How To Rebuild My Credit

How To Rebuild My Credit

Rebuilding your credit may seem challenging, but it's achievable and rewarding with the right strategies. Whether you've faced financial setbacks or want to improve your creditworthiness, taking proactive steps can make a big difference.

In this guide, we’ll cover how to rebuild my credit with practical tips, from understanding your credit report to adopting better financial habits.

What Is A Credit Score?

A credit score numerically represents your creditworthiness, typically 300 to 850. It’s calculated based on your credit history and is a key factor for lenders when assessing your ability to repay or manage credit responsibly.

Lenders see higher scores as an indication of lower risk, which usually leads to better lending terms and lower interest rates.

Conversely, lower scores may make it harder to secure credit or result in higher costs. Credit scores are generated by credit bureaus like Experian, Equifax, and TransUnion and are used by banks, landlords, employers, and insurance companies.

Understanding your credit score and its components is essential for maintaining healthy financial habits. Your capacity to accomplish life goals, like purchasing a home or obtaining a vehicle loan, might be significantly impacted by your credit score.

Types Of Credit Scores

Credit scores, numerical depictions of your creditworthiness, are used by lenders to evaluate your ability to repay loans or credit. There are several credit scores, each with its scoring model and purpose. Here are the main types:

1. FICO Score

Overview

The FICO Score is US lenders' most widely used credit score. It assesses creditworthiness to guide lending decisions for loans, credit cards, and other products. A higher score (between 300 and 850) means the risk is lower.

Score Range

300 to 850

Key Factors

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- Credit mix (10%)

- New credit inquiries (10%)

Variations

FICO offers industry-specific scores tailored for particular lending needs, such as auto loans or mortgages. These scores adjust their weighting to better predict repayment behaviour within specific contexts, helping lenders evaluate borrowers more accurately for specialized loans.

Want to Start Making Money Online?

Try My #1 Recommendation Program!

2. VantageScore

Overview

VantageScore, developed as a competitor to FICO, is used by some lenders and credit bureaus. It evaluates creditworthiness using a scale of 300 to 850, offering an alternative scoring model to assist lending decisions across various industries.

Score Range

300 to 850

Key Factors

- Total credit usage

- Credit mix

- Payment history

- Age of credit

- Recent credit behaviour

Highlights

VantageScore excels in generating scores for individuals with limited credit history. Unlike FICO, it requires less data, making it easier for people with thin credit files or short credit histories to obtain a credit score.

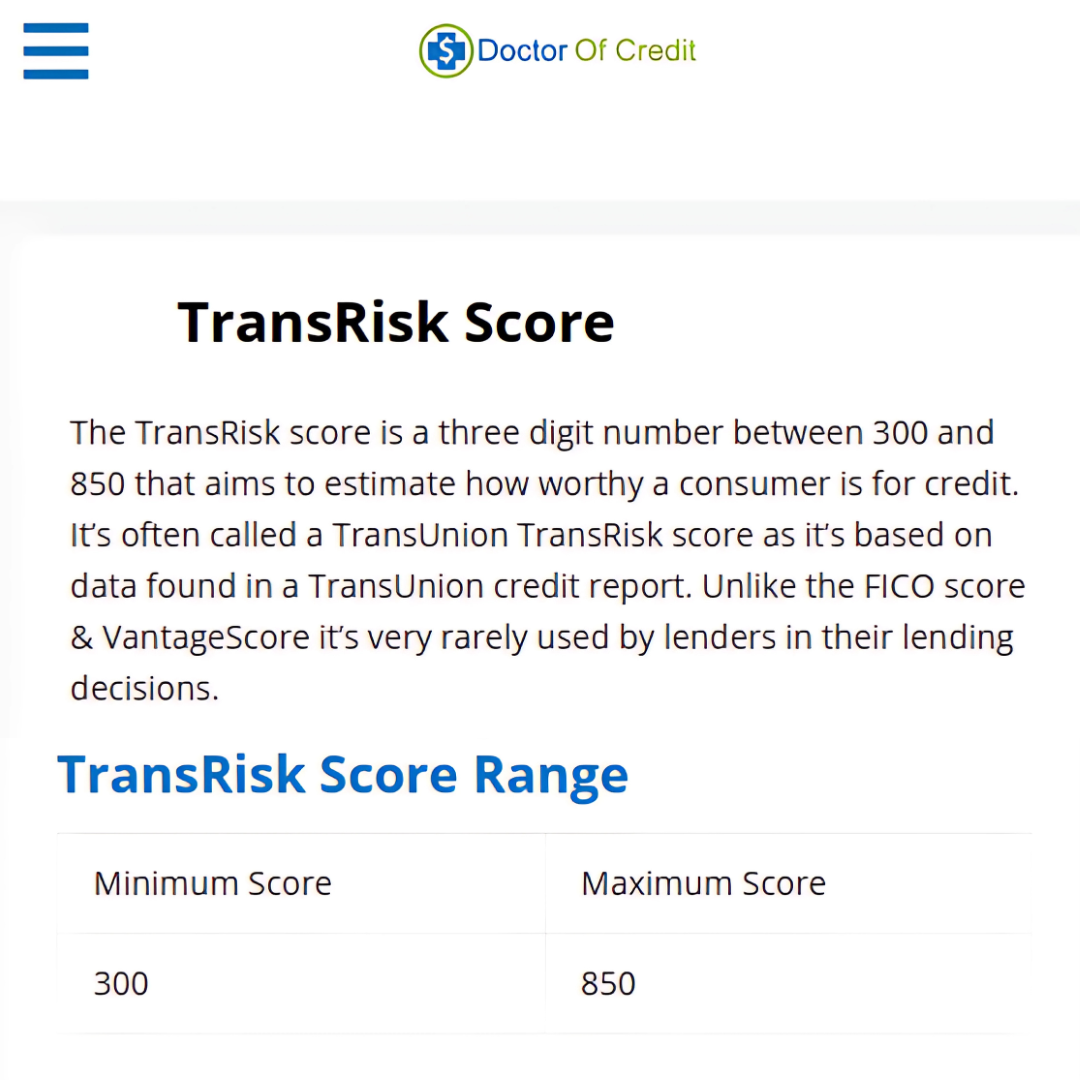

3. TransRisk Score

Overview

The TransRisk Score, developed by TransUnion, is designed for specialized credit assessments. It helps lenders evaluate potential borrowers’ credit risk using tailored methodologies, providing insight for industry-specific scenarios like auto loans or credit card approvals.

Score Range

Varies depending on the specific scoring model

Key Factors

- Payment history

- Credit utilization

- Debt balances

- Credit inquiries

Purpose

TransRisk predicts credit risk for specific credit types, helping lenders assess borrowers’ likelihood of default. This information is beneficial for targeting credit needs and making more precise decisions about particular financial products or lending categories.

4. Experian National Equivalency Score

Overview

Created by Experian, this score functions similarly to FICO in evaluating credit risk. It gives lenders a clear picture of a borrower’s creditworthiness, aiding in informed lending decisions for personal loans, mortgages, or other credit products.

Score Range

360 to 840

Key Factors

- Payment history

- Credit utilization

- Length of credit history

- Recent inquiries

- Credit balances

Purpose

Lenders can use the score to estimate a borrower's probability of missing payments. It uses credit history, balances, and inquiries to assess risk, ensuring better credit evaluation and tailored financial offerings.

Want to Find Out How To Start Your Home-Based Business?

Try My #1 Recommendation Platform!

5. Educational Scores

Overview

Credit scores provided by services like Credit Karma and Experian are designed to give consumers a clear understanding of their credit health. These tools allow individuals to monitor their credit trends and identify areas for improvement.

Key Factors

- Payment history

- Credit utilization

- Length of credit history

- Recent inquiries

- Types of credit used

Purpose

Lenders do not directly use these scores but serve as an educational resource. They help individuals understand their credit profile, track changes, and prepare for financial decisions like applying for loans or credit cards.

6. Equifax Credit Score

Overview

Equifax provides the Equifax Credit Score, often customized to meet specific lenders' requirements. The score offers insights into borrowers' creditworthiness, helping lenders make informed decisions about loans, credit cards, and financial products.

Score Range

280 to 850

Key Factors

- Payment history

- Total credit balances

- Credit utilization ratio

- Length of credit history

- Recent credit inquiries

Purpose

This score, designed to evaluate a consumer's credit risk, helps lenders assess the probability of timely repayment. It focuses on factors like credit activity and balances, ensuring accurate risk predictions tailored to individual financial behaviour.

How To Rebuild My Credit

1. Check Your Credit Report

You can obtain reports from Equifax, Experian, and TransUnion through annualcreditreport.com. Look for errors such as incorrect balances or unknown accounts.

Dispute inaccuracies immediately via the credit bureau’s website. Regular monitoring ensures accuracy and prevents surprises. Staying informed about your report is foundational for rebuilding your credit and financial health.

Key Points

- Obtain reports annually.

- Dispute errors promptly.

- Monitor changes regularly.

2. Pay Bills On Time

Always pay credit cards, loans, and utilities by their due dates. Late payments damage credit scores and remain on your report for years.

Are You Tired Of Scams?

Want to Start Making Money Online?

Set up automatic payments or use reminders. Timely payments strengthen your history, accounting for 35% of your score—the most significant factor in credit rebuilding.

Key Points

- Automate payments

- Pay all bills on time

- Avoid missed due dates

3. Reduce Credit Card Balances

Lower balances to keep your credit utilization under 30%, ideally below 10%. Pay off high-interest debts first while maintaining minimum payments on others.

Avoid maxing out cards. Reducing credit usage shows responsible borrowing behaviour, significantly improving your score. Budget wisely to tackle outstanding debts.

Key Points

- Reduce credit utilization ratio

- Prioritize high-interest debts

- Avoid maxing out cards

4. Avoid Closing Old Accounts

A critical step in rebuilding my credit is keeping older credit accounts open. Maintaining a lengthy credit history positively impacts your score, which is 15%.

Close newer or inactive accounts only if necessary. Use older accounts occasionally for small purchases to ensure they stay active and positively contribute to your credit profile.

Key Points

- Retain older accounts

- Close newer accounts last

- Use inactive cards sparingly

5. Consider A Secured Credit Card

Secured cards require a refundable deposit and help build credit. Choose a card that reports to all credit bureaus. Use it responsibly for small purchases, keeping balances low.

Want To Learn How To Create Your Own Website And Online Business?

Try My #1 Recommendation Training And Hosting Platform!

Pay in full monthly to show consistent, reliable behaviour. This approach establishes positive credit-building habits over time.

Key Points

- Use secured cards wisely.

- Keep balances minimal.

- Always pay in full monthly.

6. Become An Authorized User

Ask a trusted person to add you to their credit card account. Their on-time payments and low balances will boost your credit.

Confirm their positive habits before agreeing. Without you having to shoulder the card's financial burden, this tactic can raise your credit score rapidly.

Key Points

- Select a trusted primary user

- Confirm their good credit habits

- Leverage their credit behaviour

7. Diversify Your Credit Mix

A balanced mix of credit accounts—like credit cards, auto loans, or personal loans—boosts your score. Lenders view diverse credit types favourably.

Only take on new credit if it is manageable. Ensure timely payments to all accounts, as missed payments harm your progress toward rebuilding your credit.

Key Points

- Maintain a mix of credit types

- Only borrow within limits

- Pay all debts on time

8. Limit New Credit Applications

Your score may drop a few points with each credit inquiry. Refrain from applying for several credit accounts at once. Instead, focus on improving your current accounts.

Lenders may perceive frequent applications as financial instability, potentially hurting your ability to secure future credit.

Key Points

- Limit hard inquiries

- Space out applications

- Focus on improving existing accounts

9. Work With Credit Counseling Services

Non-profit credit counselling agencies offer professional guidance to manage debts and rebuild credit. They help create tailored repayment plans and negotiate with creditors for lower interest rates. This ensures you regain control of your finances while establishing better financial habits for long-term credit health.

Key Points

- Seek reputable counsellors.

- Create debt repayment plans.

- Negotiate with creditors.

10. Monitor Your Progress

Track your credit score and report improvements using free tools from banks or credit bureaus. Look for unauthorized activity or errors.

Monitoring progress ensures accountability and helps identify areas needing attention. Staying consistent in your efforts will result in measurable credit score improvements.

Key Points

- Use free monitoring tools

- Identify errors or fraud

- Celebrate consistent progress

11. Avoid High-Risk Financial Products

Avoid payday loans and high-interest financial products, as they can lead to more debt and negatively impact your credit.

These options often trap borrowers in cycles of high payments, worsening their financial situation. Opt for manageable, lower-interest alternatives to protect your credit.

Key Points

- Avoid payday loans

- Stick to manageable loans

- Choose lower-interest products

12. Negotiate For Lower Interest Rates

Speak with your creditors and request a lower interest rate if you have a good payment history. A reduced interest rate helps lower monthly payments, allowing you to pay down debt more effectively. This can raise your score and enhance your credit utilization ratio.

Key Points

- Request lower rates

- Focus on paying high-interest debt

- Improve financial stability

13. Set Up A Budget And Stick To It

Make a reasonable budget to control your spending and prioritize debt repayment. A well-planned budget helps prevent further debt accumulation and ensures you can direct funds toward improving your credit. Staying disciplined with your budget will support consistent credit rebuilding over time.

Key Points

- Create a budget

- Prioritize debt repayment

- Track your spending

14. Avoid Late Fees And Penalties

Late fees accumulate quickly and can damage your credit score. Always aim to pay on time, but if you can't, contact your creditors in advance to request an extension or a payment plan. This proactive strategy can safeguard your credit health and prevent penalties.

Key Points

- Avoid late fees.

- Set up payment reminders.

- Contact creditors for extensions.

15. Handle Defaulted Accounts

If you have defaulted on accounts, contact the creditor to schedule a payment. They may offer a settlement for less than the full amount owed or agree to remove negative marks from your credit report after you pay.

Key Points

- Negotiate settlements.

- Settle accounts in default.

- Keep track of agreements.

16. Check Your Credit Utilization Regularly

Monitor your credit utilization ratio regularly. Your available credit is compared to the balances on your credit cards. A high utilization ratio may negatively impact it below 30% to show that you are a responsible borrower and gradually strengthen your credit.

Key Points

- Monitor credit utilization

- Aim for less than 30%

- Reduce balances regularly

17. Build A Positive Payment History With Rent Payments

Rent payments don't typically appear on credit reports, but you can use services that report your rent history. Doing this may establish a solid payment history, demonstrate your dependability, and raise your credit score.

Key Points

- Report rent payments

- Use rental history to build credit

- Check reporting services

18. Rebuild After Financial Setbacks

Financial setbacks, like job loss or illness, are challenging but don’t define your future. Reach out to your creditors or a credit counsellor for support. With a steady, strategic approach, you can rebuild your credit over time and regain financial stability.

Key Points

- Seek help after setbacks.

- Work with creditors.

- Build credit gradually.

19. Limit Co-Signing For Others

Co-signing loans can be risky. You're responsible if the primary borrower misses payments, which can hurt your credit. Only co-sign for individuals with a reliable financial history and strong repayability. Protect your credit by being selective with co-signing agreements.

Key Points

- Limit co-signing

- Ensure borrower reliability

- Protect your credit

20. Consider Debt Consolidation

Debt consolidation simplifies your finances by combining several debts into one, frequently at a reduced interest rate. It helps you manage payments more efficiently, reducing the risk of missed payments.

Key Points

- Explore debt consolidation

- Lower interest rates

- Simplify payments

21. Use A Credit Builder Loan

A credit builder loan is a small loan for which you make monthly payments that are reported to credit bureaus. Regularly making on-time payments will raise your credit score. It's an effective way to build or rebuild your credit history.

Key Points

- Use credit builder loans

- Make regular payments

- Build credit history

22. Keep Old Accounts Open

Extending your credit history and opening older credit accounts raises your credit score. Closing accounts reduces this positive impact and can lower your score—only close accounts when necessary to maintain a healthy credit profile.

Key Points

- Retain old accounts

- Avoid closing active accounts

- Maintain a long credit history

23. Pay More Than The Minimum

Making higher-than-minimum payments on loans or credit cards speeds up the process of paying off your balance, which decreases your credit usage ratio.

This shortens the time it takes to pay off debt and improves your credit score by demonstrating responsible financial habits.

Key Points

- Pay above the minimum

- Reduce balance faster

- Lower credit utilization

24. Use A Secured Credit Card

A secured credit card lowers the risk for lenders by requiring a deposit as collateral. You can build a good payment history by using it for minor purchases and paying the entire amount due each month. Make sure it reports to credit bureaus to boost your score.

Key Points

- Use secured cards

- Pay off balances in full

- Build credit safely

25. Stay Consistent

Consistency is essential when rebuilding credit. You ensure steady progress by sticking to a budget, paying bills on time, and regularly monitoring your credit. Over time, Small, consistent actions can significantly improve your credit score and overall financial health.

Key Points

- Stay disciplined

- Monitor progress regularly

- Be patient and consistent

FAQ

1. How Long Does It Take To Rebuild Credit?

Answer: Rebuilding credit can take anywhere from a few months to several years, depending on the severity of past issues and your consistency in managing credit responsibly.

2. Can I Rebuild Credit Without Using A Credit Card?

Answer: Yes, you can. Among the options are a credit-builder loan, regular on-time utility bill payments if they report to credit agencies, or adding oneself as an authorized user on someone else's card.

3. How Do I Protect My Credit While Rebuilding It?

Answer: Monitor your credit report regularly, set up payment reminders, and avoid taking on unnecessary debt to protect your progress.

Conclusion

To learn how to rebuild my credit, one must be patient, stay consistent, and follow strategic steps like monitoring your report, making timely payments, and reducing debt.

You can gradually improve your score by regularly checking your credit report, making timely payments, reducing debt, and avoiding high-risk financial products.

Stay disciplined with budgeting, monitoring progress, and seeking professional help when necessary. Over time, your efforts will pay off, giving you a stronger financial foundation and better opportunities for future credit.

I trust you enjoyed this article about How To Rebuild My Credit. Please stay tuned for more articles. Take care!

JeannetteZ

Want to Learn How to Build Your Own Home-Based Online Business And Start Making Money Online From Your Comfortable Couch?

Try Wealthy Affiliate!

Your Opinion Is Important To Me

Do you have thoughts, ideas, or questions? I would love to hear from you. Please leave me your questions, experiences, remarks, and suggestions about How To Rebuild My Credit in the comments below. You can also email me at Jeannette@WorkFromAnywhereInTheWorld.com.

Disclosure

This post may contain affiliate links. I earn from qualifying purchases as an Amazon Associate and other affiliate programs. Please read my full affiliate disclosure.

You may also enjoy the following articles:

Wealthy Affiliate Coupons For Premium Memberships

Wealthy Affiliate Review – Scam or Legit? The Truth Exposed