Top eCommerce Brokers And Their Key Services

Choosing the right eCommerce brokers can make all the difference in growing your online business successfully. These professionals connect buyers and sellers of eCommerce stores. They offer essential services that simplify the complex buying or selling process.

In this blog, we’ll explore the different types of eCommerce brokers and highlight the powerful services they offer to help you achieve fast and sustainable growth.

What Are eCommerce Brokers?

eCommerce brokers are experts or companies that help with the purchase and sale of online companies and eCommerce enterprises.

They act as intermediaries, connecting sellers who want to exit their online ventures with buyers looking to invest or expand in the digital marketplace.

These brokers provide valuable services such as business valuation, marketing listings, negotiating deals, and handling due diligence. Their expertise helps streamline complex transactions, ensuring both parties achieve fair terms.

eCommerce brokers typically focus on various online business types, including dropshipping stores, Amazon FBA businesses, Shopify shops, and other digital retail models.

By leveraging their knowledge of the market and networks, eCommerce brokers make it easier to navigate the online business buying and selling process efficiently and securely.

They also assist with paperwork, confidential communication, and post-sale support to ensure smooth transitions for all involved.

Types Of eCommerce Brokers

eCommerce brokers simplify the process of buying or selling online businesses. From Amazon FBA to full-service advisors, each type offers specialized support, pricing models, and global reach for seamless transactions.

1. Business Sale Brokers (eCommerce M&A Brokers)

Business sale brokers focus on mid to large eCommerce businesses. They handle the full sales process: valuation, listing, buyer screening, negotiation, and deal closing.

Their rates typically range from 8% to 15% of the final sale price, depending on business value. These brokers work globally, often headquartered in the U.S. or the UK.

Notable firms include Empire Flippers (U.S.), Quiet Light (U.S.), and Website Closers (U.S.). They often cater to sellers with revenues over $500,000 annually.

Their due diligence process is rigorous and ensures high-quality buyer matches, which makes them ideal for established business exits.

2. Amazon FBA Brokers

Amazon FBA brokers specialize in buying and selling Fulfillment by Amazon businesses. They understand how FBA works, including Amazon rankings, inventory management, and seller performance metrics.

These brokers provide valuations based on net profits, account health, and SKU performance. Rates typically range from 10% to 15%. Companies like SellerX (Germany, UK & USA) and AMZ Advisers (USA) are well-known.

These brokers often attract buyers from North America, Europe, and Asia. They handle all communication, due diligence, and Amazon-related paperwork, simplifying the sale for FBA sellers and buyers alike.

3. Shopify Store Brokers

Shopify store brokers are specialists in Shopify-based eCommerce businesses. They assess performance through analytics, custom design elements, app usage, customer retention, and fulfillment processes.

Their fee structure ranges from 8% to 12%. Brokers such as OpenStore (U.S.) and platforms like Acquire.com (formerly MicroAcquire) often feature Shopify brands. Many Shopify brokers operate out of the U.S., Canada, and the UK.

They cater to both dropshipping and inventory-based sellers and can facilitate sales quickly due to their familiarity with the Shopify ecosystem, particularly for stores earning $1,000–$100,000 per month.

4. SaaS eCommerce Brokers

SaaS eCommerce brokers assist in selling businesses offering software subscriptions or tools related to eCommerce. They evaluate metrics like monthly recurring revenue (MRR), churn rate, and customer lifetime value (CLV).

These brokers often charge 10%–15% commission. FE International (U.S. & UK) and MicroAcquire (U.S.) are prominent. Headquartered in global financial hubs, they work with tech-savvy buyers and sellers.

Their process includes in-depth financial audits, buyer vetting, and often includes post-sale transition support. They’re ideal for digital product companies or eCommerce SaaS tools generating $5K–$100K MRR.

5. Micro eCommerce Brokers

Micro eCommerce brokers focus on small-scale online stores valued under $100K. They streamline the buying/selling process with templated listings and simplified contracts.

These brokers typically charge a 5% to 10% fee. Examples include Flippa (Australia) and Acquire.com (U.S.). They are popular with beginners and solopreneurs.

Listings often include starter sites, side hustles, and new dropshipping stores. Transactions close quickly, often within 30 days.

These platforms are based globally and cater to worldwide audiences, especially English-speaking markets. Their intuitive dashboards make it easy for non-technical sellers to sell micro-businesses efficiently.

6. Marketplace Aggregators (Acquisition-Focused)

Aggregators like Thrasio (U.S.), Perch (U.S.), and Elevate Brands (U.S.) buy multiple eCommerce brands—especially Amazon FBA.

While not traditional brokers, they operate similarly by acquiring vetted brands directly or through broker networks. They do not charge sellers a fee; instead, they purchase the business outright, often using performance-based earn-outs.

Aggregators are funded by private equity or venture capital and are mainly U.S.-based with global acquisition targets. They work fast, often closing deals within 30–45 days.

Sellers benefit from quick exits, though valuations are tightly linked to EBITDA and niche viability.

7. Niche Product Brokers

These brokers specialize in particular product categories like fashion, eco-products, pet supplies, or health goods. They offer tailored valuations and curated buyer networks.

Their commission rates are usually 10%–12%. Examples include OpenStore for DTC brands and Allies Commerce for niche product lines.

These brokers often operate from the U.S., UK, and Canada, serving clients globally. They work closely with sellers to present brand stories, manufacturing relationships, and loyal customer bases.

This specialization allows them to command premium prices for well-positioned niche brands and connect sellers with highly relevant buyers.

8. Affiliate Website Brokers

Affiliate website brokers handle monetized content sites rather than product-selling stores, but they’re common in the broader eCommerce space. They evaluate SEO traffic, content quality, affiliate partnerships, and earnings per visitor.

Commission fees are about 10%–15%. Companies like Motion Invest (Canada) and Investors Club (U.S.) lead this niche. These brokers often operate virtually and serve a global client base.

They facilitate sales of blogs and niche sites that earn via Amazon Associates, ShareASale, or other affiliate programs. These sites appeal to buyers who prefer content-driven revenue rather than physical product sales.

9. Dropshipping Business Brokers

Dropshipping brokers focus exclusively on businesses that use third-party suppliers to fulfill orders. They assess advertising ROI, supplier reliability, and automation tools.

Rates typically range from 10% to 12%. Notable platforms include Dropship.io (UK) and Flippa (AU), which feature many dropshipping businesses.

Brokers help sellers clean up Facebook ad accounts, automate operations, and improve profitability before listing. Most are based in the U.S., UK, and Australia, but cater to global buyers.

Dropshipping businesses sell faster when tied to strong branding, low ad spend, and consistent supplier fulfillment.

10. Full-Service eCommerce Advisors

These are high-end brokers offering end-to-end services: exit planning, valuation, listing, due diligence, negotiations, and legal guidance.

They often charge 12%–15% of the final sale price. Examples include Raincatcher (U.S.) and Digital Exits (Australia). These advisors usually operate in North America and Oceania, serving clients globally.

Their process involves deep financial review, market trend analysis, and customized buyer matching. They’re ideal for complex exits or multi-brand eCommerce businesses with logistics, inventory, and international presence.

Many also support post-sale integration and long-term transition strategies, making them suitable for six- and seven-figure exits.

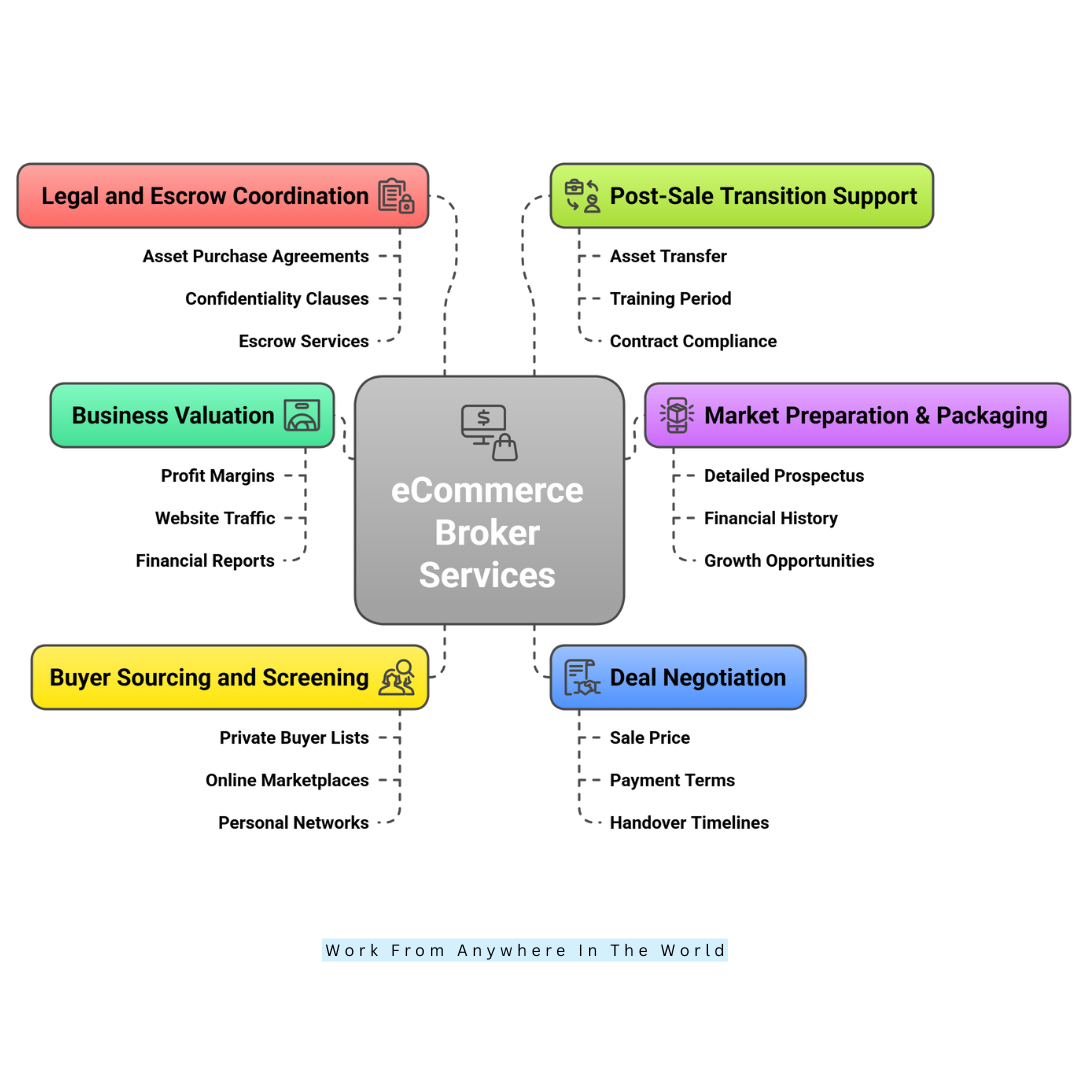

Key Services Offered By eCommerce Brokers

eCommerce brokers offer a range of services to help online business owners sell efficiently and profitably. From valuation to post-sale support, their expertise simplifies the entire selling process.

1. Business Valuation

eCommerce brokers begin with a detailed business valuation to determine what your online store is worth. They analyze profit margins, website traffic, financial reports, and customer data.

Valuation methods often include SDE (Seller’s Discretionary Earnings) or EBITDA multiples based on industry standards. Brokers compare your business to similar recent sales in their database.

This ensures your listing price is competitive, realistic, and attractive to buyers. Accurate valuation reduces negotiation hurdles and increases the chance of a successful sale.

Many brokers offer this service for free to engage potential sellers and build trust early in the selling process.

2. Market Preparation & Packaging

Before listing a business, brokers professionally package it for presentation to buyers. This includes preparing a detailed prospectus with financial history, traffic data, supplier relationships, operational workflow, and growth opportunities.

The goal is to make your business appear low-risk and scalable. Brokers may also advise you on small improvements like tidying up books or automating processes. These tweaks can increase value and appeal.

By professionally organizing all relevant documents and highlighting key strengths, brokers make your listing more attractive and trustworthy. A well-packaged business is more likely to sell faster and at a better price.

3. Buyer Sourcing And Screening

Brokers actively source and vet buyers using private buyer lists, online marketplaces, and personal networks. Once your business is listed, they market it to a curated pool of interested buyers.

Potential buyers are screened through interviews, financial background checks, and proof-of-funds verification. Brokers require buyers to sign NDAs before sharing sensitive details.

This helps ensure only serious, qualified buyers engage with your listing. By filtering out unqualified leads, brokers save time and prevent unnecessary delays.

This strategic matchmaking between business and buyer increases the chance of a smooth sale and successful business transition.

Wealthy Affiliate – Mini Review (2025)

If you’ve ever thought about turning your blog, passion, or niche into an online business,

Wealthy Affiliate (WA) is one of the most beginner-friendly platforms I’ve used.

It combines step-by-step training, website hosting, SEO research tools,

and an active community all in one place.

What I like most: you can start free (no credit card needed),

explore lessons, test the tools, and connect with other entrepreneurs

before upgrading. WA isn’t a “get rich quick” scheme — it’s a platform where success comes

from consistent effort and applying what you learn.

4. Deal Negotiation

Negotiation is a crucial part of selling an eCommerce business, and brokers handle it expertly. They negotiate not just the sale price but also the deal structure—payment terms, handover timelines, and contingencies.

Acting as a neutral third party, brokers ease tension between buyer and seller and reduce emotional decision-making. They use market data and comparable deals to support your position.

Brokers also help identify and resolve objections early, keeping the deal on track. Their goal is to get the highest value while maintaining fairness. Skilled negotiation increases deal success rates and protects the seller’s financial and strategic interests.

5. Legal And Escrow Coordination

After an agreement is reached, brokers assist with legal documentation and escrow services. They help draft asset purchase agreements (APAs), confidentiality clauses, and non-compete agreements.

Brokers coordinate with platforms like Escrow.com to hold funds securely during the transition. They often work with attorneys and accountants to ensure all legal and financial aspects are compliant.

This reduces risk and builds trust between both parties. Brokers manage the timeline and checklist for due diligence, transfer of assets, and final payouts.

Their role during this phase ensures that the transaction is executed smoothly, legally, and without costly errors or delays.

6. Post-Sale Transition Support

After the sale closes, brokers help manage the transition between seller and buyer. They ensure all assets are transferred—like domain names, store accounts, supplier contacts, and SOPs.

Brokers also help establish a training period, often ranging from 30 to 90 days, where the seller teaches the new owner how to operate the business. This support helps maintain business continuity, prevent customer disruptions, and build trust.

Brokers may remain available during the transition to resolve misunderstandings and ensure contract terms are met. Post-sale support is critical for buyer satisfaction and the long-term success of the transferred business.

7. Exit Planning

Exit planning helps business owners prepare for a profitable and smooth sale months—or even years—in advance. eCommerce brokers guide sellers on optimizing operations, organizing financials, and increasing valuation before going to market.

They identify weak areas such as high owner involvement, low margins, or poor documentation and suggest improvements.

This strategic preparation enhances the appeal and price of the business. Brokers also advise on timing the sale to match favourable market conditions.

With proper exit planning, sellers can avoid last-minute scrambling and make informed decisions. It’s ideal for entrepreneurs who want to sell but aren’t quite ready yet.

8. Financing Assistance For Buyers

Some buyers need help securing financing, and brokers assist by connecting them with trusted lenders. This includes SBA loan providers, private lenders, or alternative financing platforms.

Brokers help prepare the required documentation—financial records, business plans, and valuation reports—to increase approval chances.

By supporting financing efforts, brokers expand the pool of potential buyers and speed up deal closure. They ensure the buyer’s funding matches the deal size and timing.

This service is valuable for high-ticket eCommerce businesses and first-time buyers. It also reassures sellers that the buyer is financially qualified and more likely to follow through.

9. Due Diligence Management

Before completing the purchase, the buyer does due diligence, which is a crucial stage. Brokers coordinate this process by organizing necessary documents like tax returns, supplier contracts, analytics, and legal records.

They act as intermediaries to protect sensitive data and keep communications professional. Brokers also ensure deadlines are met and clarify buyer concerns quickly to maintain deal momentum.

Their structured approach helps prevent delays, misunderstandings, and failed deals. Brokers effectively assist both parties through the sometimes daunting process of due diligence, particularly for first-time sellers. This service builds trust and leads to smoother closings.

10. Marketplace Listing Management

eCommerce brokers manage listings on platforms like Flippa, Empire Flippers, FE International, and others to reach a broad buyer audience.

They write compelling listing descriptions, highlight key business metrics, and upload financials and traffic data. Brokers optimize listings with targeted keywords to attract the right buyer profiles.

They also monitor listing performance, respond to inquiries, and update details as needed. This hands-on service saves sellers time and ensures maximum visibility.

Listings are promoted through broker email lists, social media, and private networks. Strategic listing management increases buyer engagement and shortens the time it takes to sell the business.

11. Brand And Asset Valuation

Beyond total business value, brokers help sellers evaluate individual brand elements—like trademarks, domain names, proprietary products, social media accounts, and email lists.

These intangible assets often carry significant weight in the eyes of buyers. Brokers assess how each component contributes to the business’s success and factor it into the overall valuation.

This service is essential for companies with strong branding, influencer deals, or proprietary content. A detailed asset breakdown provides transparency and justifies a higher asking price.

Understanding each asset’s worth helps both parties agree on fair terms and makes negotiations more transparent and more effective.

12. Recurring Revenue Analysis

Brokers evaluate the consistency and reliability of a business’s income by analyzing recurring revenue streams such as subscriptions, memberships, or repeat customer orders.

This service identifies how much of the monthly income is predictable, which adds significant value to the business. Buyers prefer stable revenue over one-time spikes, so brokers highlight customer retention rates, average order value, and lifetime value (LTV).

They may also suggest improvements, like introducing loyalty programs or bundling offers. By showcasing predictable earnings, brokers position the business as lower risk and more desirable. This analysis can increase both the sale price and buyer interest significantly.

Conclusion

Partnering with the right eCommerce brokers ensures you get expert guidance and essential services tailored to your business needs.

Whether you’re buying, selling, or scaling your online store, understanding the types and services of eCommerce brokers will help you make smarter decisions and unlock new growth opportunities.

Start leveraging their expertise today to take your eCommerce journey to the next level and achieve long-term success in the competitive digital marketplace.

I trust you enjoyed this article on the Top eCommerce Brokers and Their Key Services. Please stay tuned for more insightful blogs on affiliate marketing, online business, and working from anywhere in the world.

Take care!

— JeannetteZ

💬 Your Opinion Is Important To Me

Do you have thoughts, ideas, or questions? I’d love to hear from you. Please leave your comments below or email me directly at Jeannette@WorkFromAnywhereInTheWorld.com.

📚 More Work From Anywhere Reads

🚀 Ready to Build a Business You Can Run from Home

or from Anywhere in the World?

Imagine creating income on your terms — from home, a cozy café, or wherever life takes you.

With the right tools, training, and community support, it’s entirely possible.

Start your own online business for free — no credit card needed.

Disclosure

This post may contain affiliate links. As an Amazon Associate and participant in other affiliate programs, I earn from qualifying purchases at no extra cost to you. Please read my full affiliate disclosure.