How To Invest In Real Estate

How To Invest In Real Estate

Purchasing and owning real estate may be a rewarding and profitable financial option. Unlike stock and bond investors, real estate buyers may use leverage to purchase a home by paying a percentage of the whole cost upfront and then repaying the remainder, plus interest, over time.

A standard mortgage typically demands a 20% to 25% down payment, however, in certain situations, a 5% down payment is all that is required to acquire an entire house.

This ability to own the asset as soon as the documents are completed gives real estate flippers and landlords more confidence, allowing them to take out second mortgages on existing houses to fund down payments on more properties. Here are five important ways real estate investors may profit.

Want to Start Making Money Online?

Try My #1 Recommendation Program!

1. Real Estate Rentals

Individuals with do-it-yourself (DIY) remodelling abilities and the patience to supervise renters may find that owning rental homes is a terrific possibility. This technique, however, needs a significant amount of money to cover initial maintenance expenses and unoccupied months.

Pros

- Provides consistent income and assets that may grow

- Leverage maximizes capital

- Many taxes

- Deductible related expenditures

Cons

- Managing renters may be time consuming

- Tenants may cause property damage

- Potentially lower income due to vacancy

According to statistics from the United States Census Bureau, new house sales prices (a rough measure of real estate values) grew steadily from 1940 to 2006, before dropping during the financial crisis. Following that, sales prices began to rise again, eventually approaching pre-crisis levels. The coronavirus pandemic's long-term consequences on real estate prices are yet unknown.

Want to Find Out How To Start Your Home-Based Business?

Try My #1 Recommendation Platform!

2. Real Estate Investment Groups (REIGs)

Real Estate Investment Groups (REIGs) are the kind of real estate investments that are perfect for persons who wish to own a rental property but don't want to deal with the inconveniences of managing it. Investing in REIGs requires a financial buffer as well as access to money.

REIGs are rental property investment trusts that are similar to small mutual funds. In a typical real estate investment group, a corporation buys or constructs a series of apartment buildings or condominiums, then enables investors to acquire them via the firm and therefore become members of the group.

A single investor may purchase one or more self-contained living units, but the investment group's management firm oversees all of the units, including maintenance, advertising vacancies, and tenant interviews. The firm gets a part of the monthly rent in return for doing these management services.

A typical real estate investment group lease is in the name of the investor, and all of the units pool a part of the rent to protect against vacancy. As a result, even if your unit is vacant, you will earn some money. There should be enough to pay expenditures as long as the vacancy rate for the pooled units does not surge too high.

Pros

- Less time

- Consuming than owning rental properties

- Generates revenue and appreciation

Cons

- Risks of vacancy

- Charges comparable to mutual fund fees

- Susceptible to unethical management

3. Buying And Selling Houses

House flipping is only for those with extensive knowledge in real estate assessment, marketing, and renovation. House flipping necessitates money and the skill to do or supervise repairs as required. This is the “wild side” of real estate investment, as they say.

Real estate flippers vary from buy-and-rent landlords in the same way that day traders differ from buy-and-hold investors. Real estate flippers, for example, often seek to financially sell the discounted homes they acquire in less than six months.

Property flippers seldom spend time renovating their homes. As a result, the investment must already have the inherent value required to earn a profit without any changes, or the property will be eliminated from consideration.

Flippers who are unable to quickly sell a home may find themselves in problems since they often do not have enough uncommitted cash on hand to pay a property's mortgage over time. This might lead to a downward spiral of losses.

Another kind of flipper earns money by purchasing low-cost houses and refurbishing them to increase their worth. When investors can only afford to take on one or two homes at a time, this might be a longer-term investment.

Pros

- Capital is locked up for a shorter length of time

- Quick returns are possible

Cons

- Requires a greater understanding of the market

- Hot markets may cool suddenly

4. Real Estate Investment Trusts (REITs)

A real estate investment trust (REIT) is the greatest option for investors who want real estate exposure in their portfolio without having to make a typical real estate transaction.

When a company (or trust) utilizes money from investors to buy and run income properties, it is known as a REIT. REITs, like any other stock, may be purchased and traded on the main markets. To preserve its REIT designation, a company must distribute 90% of its taxable income in the form of dividends.

REITs avoid paying corporate income tax in this way, while a typical firm would be taxed on its earnings and then have to determine whether to distribute the after-tax gains as dividends.

REITs, like normal dividend-paying equities, are a good choice for stock market investors looking for consistent income. REITs, in contrast to the aforementioned categories of real estate investment, allow investors to participate in nonresidential ventures such as malls and office buildings, which are often not available to individual investors.

More crucially, since REITs are exchange-traded trusts, they are very liquid. To put it another way, you won't need a real estate agent or a title transfer to get your money back. REITs are a more structured version of a real estate investment group in reality.

Finally, investors should differentiate between equity REITs that own buildings and mortgage REITs that offer real estate financing and dabble in mortgage-backed securities when looking for REITs (MBS).

Both provide real estate exposure, but the form of that exposure differs. An equity REIT is more conventional in that it symbolizes real estate ownership, while mortgage REITs concentrate on real estate mortgage financing revenue.

Pros

- Basically dividend-paying stocks

- Core holdings are long-term, cash

- Generating leases

Cons

- The conventional rental real estate leverage does not apply.

Are You Tired Of Scams?

Try The Most-Trusted Training Platform To Make Money Online!

5. Real Estate Platforms On The Internet

Platforms for real estate investment are for people who wish to join others in a larger business or residential purchase. The money is invested via online real estate platforms, often known as real estate crowdfunding.

This still requires financial investment, although it is far less than purchasing homes altogether. Online platforms link real estate developers with investors eager to fund projects. You may diversify your assets with a little amount of money in certain instances.

Pros

- You may invest in a single project or a portfolio of projects

- You can diversify geographically

Cons

- Lockup periods make them illiquid

- Management costs

Why Should I Include Real Estate In My Investment Portfolio?

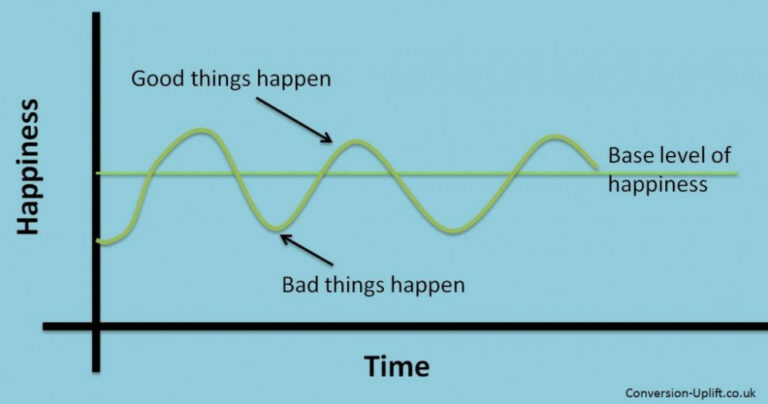

Real estate is a unique asset type that many experts believe should be included in a well-balanced portfolio. This is due to the fact that real estate seldom correlates with equities, bonds, or commodities. In addition to the potential for financial gains, real estate investments may provide income via rentals or mortgage payments.

What Is The Difference Between Direct And Indirect Real Estate Investing?

Direct real estate investments include the ownership and management of properties. Investing in pooled entities that own and manage properties, such as REITs or real estate crowdfunding, is one example of indirect real estate.

Is Crowdfunding For Real Estate A Risky Business?

Crowdfunding, in comparison to other types of real estate investment, might be riskier. This is often due to the fact that real estate crowdfunding is still relatively new.

Furthermore, some of the projects accessible on crowdfunding platforms may have been unable to get funds via more conventional ways.

Finally, many real estate crowdfunding sites force investors to lock their money away for many years, making it illiquid. Nonetheless, the best platforms have annualized returns ranging from 2% to 20%.

Final Thoughts

It's feasible to construct a comprehensive investment program by paying a very modest portion of a property's overall worth upfront, whether real estate investors utilize their assets to produce rental income or to bid their time until the right selling opportunity occurs. Real estate, like any other investment, has profit and potential, regardless of whether the entire market is up or down.

We've been dealing with the epidemic for two years, and the economy is divided between those who are prospering, those who are struggling, and those who are just scraping by. Travel, social, and in-person enterprises, as well as specific organizations impacted by supply chain interruptions, are all hurting.

While it seems that the economy is becoming more accepting of the idea of “just getting by,” inflation is increasingly affecting everyone. Inflation is a result of labour market disruptions, supply/distribution system disruptions, and rising money supply. So, what does this mean for the housing market?

Real estate categories such as hospitality and accommodation will continue to suffer until 2022 due to drastically decreased travel, social events, and in-office employment. This article discusses the top three trends that will have an influence on real estate prices and opportunities.

Want To Learn How To Create Your Own Website And Online Business?

Try My #1 Recommendation Training And Hosting Platform!

1. Rising Interest Rates And Inflation

Everyone understood that interest rates and inflation would have to increase at some point. For the last 15 years, we've been in a historically low-interest-rate environment, with modest economic growth and low inflation. But there was no reason to believe that now was the moment for things to change.

Then came Covid, which threw this cozy economic balance on its head. After grinding to a halt in 2020, the economy rebounded in 2021, growing at a rate of 6.9%, the highest rate in decades.

Although the quick recovery is good news, the impact of Covid on the economy in 2022 will be felt as we deal with inflation caused by rising consumer demand—government stimulus payments and higher wages have put money in consumers' hands—coupled with a shortage of products and services to meet that demand-supply chain disruption and labour shortages that aren't going away anytime soon.

The Fed seems to be treading carefully as it seeks methods to contain inflation without harming growth, but interest rates are expected to rise in 2022, maybe as early as March.

What does all of this imply for real estate investors? The prospects are varied, much like the Covid economy. Rising mortgage rates, whether for residential or commercial property, are expected to stifle sales activity.

Furthermore, growing inflation has already resulted in significantly greater prices in the real estate business, including increased construction materials, energy, and utility rates. Increasing rents, on the other hand, have aided landlords in recouping these costs in real-time.

Property prices are also expected to rise as a result of a shortage of supply (as construction costs rise, development decreases) and growing income returns. Rents have risen far faster than mortgage rates and expenses, resulting in excellent purchase prices and financing.

Property prices will grow in tandem with increased net operating income. The fundamental issue is whether cap rates will grow in tandem with inflation or stay low in light of real estate's desirability as an investment asset.

2. The Single-Family And Multifamily Rental Markets Will Survive

Despite the possibility of increased mortgage rates, for-sale house prices jumped 19.5 percent in 2021, according to Zillow Research, and are predicted to rise another 11 percent in 2022.

This heated market is pricing many young families out of the market who would prefer a single-family house. Enter the SFR (single-family rental) market.

A niche market that has traditionally featured one-off mom-and-pop rentals is now witnessing a boom of professionally managed portfolios of properties, fueled by major institutions looking for a long-term investment opportunity.

Blackstone, one of the country's top real estate investors, is launching a new single-family rental REIT. This is no longer a fun side project. SFRs seems to be a trend that is here to stay, as proven by the fact that investors purchased 18% of single-family houses sold in Q3 2021.

According to the National Association of Realtors, the vacancy rate will drop to 4.8 percent in 2022 (from 5.1 percent in 2021) and rent increases will average 10%. (7.8 percent in 2021).

The Covid-driven work-from-home trend is one of the key reasons driving the rental market boom. Many employees took advantage of the freedom to relocate from high-cost-of-living areas to more lifestyle-friendly areas of the nation after they understood they could work from any place.

3. The Sunbelt Is Where You Should Be

According to the latest housing starts data from the Census Bureau, big metro regions are losing market share to smaller communities. In December 2021, 811,000 newly built houses were sold in the United States, according to the latest available statistics.

Sixty-six percent of the properties were in the South, while just three percent were in the Northeast. This isn't a new trend, but Covid has expedited it as younger people seek a better work-life balance and older workers retire in near-record numbers.

This behaviour has been noted by participants in the PricewaterhouseCoopers Emerging Trends in Real Estate 2022 study. All of the top eight “markets to watch” are in the southern United States.

These markets provide excellent growth potential, affordable housing, substantial employment growth, and a pleasant environment. The following are the eight markets with good real estate investment prospects:

- Nashville, Tennessee is number one.

- Raleigh/Durham, North Carolina is ranked second.

- Phoenix, Arizona is number three.

- Austin, Texas is number four.

- Florida's Tampa-St. Petersburg is ranked fifth.

- Charlotte, North Carolina is number six.

- Texas's Dallas-Fort Worth is ranked number seven.

- Atlanta, Georgia is ranked number eight.

These smaller markets in southern states are expanding at an exponential pace, thus it stands to reason that the factors that drew people to them in 2021 will continue to entice people to migrate there in 2022.

Conclusion

For the educated investor who understands the trends accelerated by Covid-19 and knows how to take advantage of them, 2022 is shaping up to be a very excellent year.

Unstable and unpredictable markets often provide some of the biggest opportunities—but also some of the largest hazards for individuals who aren't used to adjusting to changing trends.

Those that are interested in this industry should keep an eye on these patterns and how they develop over the next year.

There are a few fundamental things you need to know about real estate investment in order to be successful. This thorough book will provide you with an overview of how to invest in real estate when you're just starting, as well as some pointers on how to get the most out of your money.

The practice of purchasing and selling property for a profit is known as real estate investment. This is often accomplished by either purchasing real estate and then selling it at a higher price or renting it to tenants for a monthly fee.

While purchasing and selling depend on inflation and probable rehab work to raise the sale value, renting may provide a consistent source of income that can be utilized to supplement a real estate company or be used to start one.

I trust you enjoyed this article on How To Invest In Real Estate. Would you please stay tuned for more articles to come? Take care!

JeannetteZ

Want to Learn How to Build Your Own Home-Based Online Business & Start Making Money Online From Your Comfortable Couch?

Try Wealthy Affiliate!

Your Opinion Is Important To Me

Thoughts? Ideas? Questions? I would love to hear from you. Please leave me your questions, experiences, remarks, and suggestions about How To Invest In Real Estate, in the comments below. You can also contact me by email at Jeannette@WorkFromAnywhereInTheWorld.com.

You may also enjoy the following articles:

How To Set Your Own Money Rules

Everything You Need To Know About Financial Health

Best Ways To Improve Your Social Skills

How To Start A Business When You Have Literally No Money