How To Overcome The Fear Of Money

How To Overcome The Fear Of Money

Chrometophobia is the extreme fear of money. Also known as chrematophobia, it encompasses everything from the fear of spending money and the fear of thinking about money, to even the fear of touching money. It combines the Greek word chermato, which means “money,” and the Greek word Phobos, which means “fear.” Most of us have struggled with financial stress at some point in our lives.

A quarter of Americans say they worry about money all or most of the time. That makes sense given that four out of five Americans are in debt and around 15 percent of households have a negative net worth. Let’s face it: money and debt can be pretty scary.

There are times when we pinch pennies or even save to the extreme and then there are those that have developed a fear of spending their money. This fear is probably based on a past experience when someone had no access to funds and because of poor budgeting or lack of income they were put in a dire situation.

Want to Start Making Money Online?

Try My #1 Recommendation Program!

There is a word for the extreme fear of money – chrometophobia. It may derive from the fear of financial failures or just thinking about the responsibility that money brings. Luckily, there are ways for you to face that fear head-on and think about your finances proactively.

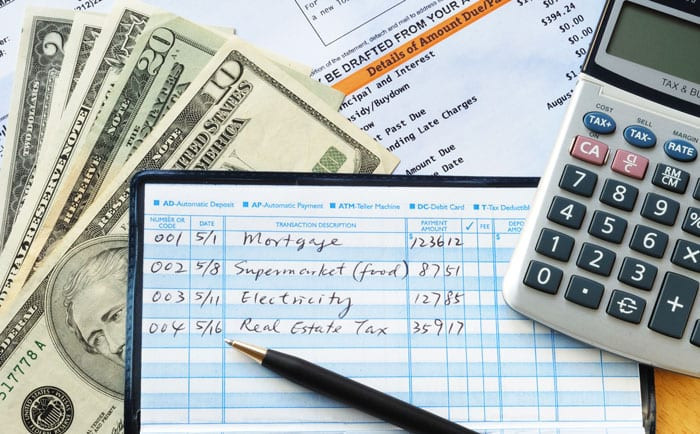

The first tip is to make time to think about your finances every day as part of your self-care routine. Creating a plan with achievable goals will begin easing your financial fears along with helping you to see a broader perspective when it comes to your money. You can begin with planning a budget, reviewing your bank statements, and making detailed savings and spending plans.

Take time to figure out what you can afford reasonably without putting yourself under financial strain. Rely on those that you trust to give you some of their wisdom on how they are able to keep their monies on track. You can talk with your family or even meet with your advisor to discuss your money anxieties. Take these steps and focus on the progress you are making each day, week, or month. Look at whether you increased your savings last month, even if it is just a minute amount, every little bit counts.

When creating your budget make sure to plan for an emergency fund and are saving for your future self, aka retirement. Not sure how much to contribute to your retirement? It all comes down to your age and what you feel comfortable doing with your money. Again, meet with a financial expert who is knowledgeable about your financial situation and can help you determine the best decisions for you.

What Is The Term ‘Fear Of Money’

It is a term that is often used to describe the fear of financial failures or just thinking about the responsibility that money brings. It may derive from the fear of financial failures or just thinking about the responsibility that money brings.

The fear of money is a common problem, but the term most often used to describe it is “money phobia.” The word chrometophobia has been coined for the extreme fear of money. There are many reasons that people develop this fear. It may be due to past experiences when someone had no access to funds and because of poor budgeting or lack of income, they were put in a dire situation. This anxiety can become so prevalent that it becomes a hindrance to one's life.

Why Is There A Fear Of Money?

There are many reasons why people have a fear of money. For some, it is due to past experiences they may have had with not having enough and being in debt. For others, the lack of budgeting skills or just thinking about the responsibility that money brings leads to a fear of money.

Luckily, there are ways for you to face that fear head-on and think about your finances proactively. There are many techniques for overcoming this fear that can help you stay in control of your finances. Here are some techniques for overcoming the fear of money:

- Take a deep breath and remember that no one is perfect – everyone makes mistakes when saving or spending their money

- Remember that only 10 percent of your net worth is actually liquid cash – so don't freak out about every little thing

- Start by identifying what makes you feel uncomfortable about spending and then work on reducing those feelings

- Find someone who has been where you are now and talk with them about how they overcame their fears

- Set up an automatic savings plan with your bank so the bills automatically come out without any thought needed

Want to Find Out How To Start Your Home-Based Business?

Try My #1 Recommendation Platform!

When you have money, you are in control. You make the decisions about how to use that money and what to do with it. On the other hand, when you don't have money, you give that power away to someone else — your parents or your boss. The fear of not having finances can lead to anxiety and stress, but there are ways for you to overcome this fear by thinking proactively and being more confident in your ability to handle anything that comes your way.

Signs of fear often indicate a lack of confidence. It can be helpful to break these habits down into smaller steps so that you don't overwhelm yourself with too much change all at once. One strategy is starting small with a goal that is achievable within a week or two such as setting specific monetary goals for each month and tracking those goals regularly so you stay motivated and on track.

Another option is going back through past experiences where things seemed easy and remembering why you were able to pull through them without worrying about money. Maybe it was because you were young or because you had support from friends or family members. Seeing how far back into the past this goes helps create a sense of confidence in your ability to handle future financial concerns since they're nothing new–you've handled them before!

Tips For Overcoming Fear Of Money

First, you should find someone to help you. Whether it be a significant other, family member or friend, there is likely somebody who would be happy to work with you on this. It could also help to seek professional advice from a financial expert. Next, use the list of fears below and rank the order in which they are most intense for you.

- Fear of poverty

- Fear of uncertainty

- Fear of failure

- Fear of loss

- Fear of being judged by others

- Fear of embarrassment

- Fear of death

Look into your past to see what happened and why you developed this fear. Did you not have a lot of money growing up? Did you grow up hearing about how people in hard times ended up selling their homes, cars, and foregoing food in order to pay a debt? If so, there’s no doubt that these events have shaped your attitude towards money.

It’s important to make note of the past so that you can focus on the future. Once you can identify the root cause of the problem, then it becomes easier to find solutions for it. Take action by initiating change for yourself and around you. This change could be as simple as developing better financial habits or taking more control over your finances with tools like budgeting software.

Identify Your Values

You have to be honest with yourself and think about the values that are important to you. Is it money or not having enough money? If you're afraid of spending your money, then maybe it is worth investing in a budgeting app so you can plan what you need for the month. Another way to overcome the fear of money is by taking a deep breath. Think about why you have this fear and what you can do to deal with it. If someone else struggles with this fear, they could use one of these tips (or all of them) as well.

Before you can overcome your fear of money, you have to identify what your values are. They say that money can’t buy happiness but it does make life easier. So what are your values? Do you want to save for retirement? Do you believe in giving back to the community? What is important to you about having a positive impact on society and the world around us? Those are just a few of the questions you should ask yourself.

You might also want to think about how much money makes you happy. There is a study done by Dr. Martin Seligman, who found that people who make roughly $75,000 annually were happier than those making $25,000 annually. This is because these individuals were able to provide for themselves and their families instead of stressing over bills or saving all their time in order to provide for their needs.

Are You Tired Of Scams?

Try The Most-Trusted Training Platform To Make Money Online!

Prioritize Your Spending

There are three key ways to overcome that fear.

- The first is to prioritize your spending. When the economy is good, it's easy to get caught up in the fun things that you want in life. In reality, a lot of the things people spend their money on aren't as important or beneficial for them as they may seem. It's about prioritizing what you need and what you want and then spending your money accordingly.

- The second way is to take time away from your day-to-day responsibilities and focus on personal growth. Spending time with friends and family can help reduce this fear and actually increase your happiness level at home.

- The third way is by setting financial goals for yourself that are realistic but also challenging. For example, if you're working towards building a business, create goals or milestones for yourself that will motivate you to keep going with your efforts so that you don't back down when it gets tough.

There is a balance between the fear of money and spending. Sometimes you have to spend your hard-earned money in order to make a better life for yourself. If you are afraid to spend because you think it will be wasteful or unwise, then there may be an underlying issue with how you view your finances.

According to The Money Mindset Solution by Dr. Ava Cadell and Kristin Wong, there are steps that can help you overcome this fear such as prioritizing certain expenses over others and even changing your mindset of what it means to save money.

Diversify Your Income

One way to combat your fear of money is to diversify your income sources. There are people who have a fear of spending, but they don’t have the opportunity to make that much money. By having more than one source of income, you’ll be able to feel comfortable knowing that you can always pay bills.

There are also people who fear the responsibility that comes with being in debt and by having more than one source of income, you’ll be able to pay off your debt without feeling like it’s all on your shoulders. Another way to combat this fear is to start thinking about what you want for yourself now and in the future.

By doing this, you’ll develop a positive mindset about money and see how it can work for you. If there are some things that you want and would like to see happen in the future, consider starting an investment account for those things or building up savings for them before they happen.

One way for you to overcome your fear of money is to diversify your income streams. This includes ways such as investing, entrepreneurship and side hustles. But also consider looking for ways to make money on the side instead of always banking on your day job. For example, what do you like to craft?

Check Etsy or eBay and start selling online. Or maybe you love taking pictures but don’t want to spend a lot of time learning how to edit them on Photoshop. Consider getting a photography course or an app like Adobe Lightroom CC so that you can sell your photos right away. If you don’t have any skills yet, try websites like Upwork or Clickworker which are sites where people hire others to complete tasks at an affordable rate.

Start A Regular Savings Plan

If you’re having trouble with your budget, it may help if you set aside a certain amount of money each month and put it in your savings account. This can help ease the fear of spending by giving you something that has been set aside for future use. You can also take a look at what might be keeping you from saving money.

Maybe it’s not because of a lack of funds but due to other obligations like bills or other commitments. In this case, try setting up an automatic transfer into your savings account so that the money automatically goes in without notice and you won’t worry about whether or not you have enough saved or not.

If you are afraid of spending your money, it is important to start a regular savings plan. This can help you prepare for emergencies that may arise and make sure that your funds are always available. It is also important to track your spending and see which areas of your life are the most expensive.

You will not be able to monitor this area without the proper data from tracking tools like Mint.com or Your Money Map. These tools will help you pinpoint where you spend too much money and identify ways in which you can cut back on those expenses.

Want To Learn How To Create Your Own Website And Online Business?

Try My #1 Recommendation Training And Hosting Platform!

Invest In Learning About Money

Many people suffer from the fear of money because they don't know how to invest it, what to do with it, or have a plan for it. There is a difference between spending and investing. With a lack of education on the subject, many people are scared of spending and then they end up making poor financial decisions and overspending.

One way to overcome this fear is by investing in learning about money. You need to educate yourself on how to make smart financial decisions by learning about investments, saving for long-term goals, etc. This is not just for your own benefit but also for those around you who might be able to learn from your actions or mistakes from the past.

One way to get over the fear of money is to educate yourself and learn about your finances. You need to take a step back and really think about what you're spending your hard-earned money on. If you just let it go, you might be causing yourself more financial problems in the future.

This is not easy, but it will benefit you in the end. There are many online resources that can help you understand how your finances work. When you start learning about how money works, everything seems less daunting.

Investments

First, stop thinking about how you will use your money and start thinking of the investments it can yield. Investing in a retirement fund is a great way to start. It's also important to establish an emergency fund. This fund is designed to cover any unforeseen expenses that may occur in a short period of time.

Once you've established these funds, start investing in areas that interest you. Whether it be donating to charitable organizations or starting a business, this will help build your confidence and show that you're capable of managing your finances well.

Investing in yourself is also important as it builds self-esteem and shows that you know what you're doing with your money. Instead of focusing on where it goes, focus on why it's important when putting your hard-earned cash back into yourself.

Conclusion

Fear of money is a common emotion that can make even the most adept savers feel paralyzed. But there are many ways to overcome the fear of money, and it’s never too late to start making positive changes.

I trust you enjoyed this article on How To Overcome The Fear Of Money. Would you please stay tuned for more articles to come? Take care!

JeannetteZ

Want to Learn How to Build Your Own Home-Based Online Business & Start Making Money Online From Your Comfortable Couch?

Try Wealthy Affiliate!

Your Opinion Is Important To Me

Thoughts? Ideas? Questions? I would love to hear from you. Please leave me your questions, experiences, remarks, and suggestions about How To Overcome The Fear Of Money, in the comments below. You can also contact me by email at Jeannette@WorkFromAnywhereInTheWorld.com.

You may also enjoy the following articles:

Top Ten Richest People In The World

Best Kept Time Management Secrets