Risks Of Money Market Accounts

A money market account offers a blend of savings and investment benefits, providing higher interest rates than traditional savings accounts.

However, despite its appeal, money market accounts come with certain risks that investors should consider. From limited withdrawal options to inflation risk and fluctuating interest rates, they may not always be the safest bet for growing wealth.

This article explores the key risks of money market accounts to help you make informed financial decisions.

What Are Money Market Accounts?

A money market account (MMA) is a deposit account that offers savings and checking features. It usually provides excellent interest rates and permits fewer transactions than a savings account.

MMAs are a low-risk option for storing money because they are insured by the FDIC or NCUA. They cover up to $250,000 per depositor per institution.

MMAs earn interest because banks invest the deposited funds in low-risk, short-term financial instruments like Treasury bills, certificates of deposit (CDs), and commercial paper. However, the interest rate is variable and may fluctuate with market conditions.

Most MMAs require a minimum deposit to open and maintain the account. Banks and inks may charge a fee if the balance falls.

Additionally, federal regulations typically restrict withdrawals and transfers to six per month, making MMAs less flexible than checking accounts.

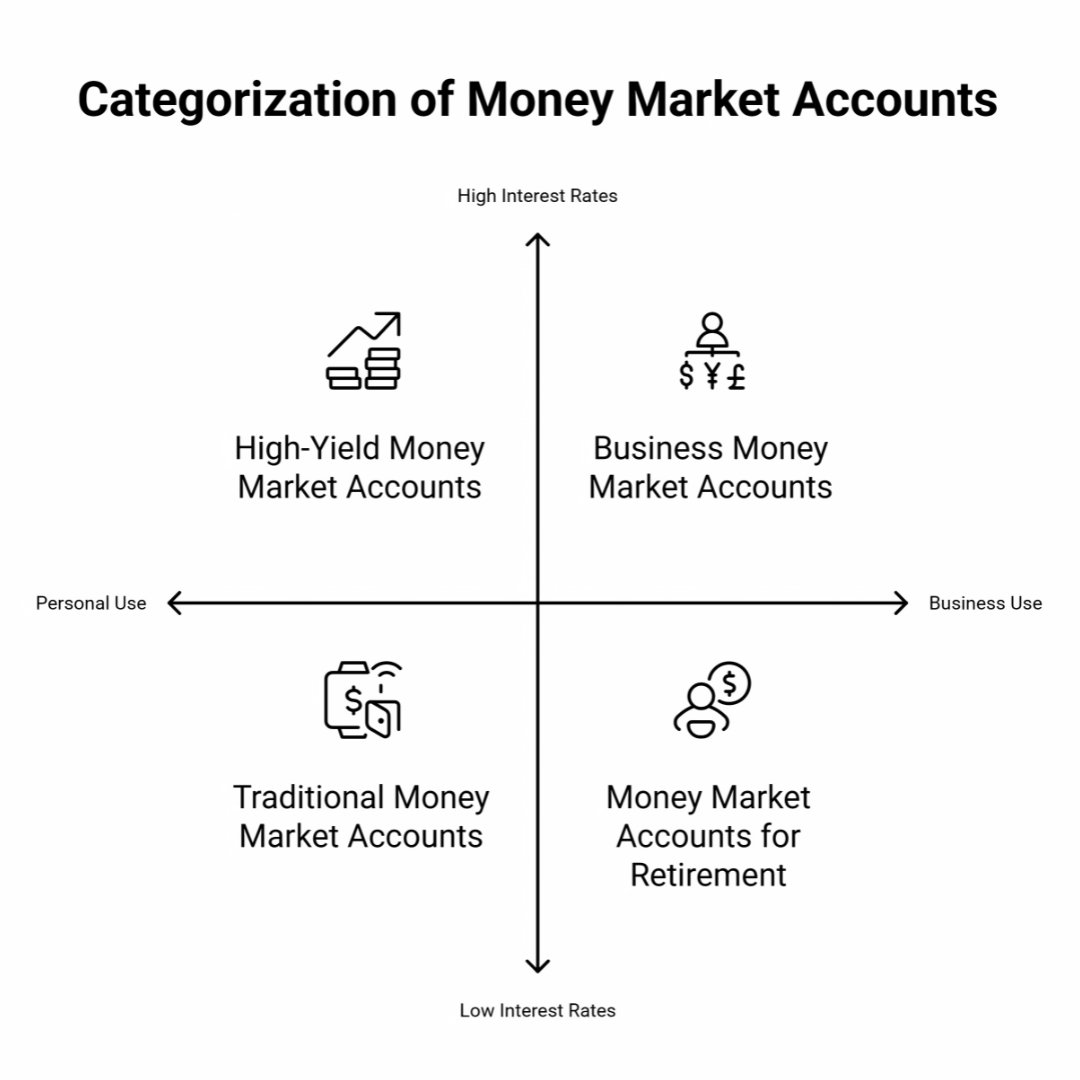

Different Types Of Money Market Accounts

1. Traditional Money Market Accounts

Features

These are the most common types of MMAs. They offer relatively higher interest rates than regular savings accounts and allow limited check-writing or debit card access. Minimum deposit requirements and maintenance fees may apply.

Ideal For

Savers who want easy access to funds with higher interest rates than regular savings accounts, without a Certificate of Deposit (CD) commitment.

2. High-Yield Money Market Accounts

Features

These accounts offer even higher interest rates than traditional MMAs. They usually require higher minimum deposits and are offered by online banks or credit unions. High-yield MMAs may have slightly more restrictions but give a better return on savings.

Ideal For

Those with more significant sums to deposit want to maximize interest earnings. These accounts are suitable for individuals who can meet the higher minimum requirements.

3. Money Market Deposit Accounts (MMDAs)

Features

Money Market Deposit Accounts (MMDAs) are bank-offered accounts similar to MMAs. They allow check writing and sometimes ATM access.

They are FDIC-insured, which guarantees low risk while providing savers with access and protection. They also offer better interest rates than savings accounts.

Ideal For

Those who want both easy access to their funds and the benefit of higher interest rates but prefer a more flexible account with the ability to write checks.

4. Money Market Accounts For Retirement (Roth Or Traditional IRA MMAs)

Features

These MMAs are set up for retirement savings and are offered through Individual Retirement Accounts (IRAs). They offer tax advantages, such as tax-deferred growth in traditional IRAs or tax-free growth in Roth IRAs. Interest rates are typically lower than high-yield options but offer safety and liquidity.

Ideal For

Individuals seek a low-risk, liquid way to grow their retirement savings while taking advantage of tax benefits.

5. Business Money Market Accounts

Features

Designed for businesses, these MMAs work similarly to personal MMAs, offering higher interest rates and easy access to funds.

Business MMAs often have higher minimum deposit requirements and may provide additional services like check-writing and credit card access for business transactions.

Ideal For

Small businesses are looking to earn interest on idle funds while maintaining quick access to capital for day-to-day operations.

Risks Of A Money Market Account

1. Interest Rate Fluctuations

Risk & Causes

One significant feature of hazardous market accounts (MMAs) is their variable interest rates, which are subject to change in response to banking regulations, market conditions, and economic downturns.

Economic downturns, lower demand for short-term investments, and banking policies can also cause rate drops, making MMAs less reliable than fixed-rate investments for consistent returns.

Prevention Tips

To minimize risk, diversify savings with fixed-rate CDs or bonds for stability. Monitor economic trends and compare different MMAs for the best interest rates.

Use high-yield savings accounts or CD laddering to maintain liquidity while securing better returns. If MMA rates decline significantly, consider reallocating funds to invest.

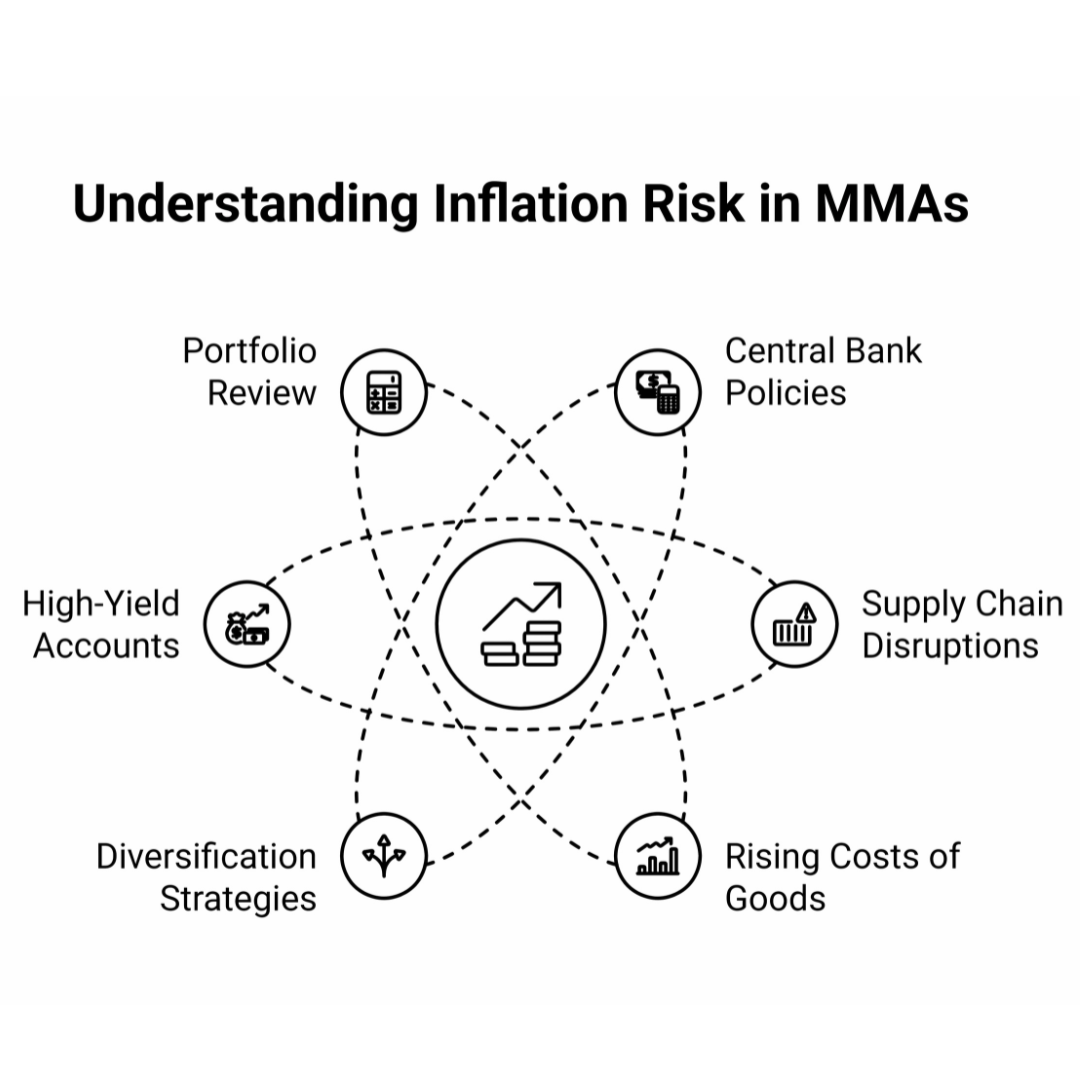

2. Inflation Risk

Risk & Causes

MMAs may not keep up with inflation, reducing the actual value of savings over time. If inflation rises faster than MMA interest rates, purchasing power declines.

Factors such as central bank policies, supply chain disruptions, and rising costs of goods contribute to this risk, which can affect long-term financial security.

Prevention Tips

To mitigate inflation risk, diversify into inflation-resistant assets such as stocks, Treasury Inflation-Protected Securities (TIPS), or real estate.

For better growth, consider high-yield savings accounts or dividends. Review your portfolio regularly to ensure competitive returns and maintain its real value against inflation.

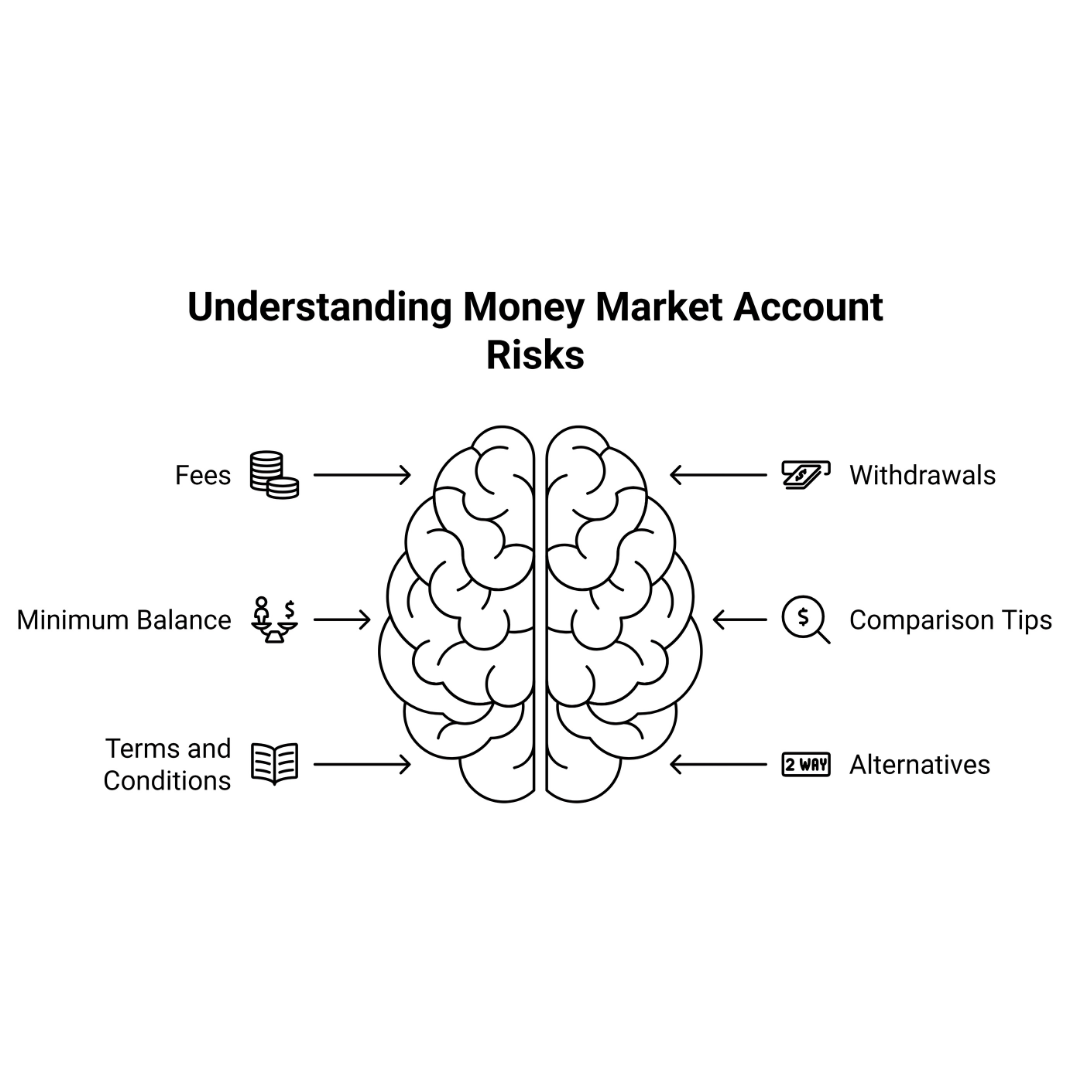

3. Limited Withdrawals

Risk & Causes

Federal regulations typically limit MMAs to six withdrawals per month. If this limit is exceeded, fees or account limitations may apply, making it more difficult to access money when needed.

This constraint reduces liquidity, especially in emergencies, when frequent transactions are less practical than using a checking account.

Prevention Tips

Use MMAs primarily for emergency savings or long-term financial goals. Keep a separate checking account for regular transactions to avoid exceeding withdrawal limits.

Plan by setting up automatic transfers for recurring expenses and monitoring withdrawal activity to prevent unnecessary penalties and maintain financial flexibility.

4. Minimum Balance Requirements

Risk & Causes

Many MMAs have minimum balance requirements, and falling below the threshold can trigger monthly fees that reduce earnings.

This restriction can be challenging if unexpected expenses arise. Additionally, some banks require a higher minimum deposit to access competitive interest rates, limiting access to accounts for lower-income savers.

Prevention Tips

Look for accounts with low or no minimum balance requirements by comparing banks before starting an MMA. Automate deposits to maintain the required balance.

If maintaining a sizable balance is challenging, consider a money market mutual fund or a high-yield savings account that offers flexibility without stringent balance requirements.

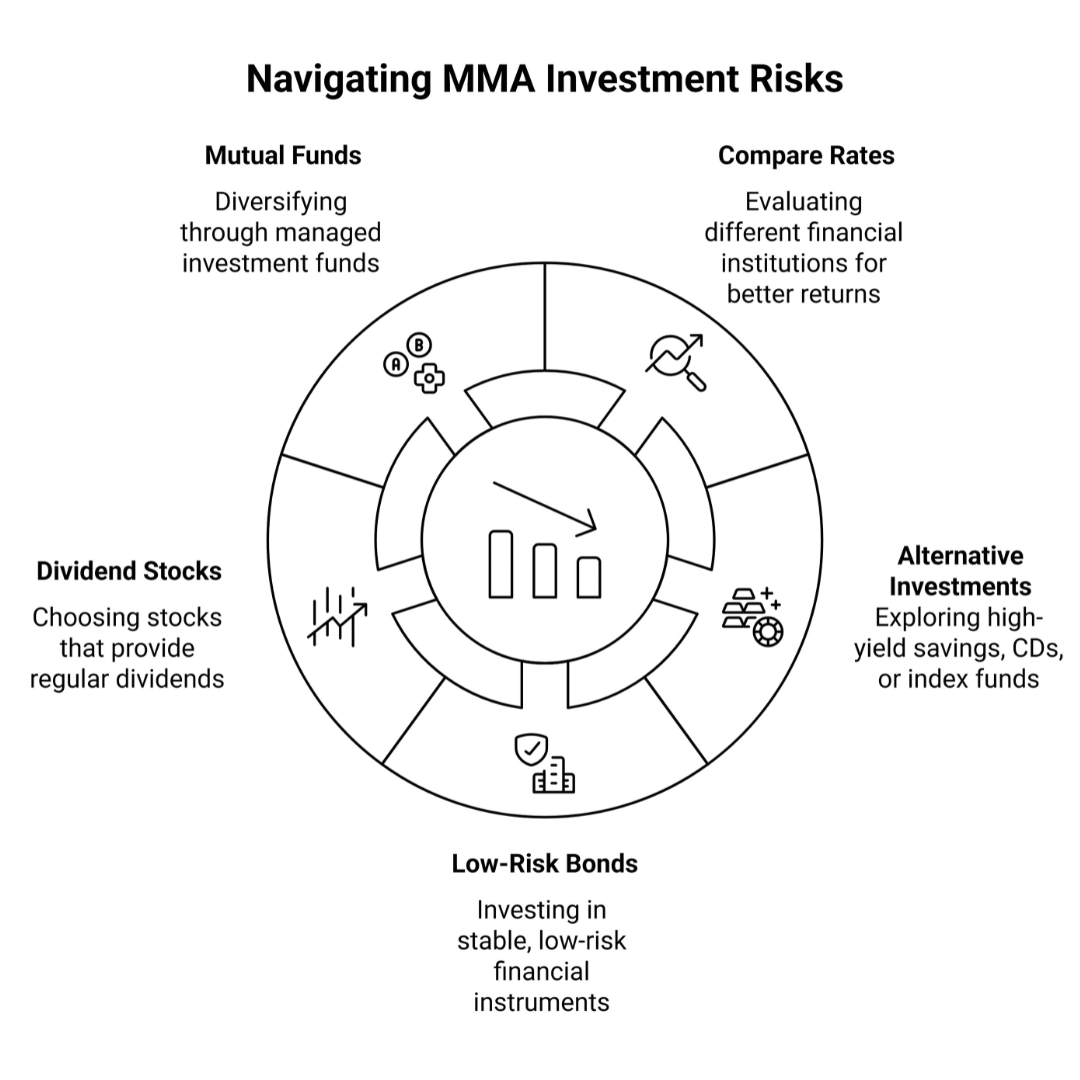

5. Not The Highest-Yield Option

Risk & Causes

One risk with money market accounts (MMAs) is that they may underperform high-yield savings accounts, CDs, or stocks, especially when interest rates remain low.

If interest rates remain low, MMAs may yield insufficient returns for long-term savings growth, making them less attractive than higher-yield investments.

Prevention Tips

To optimize returns, compare rates across different financial institutions before choosing an MMA. Consider alternatives such as high-yield savings accounts, CDs, or index funds for better long-term growth.

If investing is an option, allocate funds to low-risk bonds, dividend stocks, or mutual funds to increase earnings potential.

6. Bank Or Credit Union Failures

Risk & Causes

If a bank or credit union fails, deposits in an MMA beyond the FDIC or NCUA insurance limit of $250,000 are at risk. Economic downturns, financial mismanagement, or instability within the institution can lead to losses, leaving account holders vulnerable to potential financial insecurity.

Prevention Tips

To safeguard funds, keep deposits within FDIC or NCUA insurance limits. If savings exceed the insured amount, spread funds across multiple banks to ensure coverage.

Research the financial stability of research institutions before opening an MMA, and consider diversifying savings into insured CDs or government-backed securities for extra protection.

Wealthy Affiliate – Mini Review (2025)

If you’ve ever thought about turning your blog, passion, or niche into an online business,

Wealthy Affiliate (WA) is one of the most beginner-friendly platforms I’ve used.

It combines step-by-step training, website hosting, SEO research tools,

and an active community all in one place.

What I like most: you can start free (no credit card needed),

explore lessons, test the tools, and connect with other entrepreneurs

before upgrading. WA isn’t a “get rich quick” scheme — it’s a platform where success comes

from consistent effort and applying what you learn.

7. Opportunity Cost

Risk & Causes

MMAs offer low-risk, stable returns but may underperform stocks, bonds, or mutual funds. Keeping funds in an MMA rather than higher-yield investments limits long-term growth and reduces wealth-building potential, especially for individuals saving for retirement or other significant financial goals.

Prevention Tips

To minimize opportunity costs, diversify savings by allocating funds across stocks, bonds, real estate, and other assets. Use MMAs for short-term savings or emergency funds while investing in higher-yield options for long-term growth. Review and tweak your financial plan regularly for the best returns.

8. Potential Fees

Risk & Causes

Fees for monthly maintenance, excessive withdrawals, and penalties for failing to maintain the minimum balance are risks of mone market accounts that can reduce or eliminate interest profits.

These fees can reduce or eliminate interest earnings, making the account less profitable than expected. Unaware account holders may lose money rather than gain interest over time.

Prevention Tips

Before opening an MMA, compare banks to find accounts with low or no fees. Carefully read the terms and conditions to understand potential charges.

Maintain the required minimum balance and limit unnecessary withdrawals to avoid extra costs. If fees are unavoidable, consider fee-free alternatives, such as high-yield savings accounts.

9. Liquidity Constraints

Risk & Causes

MMAs offer less liquidity than checking accounts, as federal regulations limit monthly withdrawals to 6. Going above this limit risks fines, account restrictions, or being reclassified to a checking account, making it harder to access money when needed.

Prevention Tips

Use MMAs for savings rather than daily transactions. Keep a separate checking account for regular expenses. If frequent access to funds is necessary, consider a high-yield savings account or an investment with fewer restrictions. Monitor withdrawals to avoid excess fees and potential penalties.

10. Variable Interest Rates vs Fixed Investments

Risk & Causes

MMAs have fluctuating interest rates, making earnings unpredictable. Unlike fixed-rate investments like CDs or bonds, MMAs may yield lower returns during economic downturns.

This variability makes them unreliable for consistent income, particularly for retirees or individuals needing predictable savings growth.

Prevention Tips

Consider a CD laddering strategy that locks in fixed rates for different time frames to stabilize returns. Monitor interest rate trends and move funds when rates are higher. Diversify savings by combining MMAs with fixed-rate investments to balance flexibility and predictability in earnings.

11. Lower Returns In Low-Interest Environments

Risk & Causes

During low-interest periods, MMA returns can drop significantly, sometimes equaling or falling below those of regular savings accounts.

This makes MMAs less attractive, as funds might earn minimal interest, limiting financial growth. Without alternative investment options, long-term savings could suffer.

Prevention Tips

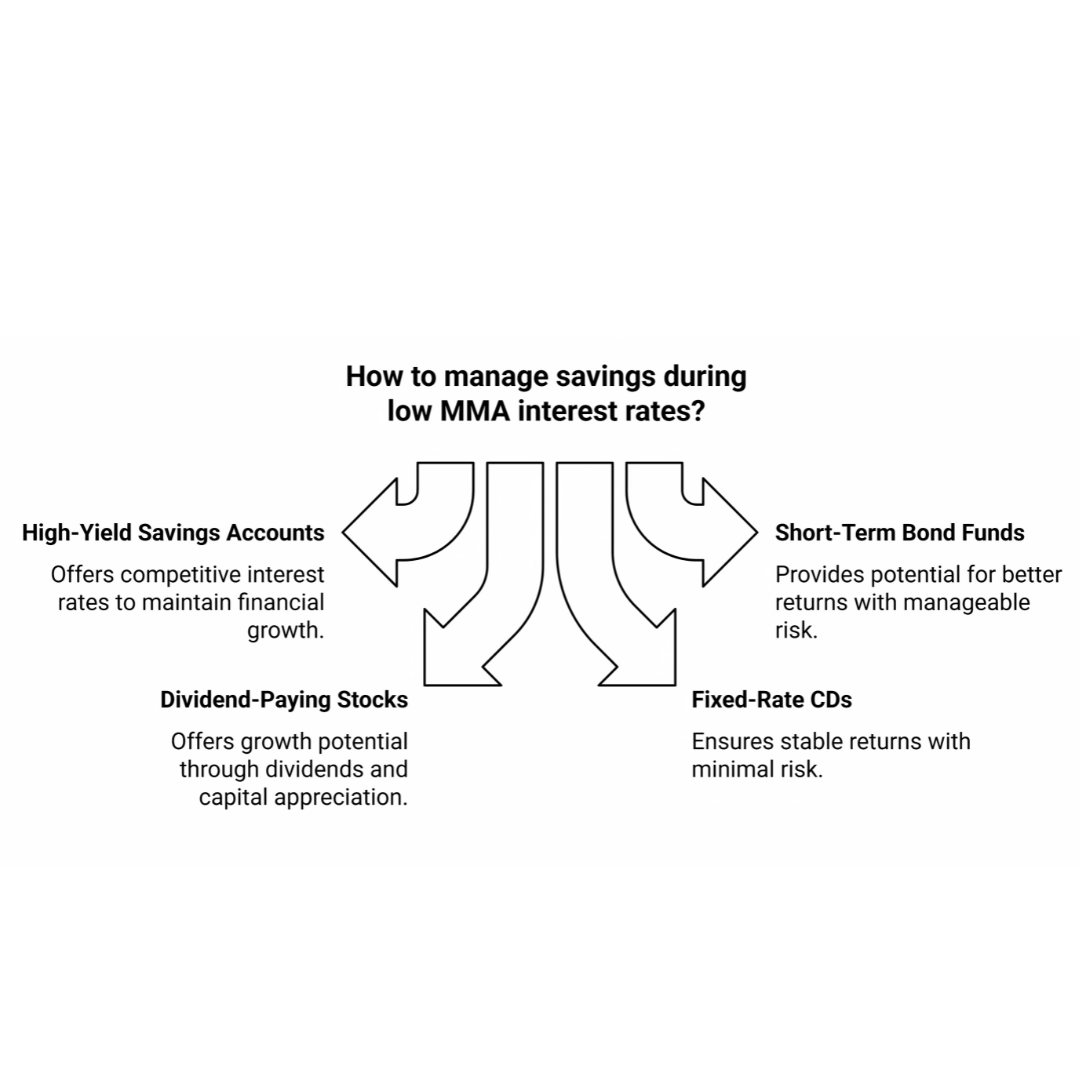

Compare high-yield savings accounts, short-term bond funds, or dividend-paying stocks as alternatives during declining MMA rates.

If long-term stability is a priority, move funds to fixed-rate CDs or other interest-protected investments to ensure continued growth despite economic fluctuations.

12. Bank Policy Changes

Risk & Causes

The risks of money market accounts include the potential for banks to change interest rates, fees, or withdrawal limits, which can negatively affect account benefits and earnings.

These changes can reduce the benefits of an MMA, making it less attractive and potentially leading to lower-than-expected earnings or stricter account restrictions.

Prevention Tips

Review your bank’s terms and interest rates regularly to stay informed about policy changes. If current terms become unfavourable, compare other financial institutions to find better options. If a higher-yield account offers better terms and aligns with your financial objectives, be ready to transfer funds there.

13. Reinvestment Risk

Risk & Causes

If interest rates drop, reinvesting MMA funds may yield lower returns, reducing overall earnings. This is risky for those who rely on MMAs for income, as shifting funds into less favourable options can lead to financial instability and diminished savings growth.

Prevention Tips

To minimize risk, diversify investments into bonds, high-yield savings, or dividend stocks. A CD laddering strategy locks in fixed rates while maintaining liquidity, ensuring stable returns without excessive reinvestment risk. Review interest rate trends regularly to adjust investment strategies accordingly.

14. Tax Implications

Risk & Causes

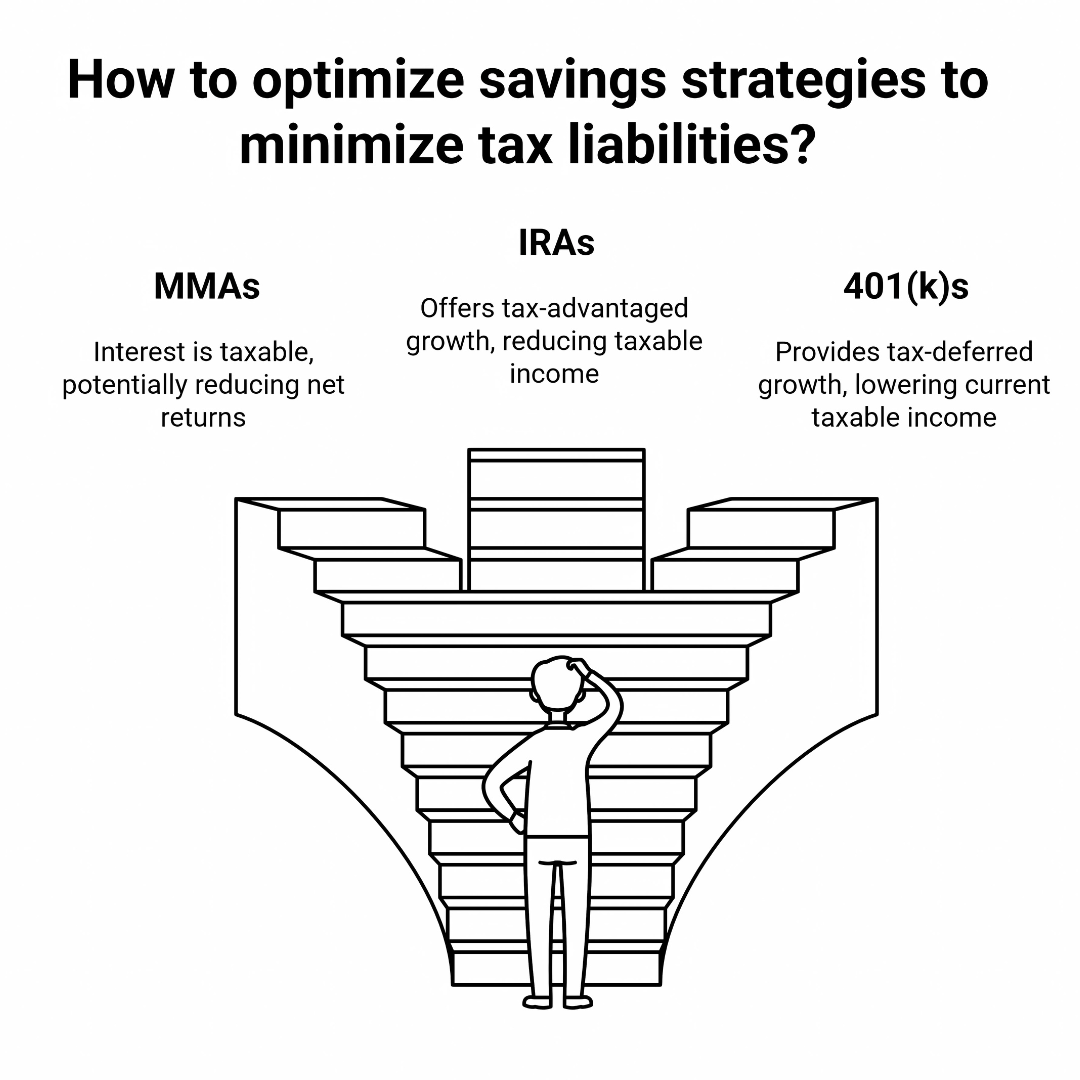

Interest earned from MMAs is taxable income, subject to federal and state taxes. If interest rates are low, the tax burden can significantly reduce net returns, making MMAs less attractive than tax-advantaged accounts like IRAs or municipal bonds, which provide more favourable tax treatment.

Prevention Tips

Track annual earnings and set aside funds for taxes. Consider IRAs, 401(k)s, or municipal bonds to minimize tax liabilities.

To reduce tax liabilities, consult a tax professional. They can help you optimize your savings strategies and reduce overall tax burdens, ensuring better long-term returns.

15. Lack Of Compounding Growth

Risk & Causes

MMAs generally offer simple interest, not compound growth, limiting long-term earnings. Unlike investments like stocks, index funds, or real estate, which experience exponential growth, MMAs provide slower wealth-building potential. This can significantly disadvantage those seeking to increase their savings over time.

Prevention Tips

To mitigate the risks of money market accounts (MMAs) and enhance returns, consider combining them with higher-growth investment vehicles like mutual funds, ETFs, or retirement accounts.

To maximize wealth-building opportunities, use MMAs primarily for short-term or emergency funds and allocate long-term savings into higher-growth investment vehicles.

16. Depreciation In Real Value

Risk & Causes

If inflation exceeds the interest rate of an MMA, the savings lose purchasing power, reducing their actual value. As inflation increases, the same amount of money in an MMA will buy fewer goods or services in the future, making it less effective for long-term wealth-building and savings goals.

Prevention Tips

Invest in inflation-protected assets like TIPS, commodities, or dividend stocks to help maintain your purchasing power. Regularly evaluate your financial plan and adjust your investments to ensure they grow faster than inflation and provide meaningful long-term returns, even amid competitive Market Conditions.

17. Interest Rate Risk & Opportunity Cost

Risk & Causes

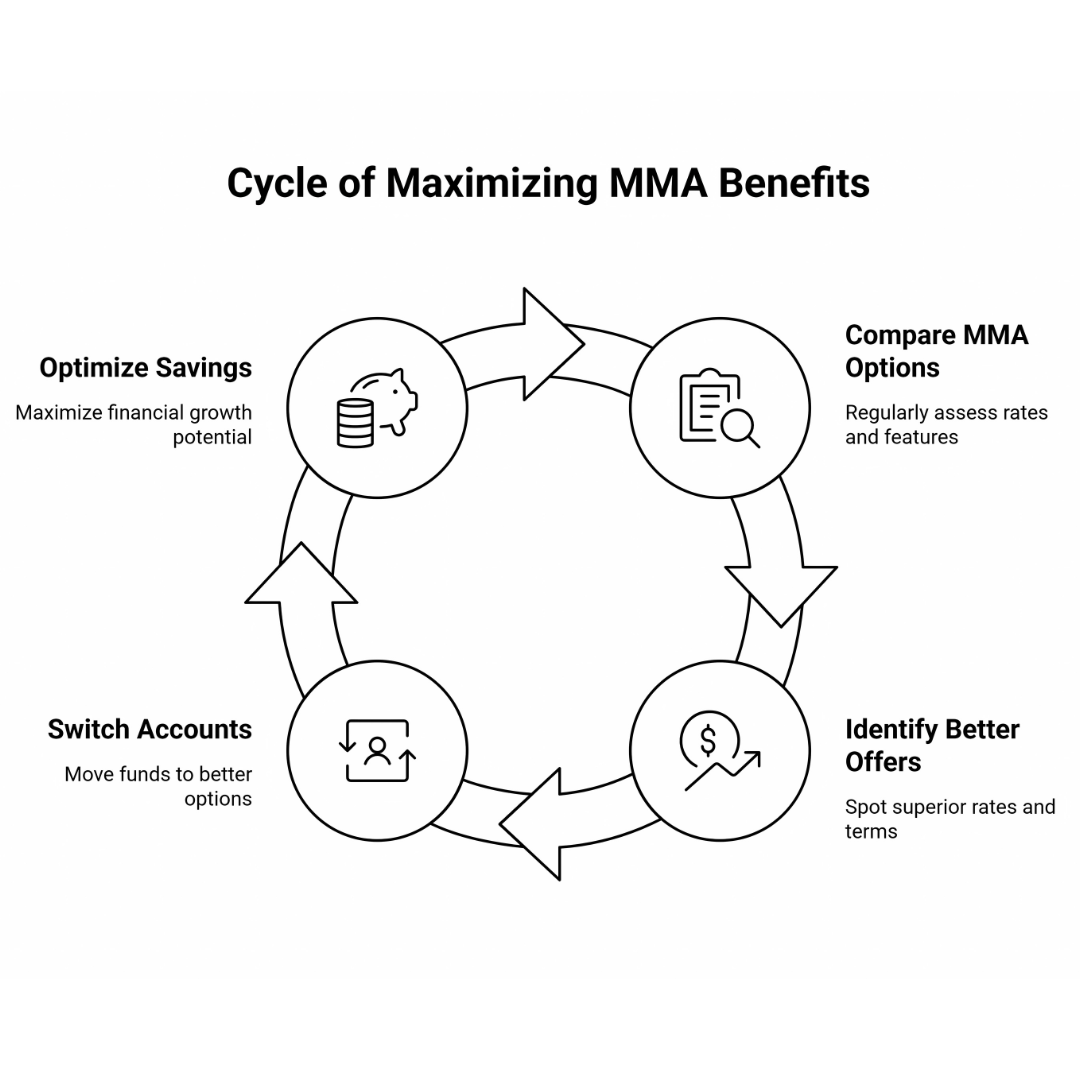

Banks frequently adjust interest rates, fees, and account benefits in response to market competition. If newer high-yield savings accounts or fintech options offer better rates and terms, continuing with an outdated MMA could result in missed opportunities for higher earnings and reduced overall financial growth.

Prevention Tips

Compare MMA rates, fees, and features regularly across various banks. When competitors offer better yields or terms, be proactive about switching accounts. To optimize your savings potential, consider online-only banks, which often offer higher interest rates and lower fees.

18. Financial Institution-Specific Risks

Risk & Causes

One significant risk of money market accounts is the potential impact of a weak or mismanaged bank, which can lower interest rates, introduce fees, or change policies, negatively affecting account holders.

If a bank faces instability, it could compromise the returns and overall benefits of the account, making it less reliable for long-term savings.

Prevention Tips

Before opening an MMA, thoroughly research a bank’s financial health and customer reviews to ensure stability. To minimize risk, diversify deposits across multiple insured institutions.

If a bank’s policies change unfavourably or signs of instability emerge, consider switching to a more reliable financial institution to protect your savings.

19. Delayed Access to Funds

Risk & Causes

Although MMAs are more liquid than CDs, they may have waiting periods for large transfers or withdrawal restrictions during banking hours.

These limitations can create cash flow problems in emergencies, preventing quick access to funds when needed, most hindering financial flexibility in urgent situations.

Prevention Tips

Keep an emergency fund in a checking or high-yield savings account for quick access. Opt for an MMA with fewer restrictions and faster transfer capabilities to ensure immediate access to your funds when necessary, minimizing delays and maximizing financial agility.

Conclusion

In conclusion, understanding the risks of money market accounts, such as low returns, inflation impact, and tax implications, helps savers make informed decisions that align with their financial goals.

It's crucial to weigh these factors and diversify investments to balance risks and rewards. By being aware of these hazards, savers can make well-informed decisions that align with their financial needs and goals.

I trust you enjoyed this article on the Risks Of Money Market Accounts. Please stay tuned for more insightful blogs on affiliate marketing, online business, and working from anywhere in the world.

Take care!

— JeannetteZ 🌍✨

💬 Your Opinion Is Important To Me

Do you have thoughts, ideas, or questions? I’d love to hear from you. Please leave your comments below or email me directly at Jeannette@WorkFromAnywhereInTheWorld.com.

📚 More Work From Anywhere Reads

🚀 Ready to Build a Business You Can Run from Home

Or from Anywhere in the World?

Imagine creating income on your terms — from home, a cozy café, or wherever life takes you.

With the right tools, training, and community support, it’s entirely possible.

Start your own online business for free — no credit card needed.

Disclosure

This post may contain affiliate links. As an Amazon Associate and participant in other affiliate programs, I earn from qualifying purchases at no extra cost to you. Please read my full affiliate disclosure.