High-Paying Jobs In The UK

High-Paying Jobs In The UK

Embarking on a career path that leads to personal fulfillment and financial security is a goal many share.

In the United Kingdom, a mosaic of industries offers a range of opportunities that promise both.

Whether you're a recent graduate looking to make your mark, a seasoned professional aiming for a pivot, or someone curious about the economic landscape, understanding where the high-paying roles are can be pivotal in planning your next move.

This blog highlights some of the highest-paying jobs in the UK, covering a wide range of industries, including technology, healthcare, finance, and more.

We'll delve into what makes these roles lucrative and in demand and offer insights into the skills and qualifications needed to excel in them.

From the bustling finance hubs of London to the tech-driven innovation centers in Manchester and beyond, let's explore the careers that offer a hefty paycheck and the opportunity to contribute significantly to the UK's dynamic economy.

High-Paying Jobs In The UK

1. Data Scientists

- Average Salary: £50,000 – £100,000

- Starting Salary: £50,000

- Highest Salary: £100,000

Data scientists play a crucial role at the nexus of technology and business strategy in the big data age.

Armed with a blend of analytical prowess and fluency in programming languages, they navigate through vast datasets to extract valuable insights.

Data scientists utilize their expertise to decipher intricate patterns, forecast trends, and unlock hidden opportunities within the data labyrinth.

Want to Start Making Money Online?

Try My #1 Recommendation Program!

Their contributions go beyond simple analysis; they enable businesses to make data-driven decisions that spur innovation and raise market competitiveness.

Data scientists are proficient in various tools and techniques, from statistical analysis to machine learning algorithms.

They can transform raw data into actionable intelligence, enabling businesses to optimize processes, personalize customer experiences, and mitigate risks effectively.

In an increasingly digitized world, the demand for skilled data scientists continues to soar, with competitive pay that matches the importance of their position.

As pioneers in data analytics, data scientists shape the future of industries and drive transformative change through the power of data-driven insights.

2. Software Engineers

- Average Salary: £40,000 – £80,000

- Starting Salary: £30,000

- Highest Salary: £100,000

In the technological realm, software engineers are the backbone of the thriving tech industry. These highly qualified individuals design the software systems that run our online lives.

Software engineers design, develop, and maintain intricate programs from conceptualization to implementation, ensuring functionality and efficiency.

Proficiency in programming languages, particularly Python or Java, is beneficial and imperative in this high-demand profession.

Software engineers are coding experts and problem solvers, collaborating across multidisciplinary teams to create innovative solutions.

A software engineer's journey often begins with a solid educational foundation, but the learning curve is perpetual.

Adapting to emerging technologies and frameworks is essential to staying relevant in this ever-evolving landscape.

Moreover, the financial rewards are substantial. The average Salary reflects the industry's recognition of software engineers' crucial role.

Graduates entering the field can anticipate competitive starting salaries, and as experience accrues, the potential for salary growth becomes significant.

The dynamic and ever-expanding tech industry offers software engineers a career and a vocation.

Its intellectual challenges, collaborative spirit, and financial incentives make it a compelling choice for those passionate about coding and driven to shape the digital future.

3. Finance Managers

- Average Salary: £65,000 to £100,000

- Starting Salary: £40,000 to £60,000

- Highest Salary: £150,000

Finance managers are pivotal in overseeing organizations' financial operations, strategic planning, and budgeting.

Finance Manager is one of the highest-paying jobs in the UK. Their duties include trend analysis, financial data analysis, and advice-making for better economic performance.

Finance managers substantially contribute to firms' general prosperity and stability by concentrating on increasing earnings and limiting risks.

These professionals possess strong analytical skills and financial acumen, enabling them to interpret complex financial information and make sound decisions.

They work with different divisions to create and carry out financial plans supporting the company's objectives.

Want to Find Out How To Start Your Home-Based Business?

Try My #1 Recommendation Platform!

Finance managers also ensure that regulations are followed and monitor the state of the finances by regularly reporting and analyzing data.

A background in finance, accounting, or a similar discipline is frequently the foundation of successful finance managers, as is a wealth of experience in financial management positions.

Finance managers are critical decision-makers in driving sustainable growth and profitability for companies across industries.

4. IT Managers

- Average Salary: £50,000 – £90,000

- Starting Salary: £50,000

- Highest Salary: £90,000

IT managers are essential to ensuring a business's IT infrastructure runs smoothly. They manage the setup and upkeep of network, hardware, and software systems, always looking to maximize security and efficiency.

Leadership qualities are paramount as they guide teams through complex projects and initiatives, fostering collaboration and innovation.

Project management skills are essential for planning, executing, and monitoring IT projects, ensuring they align with organizational objectives and timelines.

A robust IT background equips managers with the knowledge and expertise to make informed decisions, troubleshoot technical issues, and anticipate future technological needs.

By keeping up with developing technology and industry trends, IT managers may foster innovation and continuous improvement inside their firms, helping them achieve long-term success and competitiveness in the constantly changing digital world.

5. Lawyers

- Average Salary – £48,000

- Starting Salary – £86,000

- Highest Salary -£125,000

Lawyers and licensed professionals offer legal counsel to individuals and businesses, requiring a law degree.

In the UK, lawyers may serve as barristers, representing clients in court, or solicitors, providing legal assistance outside courtrooms. Specializations within law include corporate, commercial, family, and criminal litigation.

A law degree forms the foundation for a career in law, fostering critical thinking, research, and advocacy skills essential for navigating complex legal matters.

Barristers engage in courtroom advocacy, presenting cases persuasively before judges and juries. Solicitors handle various legal aspects, including drafting contracts, negotiating settlements, and offering advisory services.

Are You Tired Of Scams?

Try The Most-Trusted Training Platform To Make Money Online!

Within specialized fields like corporate law, attorneys facilitate business transactions, ensure regulatory compliance, and resolve disputes.

Commercial law focuses on commercial transactions, contract drafting, and business dispute resolution.

Family law attorneys handle divorce, child custody, and adoption, advocating for clients' best interests.

Criminal litigation involves representing individuals accused of criminal offences, safeguarding their rights, and ensuring fair legal proceedings.

In summary, the legal profession offers diverse opportunities for lawyers to specialize and make meaningful contributions to society through their expertise and advocacy.

6. Legal Professionals

- Average Salary: Varies

- Starting Salary: Competitive

- Highest Salary: Lucrative

Lawyers and experts specializing in corporate law, intellectual property, or international law often command substantial salaries in the UK job market.

Legal professions remain highly sought after, with a competitive starting salary and the potential for lucrative earnings at the top end.

A comprehensive understanding of legal nuances is imperative for success in these fields. Corporate lawyers navigate complex business transactions, ensuring compliance with regulatory frameworks and mitigating legal risks for their clients.

Intellectual property experts safeguard innovations and creative works, offering counsel on patents, trademarks, and copyrights.

International law specialists navigate the intricate web of global regulations and treaties, facilitating cross-border transactions and resolving disputes.

Beyond financial rewards, legal professionals enjoy the intellectual challenge of solving complex legal puzzles and advocating for justice.

With dedication and expertise, legal careers offer economic stability and opportunities for personal and professional growth in the UK.

7. Aerospace Engineers

- Average Salary: £60,000 – £80,000

- Starting Salary: £25,000 – £35,000

- Highest Salary: £100,000+

Aerospace Engineers play a pivotal role in shaping technological advancements, contributing significantly to the design and development of aircraft and spacecraft.

With a keen understanding of engineering principles and a commitment to leveraging cutting-edge technology, these professionals drive innovation in the aerospace industry. They use their expertise to create safe, efficient, high-performance aerospace systems.

Aerospace engineers perform various tasks, including designing aircraft structures, propulsion systems, avionics, and control systems.

They also conduct rigorous testing and analysis to ensure the reliability and functionality of aerospace components and systems.

Moreover, they collaborate with multidisciplinary teams to address complex challenges and push the boundaries of aerospace engineering.

The field of aerospace engineering offers lucrative opportunities for professionals seeking high-paying jobs in the UK.

Aerospace engineers can command substantial salaries as they advance, reflecting their expertise, experience, and contributions to the industry's growth and innovation.

8. Oil And Gas Engineers

- Average Salary: £40,000 to £80,000

- Starting Salary: £25,000 to £35,000

- Highest Salary: £100,000

Oil and gas engineers play a crucial role in the ever-evolving energy sector. They ensure that priceless resources like gas and oil are extracted effectively.

These engineers use their expertise to design, develop, and optimize extraction processes.

Their work involves conducting feasibility studies, preparing equipment, overseeing drilling operations, and implementing safety protocols to mitigate environmental risks.

Want To Learn How To Create Your Own Website And Online Business?

Try My #1 Recommendation Training And Hosting Platform!

Oil and gas engineers work in diverse environments, from offshore platforms to onshore facilities, often collaborating with geologists, environmental scientists, and other professionals.

They must remain current on industry rules and technical innovations to improve extraction efficiency and ecological sustainability.

Oil and gas engineering ranks among the high-paying jobs in the UK, offering competitive salaries and promising career growth opportunities in the dynamic energy sector.

9. Management Consultants

- Average Salary: £60,000 – £80,000

- Starting Salary: £40,000 – £50,000

- Highest Salary: £100,000+

Management Consultants provide crucial guidance to businesses regarding strategic planning and problem-solving.

This consulting profession requires great analytical and communication abilities to handle the wide range of difficulties firms encounter successfully.

Management consultants analyze complex data, identify areas for improvement, and develop actionable strategies to enhance operational efficiency and profitability.

Their expertise spans various industries, and they offer tailored solutions to meet client needs.

Professionals collaborate closely with stakeholders in this dynamic field to understand business objectives, assess current processes, and implement innovative solutions.

Management consultants leverage their expertise to drive organizational growth and navigate competitive landscapes.

They excel in crafting insightful recommendations, fostering client relationships, and delivering measurable results.

Management consultancy is one of the high-paying jobs in the UK. It offers competitive salaries, attractive benefits, and opportunities for career advancement.

With a commitment to excellence and a strategic mindset, individuals can thrive in this dynamic and rewarding profession.

10. Dentists

- Average Salary: £50,000

- Starting Salary: £36,201

- Highest Salary: £70,000

Dentists play a crucial role in providing essential healthcare services, contributing to their ability to command significant incomes.

Their pay varies according to specialty, experience, and geography. Dentists undergo extensive education and training, usually spending four years in dentistry school after earning a bachelor's degree.

Upon graduation, they may opt for additional residency programs or specialize in orthodontics, periodontics, or oral surgery, further enhancing their earning potential.

In the UK, dentists may work in private practices, hospitals, or community health centers. The continual need for dental services guarantees a steady stream of customers and prospects for dentists.

While starting salaries for dentists are competitive, experienced professionals with established practices or specialized skills can command substantial incomes.

Beyond clinical work, dentists may also engage in research, teaching, or administrative roles within the healthcare sector, which provides avenues for career advancement and higher earnings.

As integral healthcare community members, dentists enjoy rewarding careers in the UK, with the potential for professional fulfillment and financial prosperity.

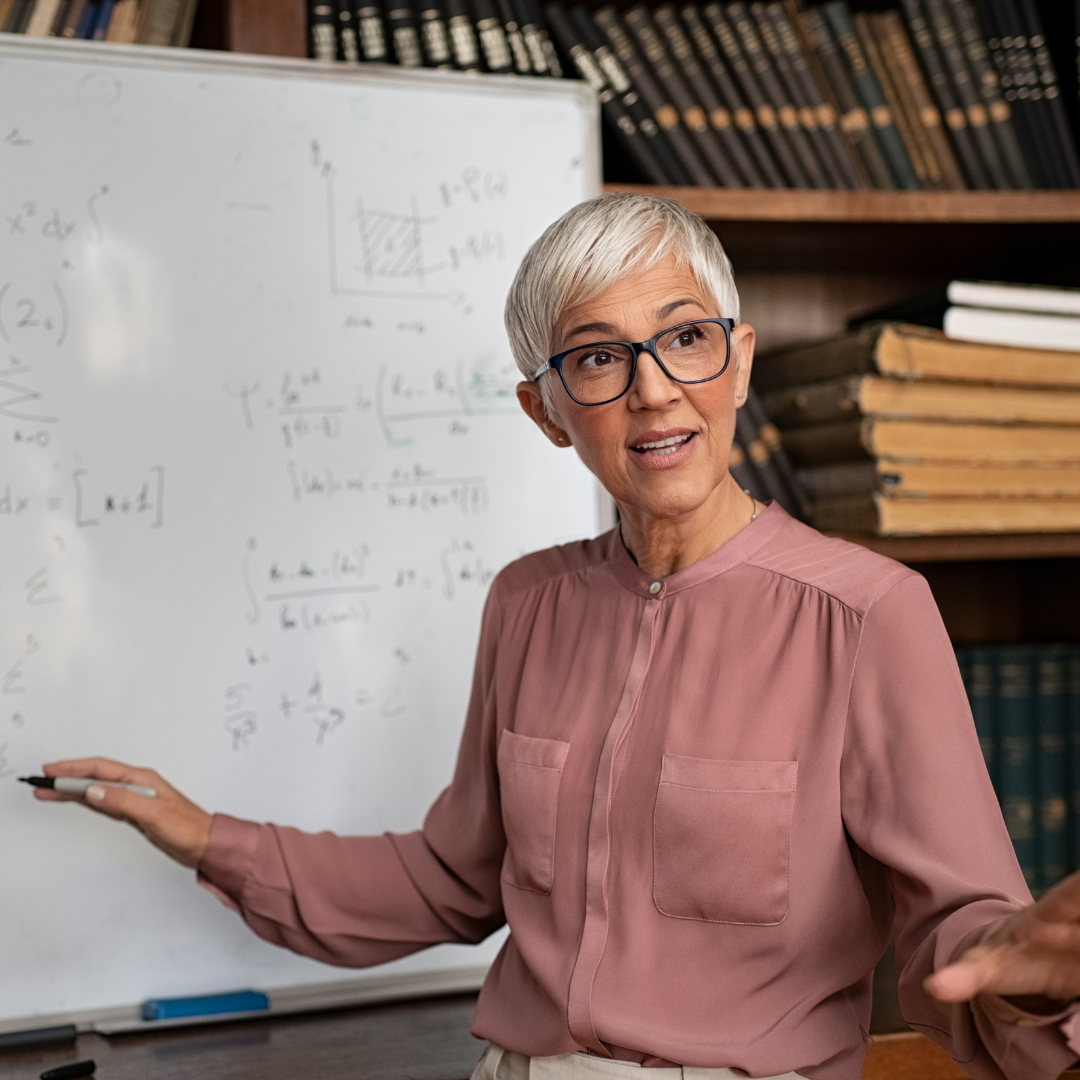

11. Professors

- Average Salary – £75,000

- Starting Salary – £61,000

- Highest Salary – £78,000

Professorships are among the highest-paying jobs in the UK, and they typically boast lucrative salary ranges.

On average, professors command substantial earnings, with starting salaries varying depending on experience and academic field.

In the United Kingdom, professors are esteemed members of academia. They often balance research and teaching responsibilities. Their earnings reflect their seniority and expertise in their respective fields.

The path to becoming a professor is arduous, demanding dedication and commitment. It typically involves acquiring a bachelor's degree, a master's degree, and ultimately culminating in a PhD.

Moreover, significant professional experience is crucial for aspiring professors to attain the pinnacle of their careers.

Professors play pivotal roles in shaping future generations through education and scholarly contributions.

Their dual focus on research and teaching enriches the academic landscape while fostering intellectual growth.

As stalwarts of higher education, professors enjoy esteemed positions and the financial rewards commensurate with their expertise and dedication.

A career as a professor in academia offers both intellectual fulfillment and substantial financial remuneration for those aspiring to high-paying jobs in the UK.

12. Actuaries

- Average Salary: £70,000

- Starting Salary: £40,000

- Highest Salary: £150,000

Actuaries use statistics and mathematics to assess and manage financial risks, which makes them essential to the insurance and financial industries.

These professionals assist organizations in making informed decisions by evaluating the potential impact of uncertain future events.

Actuaries employ advanced quantitative techniques to assess risks related to insurance policies, pension plans, investments, and other financial instruments.

Actuaries analyze data, develop models, and provide recommendations to mitigate risks and optimize financial outcomes.

They collaborate closely with underwriters, investment managers, and other professionals to ensure their organizations' economic stability and sustainability.

Actuaries must be proficient communicators and technically sound to successfully explain complicated ideas to stakeholders.

The profession offers excellent career prospects, with opportunities for advancement and specialization.

Actuaries typically work in insurance companies, consulting firms, government agencies, and financial institutions, where they enjoy competitive salaries and benefits packages.

In summary, actuarial science represents one of the high-paying jobs in the UK, offering rewarding career paths for individuals with a passion for mathematics, statistics, and financial analysis.

13. Judges

- Average Salary: £67,500

- Starting Salary: £44,000

- Highest Salary: £110,000

Judges are crucial in the legal system, making life decisions for others. Securing a position as a judge entails navigating a highly competitive and protracted process.

It demands an extensive understanding of the law, coupled with practical experience. Prerequisites include an undergraduate LLB, a Graduate Law Diploma, and a Legal Practice Course or a Bar Professional Training Course.

The journey to becoming a judge is marked by dedication and perseverance, reflecting the profound commitment required to uphold justice within society.

As our investigation into high-paying employment in the UK ends, it's clear that various industries provide prosperous prospects for individuals with the necessary abilities and perseverance.

These professions, which may be found in finance, healthcare, or technology, provide financial stability and the chance to influence their fields.

Aspirant professionals who keep up with the latest developments in the work market and obtain the required credentials may pursue a fulfilling path toward landing one of the well-paying jobs in the UK.

FAQ

1. How can I increase my chances of getting a high-paying job in the UK?

Answer: Gaining relevant qualifications, building a strong professional network, acquiring specialized skills, and gaining experience in your chosen field can significantly increase your chances of securing a high-paying job.

Maintaining industry trends and engaging in ongoing professional development are also essential.

2. Do high-paying jobs in the UK require a university degree?

Answer: While many high-paying jobs require a university degree or higher education qualifications, high-paying roles value experience, skills, and certifications over traditional academic credentials.

For example, fields like technology and digital marketing often have pathways for skilled individuals who need a university degree.

3. Are there any high-paying remote or flexible jobs in the UK?

Answer: The rise of remote work has led to an increase in high-paying jobs that offer flexibility regarding location and hours.

For example, tech, finance, and consultancy roles may offer the option to work remotely, either full-time or as part of a flexible working arrangement.

4. How does location affect high-paying jobs in the UK?

Answer: Location can significantly impact the availability and salary of high-paying jobs.

London and other major cities like Manchester, Edinburgh, and Birmingham tend to offer more high-paying opportunities due to the concentration of industries and corporations.

However, remote work is making high-paying jobs more accessible across the UK.

5. What challenges might I face when looking for a high-paying job in the UK?

Answer: Competition for high-paying jobs can be intense, requiring candidates to differentiate themselves through their skills, experience, and qualifications.

Economic fluctuations and industry-specific downturns can also affect the availability of high-paying jobs. Enhancing your CV and networking can help you prepare for these challenges.

Conclusion

Navigating through the high-paying jobs in the UK reveals many rewarding opportunities across diverse sectors.

The journey to securing one of these coveted positions demands dedication, pursuit of skill development, and adaptability to evolving industry needs.

Whether you're drawn to finance, technology, healthcare, or another high-earning field, the pathway is ripe with potential for those prepared to invest in their professional growth.

As we conclude, remember that achieving a lucrative career is as much about financial gains as finding a role that offers personal satisfaction and aligns with your values.

The UK job market awaits with open arms, ready for those eager to step up to the challenge and carve out their niche in a competitive landscape.

I trust you enjoyed this article on High-Paying Jobs In The UK. Please stay tuned for more articles to come soon. Take care!

JeannetteZ

Want to Learn How to Build Your Own Home-Based Online Business & Start Making Money Online From Your Comfortable Couch?

Try Wealthy Affiliate!

Your Opinion Is Important To Me

Do you have thoughts, ideas, or questions? I would love to hear from you. Please leave me your questions, experiences, remarks, and suggestions about the High-Paying Jobs In The UK in the comments below. You can also contact me by email at Jeannette@WorkFromAnywhereInTheWorld.com.

Disclosure

This post may contain affiliate links. I earn from qualifying purchases as an Amazon Associate and other affiliate programs. Please read my full affiliate disclosure.

You may also enjoy the following articles:

How To Make Money As An Artist

How To Become A Consultant In 2022

All You Should Know About Stocks And Bonds