Everything You Need To Know About Financial Literacy

Everything You Need To Know About Financial Literacy

To be financially literate, you must understand how to handle your finances. This entails learning how to manage your finances, including how to pay your bills, borrow and save money wisely, and invest and prepare for retirement. Start with the fundamentals of money management and work your way up to being a wise spender by taking the effort to self-educate and expand your financial knowledge.

Investing time in your financial growth can help you make better savings and investment choices. You may develop a long-term nest egg by utilizing factors such as age, skill, money, and the capacity to form healthy habits.

Want to Start Making Money Online?

Try My #1 Recommendation Program!

Money management is a personal talent that will help you for the rest of your life – yet it is not something that everyone learns. It's difficult to keep track of money pouring in and out, due dates, financing charges and fees linked to invoices and bills, and the general burden of continually making the proper judgments regarding important purchases and investments.

Because the stakes are so great, you'd think this would be a skill taught in high school (or perhaps earlier), yet it isn't. Personal finance management requires a basic grasp of personal credit and a willingness to accept personal accountability.

That is, you pay your payments on time and don't go into debt. You understand that in order to achieve long-term goals, you must occasionally sacrifice present needs and ambitions.

You have a spending plan. You are the one who saves. You keep your money safe. You spend wisely when you spend. When you make large purchases, you want to be sure they're worthwhile. You are aware of the distinction between good and bad debt. You also keep a close eye on your whole portfolio, which includes your wages, savings, and investments.

You also recognize what you don't know and seek assistance when necessary. To be financially literate, you must be able to avoid letting money – or the lack thereof – stand in the way of your pleasure while you work hard to achieve the American ideal of a long and happy retirement.

Taking care of your money should be a top concern, and it should guide your everyday spending and saving choices. Personal financial experts recommend starting with the fundamentals, such as how to handle a checking or debit account and how to pay your bills on time, then working your way up. Managing your finances demands continual attention to your expenditures and accounts, as well as avoiding living over your means.

We all know that the sooner you grasp the fundamentals of money, the more confident and successful you will be with your finances later in life. It's never too late to begin studying, but getting a head start is advantageous. Education is the first step into the realm of money.

Banking, budgeting, saving, credit, debt, and investing are the foundations that support the majority of our financial choices. We have over 30,000 articles, keywords, FAQs, and videos on these subjects at Investopedia, and we've spent over 20 years developing and enhancing our tools to help you make informed financial and investment choices.

How To Take Care Of Your Cash

Taking care of your money should be a top concern, and it should guide your everyday spending and saving choices. Personal financial experts recommend starting with the fundamentals, such as how to handle a checking or debit account and how to pay your bills on time, then working your way up. Managing your finances demands continual attention to your expenditures and accounts, as well as avoiding living over your means.

Want to Find Out How To Start Your Home-Based Business?

Try My #1 Recommendation Platform!

Deposits In The Bank

Opening a bank account is the first step in developing financial knowledge. Set up direct deposit after you've received a paycheck. This protects your funds and prevents you from paying interest to cash advance providers, who charge a portion of your check as interest.

A bank account gives convenience, as well as access to a variety of perks and security. Checks and debit cards provide evidence of payment, allowing you to keep track of where your money goes. The Federal Deposit Insurance Corporation (FDIC) covers money in a savings account for up to $250,000.

There are a variety of main accounts to choose from when it comes to storing your wages. The majority of consumers open a checking, debit, or savings account, or a combination of these accounts. These allow you to set up automated payments for monthly expenses and eliminate the need to carry cash with you.

Each choice has its own set of perks and downsides. Examine the different overdraft, monthly, withdrawal, and other account-related maintenance costs. Experts advocate having a savings account to cover unforeseen financial bills and emergencies, such as a broken arm, a flat tire, or a tuition increase.

Having the two kinds of accounts separate helps differentiate between money accessible for immediate expenditure and reserves meant to be saved for the long term. If you keep all of your money in a checking account, your savings are conveniently accessible and spendable. You will lose out on the interest that a savings account generates.

You may begin spending once you have money in your account. This is where caution is required. Learn to distinguish between essentials and extravagances. For instance, you need to pay for your annual dental cleaning, but you also want to go to the salon. Use mobile banking to keep track of how much you're spending and how much money you have left in your account.

The easiest method to make the most of the money in your bank account is to start budgeting right away. The capacity to budget is one of the primary building elements of a good personal financial strategy. It's simple to grasp, but it's tough to put into practice because it takes a long look in the mirror and a willingness to see what's truly there.

Budgeting necessitates an examination of and, most likely, an adjustment in your spending patterns. You control your money rather than your money dominating you. Develop saving habits to prevent financial crises and keep your mind at ease.

Personal Finance Basics & Financial Literacy

What is the best way to begin budgeting? It's simple: just jump right in. You must examine how you spend your money and determine where your financial gaps are.

Following are some measures to take:

- Begin keeping track of your monthly spending. Every time you spend money, jot it down in a notepad or on a mobile app. It's easy to forget about this, so stay vigilant. This is the cornerstone of your financial plan.

- Determine which costs are constant and which are changeable. Rent, mortgage, auto payment, energy bill, water bill, and student loan payment are examples of fixed costs. Groceries, pet supplies, haircuts, concert tickets, and other expenditures that fluctuate month to month and come and go are examples of variable expenses.

- Add the totals together. Calculate how much you spend on average each month after three months. Also, have a look at the categories.

- Examine your variable costs. This is where the majority of folks go beyond with their spending. Decide what aspect of this monthly spending provides you with the greatest joy, and whether or not these fees are justified. Which ones, on the other hand, can you truly do without? Start trimming and be honest with yourself. This is the start of the difficult choices.

- Take into account potential savings. One of the most important aspects of budgeting is to always pay yourself first. That is, you should set aside a percentage of each salary for savings. If you can make this one exercise a habit, it will pay you (literally in many circumstances) throughout your life.

- Now you must decide on a budget. Begin cutting your fixed and variable expenditures as soon as possible. Decide how much money you want to put aside every week or every two weeks. The money you have leftover is how much you can live on.

Effective budgeting necessitates being honest with yourself and creating a strategy that you can stick to. The more time and effort you put into your budget today, the more likely you are to develop a long-term saving habit.

Are You Tired Of Scams?

Try The Most-Trusted Training Platform To Make Money Online!

Which Is Better: Credit Or Debit?

Most individuals have some kind of plastic, such as a debit card, credit card, or a mix of the two, in addition to cash and a bank account. What you do with these tools will have a significant impact on your ability to build credit and prevent creating a borrowing habit.

Conservative financial gurus advise having simply a debit card or having both, with the credit card being used exclusively for significant purchases that are paid off quickly. This is often provided advice to persons who have accumulated a significant amount of debt.

Starting with one of each card might help you create good spending habits while also being convenient. Consider the benefits of both cards, particularly if you often travel or make major purchases.

The biggest benefit of just using a debit card on a regular basis is that you are only spending money that you currently have. Debit cards may be linked to a bank account for the automatic deposit of wages.

Debit cards feature advantages such as no transaction limits and incentives for regular use. You may spend without carrying cash, and the funds are promptly deducted from your account. Because using the card is so simple, it's critical that you don't overspend and lose sight of how often you use it. Overdraft costs might quickly deplete your account if you're not careful.

A credit card is required by certain hotels, automobile rental agencies, and other businesses. Getting a special account for occasional usage might be a good idea. You may build your credit history and use the period between making a purchase and paying your bill to your benefit. Another benefit of utilizing credit is the issuer's additional safeguards. A credit card is a safer alternative than a debit card for online shopping and bigger expenditures.

Using a credit card to pay for things might lead to substantial debt. If you decide to use a credit card, the best course of action is to pay it off in full each month. You are almost certainly already paying interest on your purchases, and the longer you carry debt from month to month, the more interest you will accrue.

Savings

Savings is an important part of smart planning. Using a savings account helps you to keep unexpected expenses from depleting your monthly budget and gradually create a reserve for significant future expenditures. This fund may be used for auto repairs, apartment deposits, unanticipated surgeries and other medical expenses, as well as saving for a down payment on a property.

- Only 67 percent of Americans have more than six months' worth of spending in savings.

- Between 2011 and 2014, 24 to 28% of Americans have no emergency savings.

- People between the ages of 30 and 49 are the least likely to have an emergency fund.

- One out of every five persons approaching retirement age has no money saved.

Make a monetary commitment that you can maintain, even if it means beginning small, such as deducting $50 from each paycheck or forgoing your gym membership for an additional $100 per month. Remember, this isn't a savings account for buying the newest Apple gadget or a Michael Kors handbag.

Make a conscious effort to only use your funds for necessities. When you take money out of your account, try to replace it as soon as possible. Time, your age, your present resources, compounding interest, investments, and tax-advantaged savings may all be used to your advantage if you develop regular saving habits.

- DO put aside a part of your income for savings on a regular basis.

- DON'T put your savings account last on your financial priorities list.

Credit Ratings

Your credit score is a good predictor of your financial health. The three major credit agencies, Equifax, Experian, and TransUnion, provide ratings ranging from 300 (high risk) to 850 (low risk) (low risk). The bureaus provide ratings based on a set of variables that represent your spending patterns.

Never undervalue the significance of your credit score. You start your history whenever you start spending money with cards and paying bills on a regular basis. This record of how much you owe, how frequently you borrow, and how fast you return it may follow you throughout your life.

Checklist for Credit Scores – Make sure you know where you are with your credit score and correct any flaws on your credit reports. Each of the credit bureaus will provide you with a free copy of your credit report once a year.

A good credit score may help you qualify for low-interest loans, credit cards, mortgages, and vehicle loans. Your credit history may be a decisive factor when it comes to renting an apartment or finding a new job.

Making late payments on bills, skipping payments, accumulating debts, and routinely maxing out your credit card, on the other hand, may significantly damage your credit score. A good credit score may open doors to loans, employment, and other opportunities, while a bad credit score might limit your ability to borrow money, pay low-interest rates, and even acquire specific positions.

Want To Learn How To Create Your Own Website And Online Business?

Try My #1 Recommendation Training And Hosting Platform!

Using Credit In A Responsible Manner

For the majority of Americans, using credit cards is a way of life. It's a tool for some people to develop credit and borrow money for big expenditures. For others, it's a never-ending debt that they rely on for practically every purchase. Do you have a lot of credit cards? Consumers hold an average of three credit cards, according to Experian's seventh annual State of Credit Report, released in February 2018.

Credit scores can be used to qualify you for better interest rates when it comes to loans, mortgages, and applying for more credit, so learning how to use these tools wisely can have a significant impact on your future. Potential employers may review your credit history, and credit scores can be used to qualify you for better interest rates when it comes to loans, mortgages, and applying for more credit.

Selecting The Correct Card

Many credit cards need you to have a certain credit score in order to be approved. The better your credit score, the more benefits you'll be eligible for, such as cheap interest rates and a large credit limit. If you are a student, you may be eligible for discounted pricing. Before you apply for a credit card, think about how you'll use it. Pay attention to promotional offers that may expire after six to one year of card ownership.

Making a Credit Use Game Plan Make a credit use game plan before you spend. By marking your calendar to prevent missing or being late on credit card payments, you may become a responsible credit card owner. Another way to avoid going into debt is to avoid spending money you can't afford to repay and to maintain your balance far below your account's limit.

Pose inquiries. Is there a way to get points if you use it frequently? Is the APR a good deal? What type of restrictions will you impose? Before you go into debt that you won't be able to pay off, read the fine print.

Getting Rid Of Your Credit Card Debt

To get control of your credit card debt, you must first determine how much you owe. Take a deep breath and assess your financial situation. You'll almost certainly need to devise a long-term plan for reducing your overall debt while avoiding further debt accumulation. Consult your creditors to see if they are willing to cooperate with you to come up with a solution. Consolidation and settlement should only be considered as a last option.

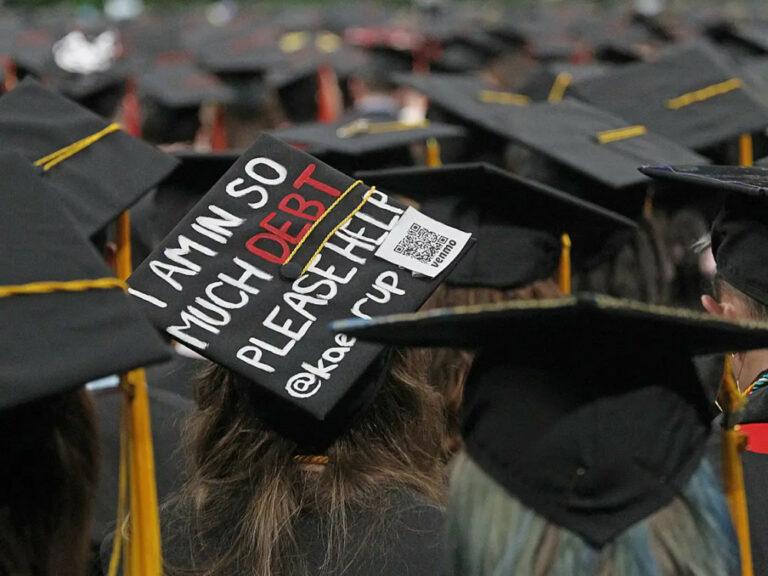

Loans For Students

Student loan debt is nearly as common as vehicle or credit card debt these days. Few college graduates graduate without owing money on a student loan. Most kids want to know where they will go to college rather than whether they will go to college. And it's possible that they won't think about how to pay for tuition until after they've made a few selections. When school is over and real-life starts, the afterthought of student debt takes its toll, and the expenses begin to pile up.

Facts about Student Loans – At least one student debt is owed to 40 million Americans.

- Student loans account for more than $1.2 trillion in outstanding debt in the United States, accounting for 6% of the total national debt.

- The typical borrower leaves college with a debt of $29,000.

While You're Still In School, Pay Attention To Loans

In addition to signing the promissory note for your loans, take the time to figure out when and how much your first payment will be. Put that future date and amount on paper, and start saving money to pay off your debts in the meantime. You may begin your post-college years with a surplus of money if you can work a few hours throughout the week, on weekends, or merely during the holidays and summers.

I trust you enjoyed this article on Everything You Need To Know About Financial Literacy. Would you please stay tuned for more articles to come? Take care!

JeannetteZ

Want to Learn How to Build Your Own Home-Based Online Business & Start Making Money Online From Your Comfortable Couch?

Try Wealthy Affiliate!

Your Opinion Is Important To Me

Thoughts? Ideas? Questions? I would love to hear from you. Please leave me your questions, experiences, remarks, and suggestions about Everything You Need To Know About Financial Literacy, in the comments below. You can also contact me by email at Jeannette@WorkFromAnywhereInTheWorld.com.

You may also enjoy the following articles:

How To Deal With Unsupportive Family Members

Should You Buy A New Or Used Car?

Everything You Need To Know About The Middle Class

How To Overcome The Fear Of Money