while keeping personal credit separate from business obligations.

Pro Tips

- Use EIN for all credit applications

- Pay balances are consistently on time

- Choose accounts that report regularly

- Diversify credit with multiple accounts

Step 6: Maintain Good Payment Habits

Having credit accounts is only the start. How you use them builds your business credit. Always pay on time, or better, pay early. Late payments can damage your reputation with lenders and credit bureaus.

Keep credit utilization low by using only a portion of your available credit. Avoid judgments, liens, or major delinquencies, as these can hurt your credit for years.

Think of your business credit like a reputation—each payment is a reflection of reliability. Consistent, responsible use signals trustworthiness and strengthens your business’s financial standing for future opportunities.

Pro Tips

- Always pay invoices before due dates

- Keep credit utilization below thirty percent

- Avoid any liens or legal judgments

- Track payments with accounting software regularly

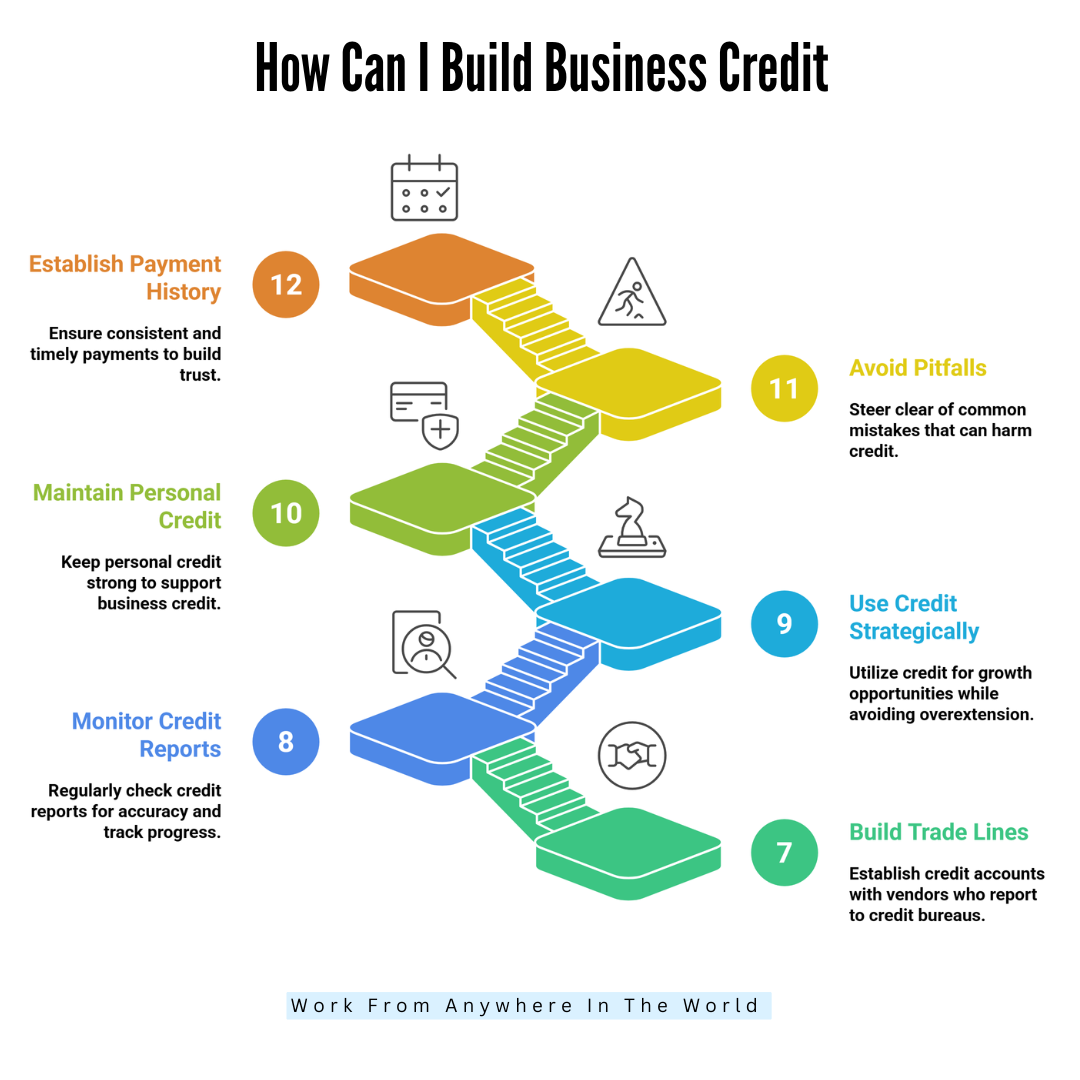

Step 7: Build Trade Lines With Vendors And Suppliers

Trade lines from vendors and suppliers are potent tools for building business credit. Start by choosing vendors who offer credit terms, such as pay-in-30-days, and ensure they report your payments to credit bureaus.

Use these credits responsibly and always pay on time to establish a strong payment history. Diversify by setting up multiple trade lines with different vendors.

This helps show lenders that your business can manage various accounts reliably. Trade lines are handy for new companies without large loans or credit cards. Consistency in payments builds trust and strengthens your credit profile.

Pro Tips

- Select vendors that report to bureaus

- Pay supplier invoices before due dates

- Establish multiple trade lines gradually

- Track vendor payments carefully every month

Step 8: Monitor Your Business Credit Reports

As your business credit grows, monitoring it becomes essential. Regularly check reports from Dun & Bradstreet, Experian Business, and Equifax Business.

Review every detail to catch errors or inaccuracies that could hurt your score. If you find mistakes, dispute them promptly to ensure your profile reflects accurate information.

Monitoring also helps you track progress, like how early payments or new accounts impact your score. You can modify your credit strategy by being aware of these shifts.

Staying proactive protects your business reputation and ensures lenders and vendors see a trustworthy, well-managed company every time they check your credit.

Pro Tips

- Check all major bureaus regularly

- Dispute inaccuracies immediately upon discovery

- Track credit score trends monthly

- Document all communications with bureaus

Step 9: Use Credit Strategically

Once your business credit is established, use it wisely to support growth. Avoid overextending your limits or taking on debt you cannot repay.

Use credit for strategic purposes, such as purchasing equipment, expanding inventory, or investing in opportunities that generate revenue.

Poor debt management can harm your credit and undo your progress. Think of credit as a tool, not a crutch. Leverage it to strengthen your business and build a strong financial reputation.

Smart borrowing and timely repayment show lenders your company is responsible, increasing trust and opening doors to better financing options in the future.

Pro Tips

- Borrow only what you can repay

- Use credit for growth opportunities

- Track all spending and repayments

- Avoid unnecessary or high-interest debt

Wealthy Affiliate – Mini Review (2025)

If you’ve ever thought about turning your blog, passion, or niche into an online business,

Wealthy Affiliate (WA) is one of the most beginner-friendly platforms I’ve used.

It combines step-by-step training, website hosting, SEO research tools,

and an active community all in one place.

What I like most: you can start free (no credit card needed),

explore lessons, test the tools, and connect with other entrepreneurs

before upgrading. WA isn’t a “get rich quick” scheme — it’s a platform where success comes

from consistent effort and applying what you learn.

Step 10: Keep Your Personal Credit Strong, Too

Even when focusing on business credit, your personal credit remains essential, especially for new businesses. Many lenders require a personal guarantee, which ties your personal credit to business funding.

Maintaining a strong personal credit score shows responsibility and increases your chances of securing loans or credit lines. Pay personal bills on time, keep debt low, and monitor your credit report regularly.

A clean personal credit record supports your business credibility and reassures lenders. Think of personal credit as a foundation; it complements your business credit and helps you access better financial opportunities while keeping your business financially healthy.

Pro Tips

- Pay personal bills on time consistently

- Keep personal debt ratios low

- Monitor personal credit reports regularly

- Avoid co-mingling personal and business finances

Step 11: Beware Of Pitfalls & Mistakes

Building business credit is simple in concept, but mistakes can set you back. Avoid mixing personal and business finances, as it blurs your company’s identity.

Only use vendors and credit accounts that report to business credit bureaus; otherwise, your activity won’t count. Keep credit utilization low—maxing out cards can hurt your score.

Pay all invoices on time, even small ones, to maintain a strong record. Regularly monitor your business credit reports to catch errors early.

Staying vigilant helps protect your credit profile and ensures your business maintains a reliable, trustworthy reputation with lenders and vendors.

Pro Tips

- Separate personal and business finances

- Use only reporting vendor accounts

- Keep credit utilization under control

- Monitor credit reports monthly

Step 12: Establish A Strong Payment History

A solid payment history is the backbone of business credit. Always pay invoices, loans, and credit accounts on time. Early payments are even better. Consistent, timely payments show lenders and vendors that your business is reliable.

Avoid partial or late fees, as they can negatively impact your score. Track all due dates using accounting software or reminders. Over time, a strong payment history builds trust and demonstrates financial responsibility.

Remember, credit is not just about borrowing—it’s about proving that your business manages money well and can be counted on for future obligations.

Pro Tips

- Pay all bills before due dates

- Set reminders for invoice payments

- Keep detailed payment records

- Automate recurring payments where possible

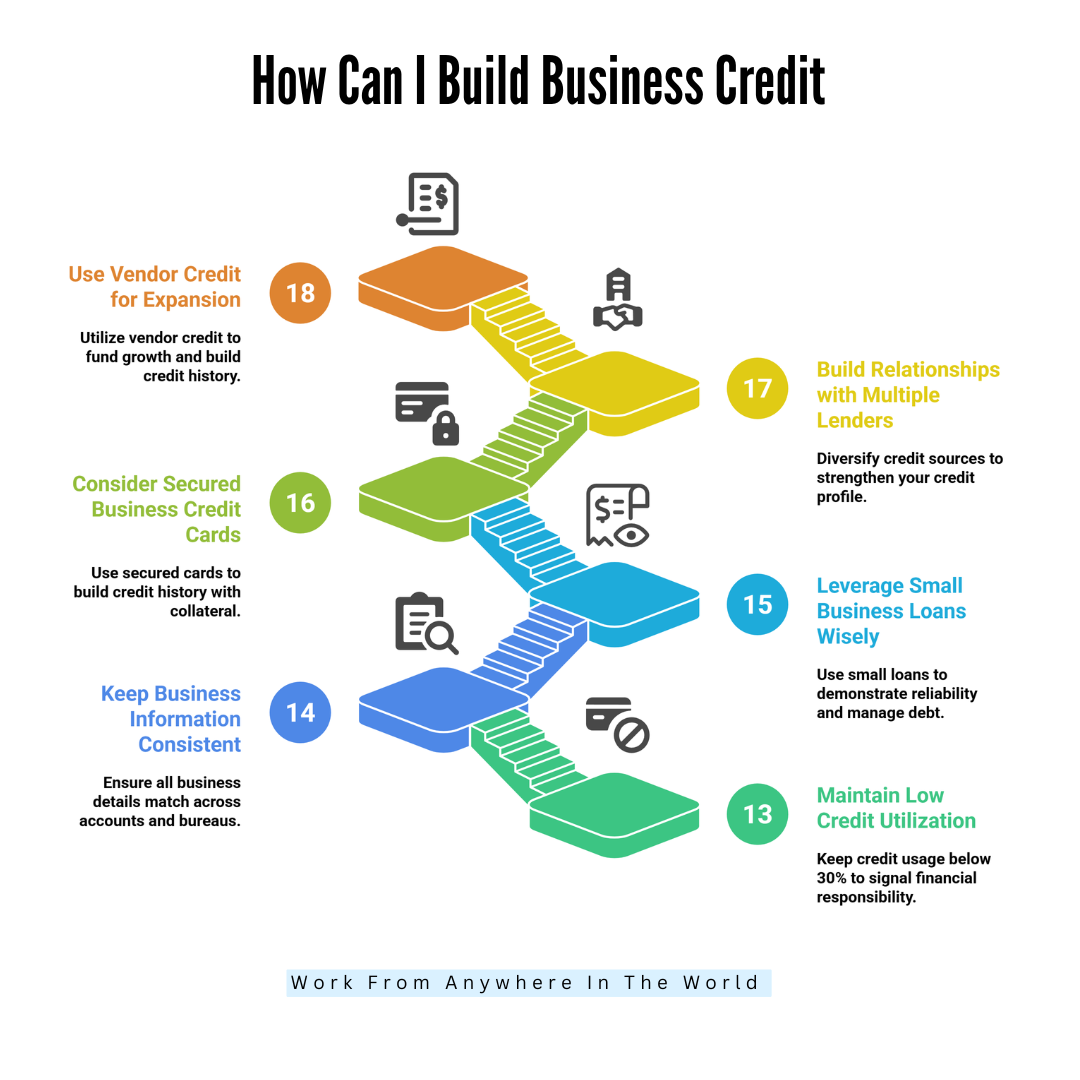

Step 13: Maintain Low Credit Utilization

How much of your available credit you use is known as credit usage. Keep it low, ideally below 30%. High utilization signals risk to lenders and can hurt your credit score.

Even if you pay on time, maxing out cards or lines of credit lowers credibility. Spread spending across multiple accounts when possible.

Monitor utilization regularly to ensure it stays within safe limits. Low utilization, combined with on-time payments, strengthens your business credit profile.

Lenders see this as responsible management and may offer higher credit limits or better terms over time, boosting growth opportunities.

Pro Tips

- Use only a fraction of available credit

- Monitor utilization weekly or monthly

- Spread purchases across multiple accounts

- Avoid sudden hefty charges on cards

Step 14: Keep Business Information Consistent

Consistency matters for building credit. Ensure your business name, address, phone number, and EIN match exactly across all accounts, vendors, and credit bureaus.

Mismatched information can cause credit bureaus to fail to report payments or even create duplicate profiles. This can delay credit building and lower your score.

Update any changes immediately and check reports regularly. A consistent, professional presence signals reliability to lenders.

Treat your business like a brand—consistent information creates trust and helps your credit history grow smoothly, making it easier to access loans, vendor credit, and financing in the future.

Pro Tips

- Use the same name on all accounts

- Keep the address and phone number identical

- Update EIN if business changes occur

- Review credit reports for consistency

Step 15: Leverage Small Business Loans Wisely

When appropriately used, small-business loans can aid in credit development. Start with small loans that are simple to pay back. Pay on time and in full each month to demonstrate reliability.

Avoid taking more than necessary, as over-borrowing can hurt your credit score. Even a modest loan helps show lenders that your business can manage debt responsibly. Track repayment schedules carefully and plan for cash flow.

Successful loan repayment boosts creditworthiness and opens doors to larger financing options. Use loans as a tool for growth, not just to cover gaps or expenses.

Pro Tips

- Start with small, manageable loans

- Pay loans on time consistently

- Track repayment schedules carefully

- Avoid borrowing beyond business capacity

Step 16: Consider Secured Business Credit Cards

Secured business credit cards are excellent for new businesses with limited credit history. Lender risk is decreased because they want a cash deposit as collateral. Use the card responsibly and make full, timely payments each month.

The reporting of your activity helps build or improve your business credit score. Over time, you may qualify for unsecured cards with better terms. Secured cards are a safe way to demonstrate financial responsibility.

They provide a credit history record while protecting your business and personal finances from high-risk exposure, laying a foundation for future credit opportunities.

Pro Tips

- Use secured cards for consistent payments

- Keep balances low each month

- Upgrade to unsecured cards gradually

- Report usage to credit bureaus

Step 17: Build Relationships With Multiple Lenders

Diversifying your credit sources strengthens your business credit profile. Don’t rely on a single bank or lender. Establish relationships with multiple banks, credit unions, and alternative lenders.

Responsible borrowing across several sources shows lenders that your business can manage credit responsibly. Each account adds to your credit history and demonstrates reliability.

Keep borrowing within your capacity, pay accounts on time, and maintain open communication with lenders. Strong relationships can also help you negotiate better interest rates and terms.

Multiple reputable lenders seeing positive activity increases your credibility and opens more financing opportunities for business growth.

Pro Tips

- Work with multiple reputable lenders

- Maintain clear communication with lenders

- Pay all accounts on time

- Diversify loan and credit types

Step 18: Use Vendor Credit For Expansion

Vendor credit, like net-30 accounts, is powerful for new businesses. It allows you to purchase goods or inventory while delaying payment.

Always choose vendors that report to credit bureaus to build history. Pay on time to show reliability. Multiple vendor accounts diversify credit activity and strengthen your profile.

Vendor credit helps fund growth without high-interest loans. It also demonstrates to other lenders that your business can handle responsibility.

Use vendor credit strategically, balancing purchases with repayment capacity. This approach builds trust and makes your business more attractive to lenders and future partners.

Pro Tips

- Choose vendors that report payments

- Pay vendor invoices promptly each month

- Open multiple vendor accounts gradually

- Track all vendor credit activity

Conclusion

Building strong business credit takes time, discipline, and consistency. Monitoring reports, diversifying accounts, and avoiding common mistakes ensure your credit grows steadily.

Strong business credit opens doors to better financing, favourable terms, and growth opportunities while protecting your personal credit.

Start early, stay consistent, and treat your business credit like a valuable asset—it’s a key foundation for long-term success and financial independence.

I trust you enjoyed this article on How Can I Build Business Credit. Please stay tuned for more insightful blogs on affiliate marketing, online business, and working from anywhere in the world.

Take care!

— JeannetteZ

💬 Your Opinion Is Important To Me

Do you have thoughts, ideas, or questions? I’d love to hear from you. Please leave your comments below or email me directly at Jeannette@WorkFromAnywhereInTheWorld.com.

📚 More Work From Anywhere Reads

🚀 Ready to Build a Business You Can Run from Home

Or from Anywhere in the World?

Imagine creating income on your terms — from home, a cozy café, or wherever life takes you.

With the right tools, training, and community support, it’s entirely possible.

Start your own online business for free — no credit card needed.

Disclosure

This post may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. I also earn through other affiliate programs. Please read my full affiliate disclosure.