What Is A Hedge Fund? A Comprehensive Guide

What is a Hedge Fund? It is a sophisticated investment vehicle designed for accredited investors and institutions, aiming to generate high returns through strategies like short selling, leverage, and derivatives.

Unlike traditional funds, hedge funds offer greater flexibility but have higher risks. This guide covers hedge fund operations, their pros and cons, and key investor considerations before investing.

What Is A Hedge Fund?

Hedge funds originated in 1949 when Alfred W. Jones introduced a strategy using long and short positions to reduce market risk.

The industry remained small until the 1990s, when assets under management (AUM) surged from $39 billion in 1990 to over $1 trillion by 2004. Today, hedge funds collectively manage around $5 trillion globally.

Though fees have declined, the industry is known for its 2% management fee and 20% performance fee. Some hedge funds, like John Paulson’s, gained over 500% during the 2008 financial crisis, while the S&P 500 dropped 37%.

However, in recent years, hedge funds have delivered 7-8% annual returns, lagging behind the S&P 500’s 10-12%, but they remain popular among institutional investors.

History Of Hedge Funds

The idea of hedge funds originated in 1949, when Alfred Winslow Jones, a sociologist and financial journalist, established the first hedge fund.

Jones's fund employed a long/short equity strategy, buying stocks he believed would increase in value (going long) and selling short stocks he expected to decline. This strategy aimed to reduce market risk while capturing returns from individual stock performance.

In the 1960s and 1970s, hedge funds acquired popularity among wealthy investors, but they remained relatively niche due to their high minimum investment requirements and limited accessibility.

The 1980s and 1990s saw a surge in hedge fund activity, driven by the rise of global financial markets, technological advancements, and the increasing sophistication of investment strategies.

The 2000s brought both growth and challenges to the hedge fund industry. The resilience of hedge funds was tested during the 2008 financial crisis and the dot-com bubble.

Many survived and thrived by adapting to changing market conditions. Today, hedge funds manage trillions of dollars in assets and play a significant role in global financial markets.

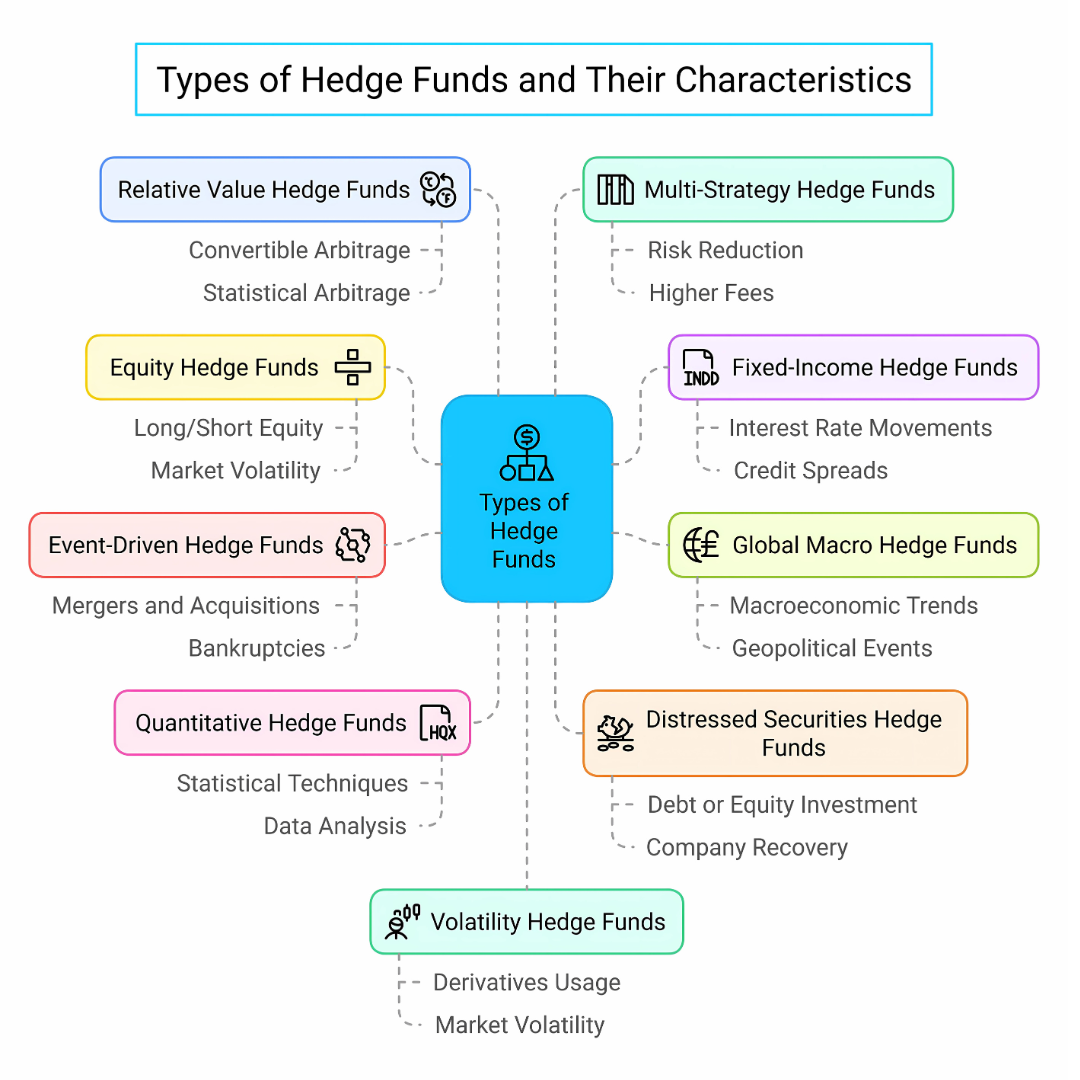

Types Of Hedge Funds

Hedge funds can be categorized based on their investment strategies, asset classes, and geographic focus. Some common types of hedge funds include:

1. Equity Hedge Funds

Equity hedge funds focus on investing in stocks and equity-related instruments. They employ strategies like long/short equity, buying undervalued stocks (long) and selling overvalued ones (short).

This approach aims to generate returns regardless of market direction, reducing exposure to market volatility. Benefits include diversification and the potential for high returns, but risks include stock-specific volatility and reliance on the manager's stock-picking skills.

2. Fixed-Income Hedge Funds

Fixed-income hedge funds invest in bonds, interest-rate derivatives, and other debt instruments. They may focus on government bonds, corporate bonds, or emerging market debt.

These funds aim to capitalize on interest rate movements, credit spreads, or bond price fluctuations. Benefits include steady income and lower volatility compared to equity funds, but risks include interest rate changes, credit defaults, and liquidity issues in bond markets.

3. Global Macro Hedge Funds

Based on macroeconomic trends, global macro hedge funds occupy international financial markets. They invest in currencies, commodities, interest rates, and equities to profit from economic shifts like inflation, geopolitical events, or policy changes.

Benefits include diversification across asset classes and regions, but risks include incorrect macroeconomic predictions and high volatility due to leveraged positions.

4. Event-Driven Hedge Funds

Event-driven hedge funds focus on corporate events such as mergers, acquisitions, bankruptcies, and restructurings. They want to profit from price movements resulting from these events.

For example, merger arbitrage involves buying shares of a target company and shorting the acquirer. Benefits include uncorrelated returns to broader markets, but risks include deal failures, regulatory hurdles, and timing mismatches.

5. Quantitative Hedge Funds

Quantitative hedge funds use mathematical models, algorithms, and data analysis to identify investment opportunities. They rely on statistical techniques and computer-driven trading strategies to execute trades.

Benefits include reduced emotional bias and the ability to process vast amounts of data quickly. However, risks include model failures, overfitting, and susceptibility to unexpected market events that algorithms may not account for.

6. Distressed Securities Hedge Funds

Distressed securities hedge funds typically invest in the debt or equity of companies with financial distress, such as bankruptcy or restructuring.

They aim to profit from the potential recovery of these companies. Benefits include high returns if the company recovers, but risks include total loss if the company fails and illiquidity due to the nature of distressed assets.

7. Relative Value Hedge Funds

Relative value hedge funds seek to exploit price discrepancies between related assets, such as pairs of stocks, bonds, or derivatives.

Strategies include convertible arbitrage and statistical arbitrage. Benefits include market-neutral returns and lower volatility, but risks include mispricing persistence and execution challenges in volatile markets.

8. Multi-Strategy Hedge Funds

Multi-strategy hedge funds diversify across multiple strategies within a single fund, such as equity, fixed income, and arbitrage.

This approach usually aims to reduce risk by not relying on a single plan. Benefits include diversification and adaptability to market conditions, but risks include higher fees and complexity in managing multiple strategies simultaneously.

9. Volatility Hedge Funds

Volatility hedge funds focus on trading volatility as an asset class, often using derivatives like options and futures. They aim to profit from changes in market volatility rather than price movements.

Benefits include uncorrelated returns to traditional markets, but risks include high complexity and the potential for significant losses if volatility predictions are incorrect.

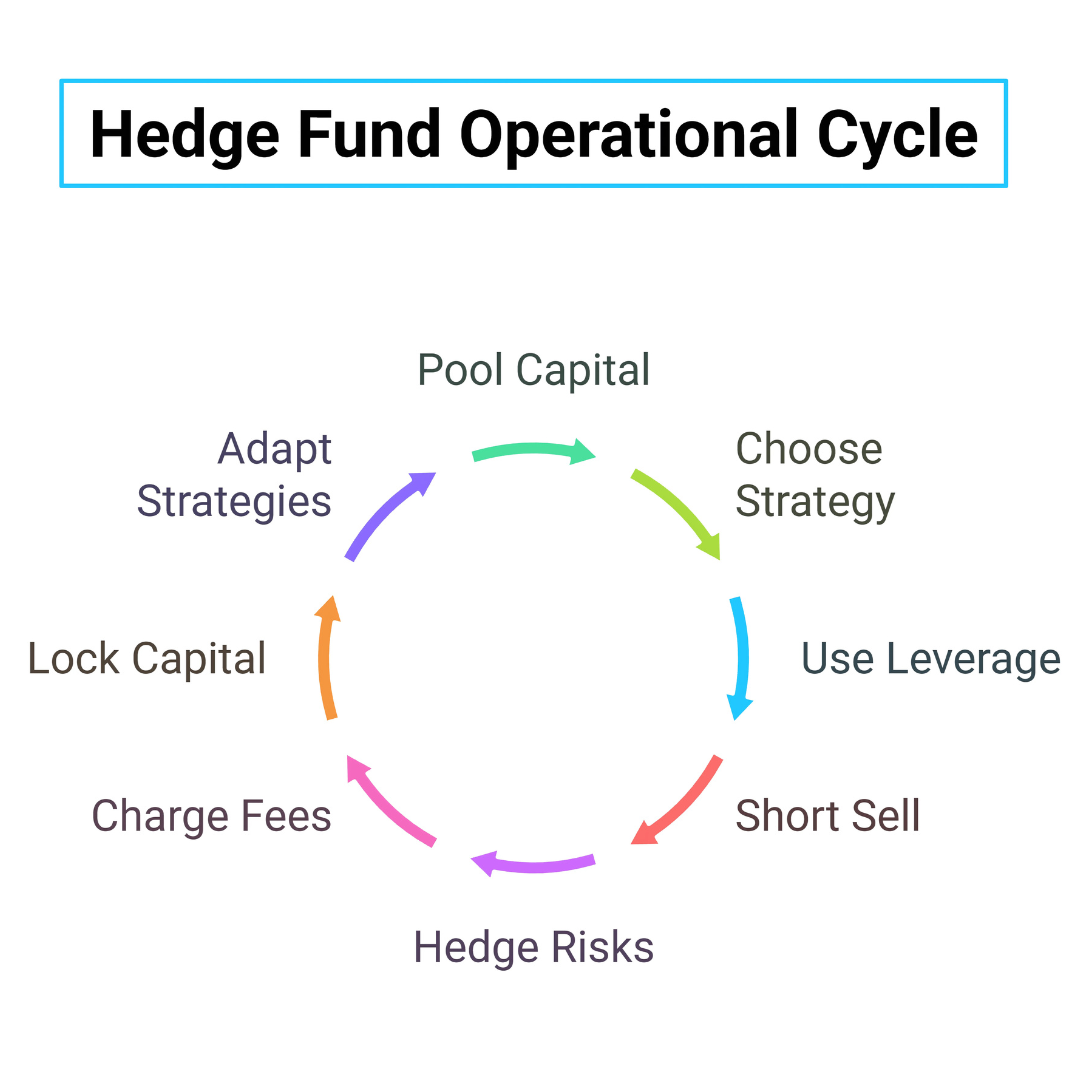

How Do Hedge Funds Work?

1. Pooling Capital From Investors

Hedge funds raise capital from accredited investors, such as high-net-worth individuals and institutions. Investors offer funding in return for a share of the profits.

Unlike mutual funds, hedge funds impose high minimum investments and require investors to commit their money for a fixed lock-up period.

Once capital is pooled, fund managers allocate resources across various assets, using advanced strategies to maximize returns while minimizing risks through diversification.

2. Choosing An Investment Strategy

Fund managers determine an investment strategy based on market conditions and their expertise. Some funds focus on long/short equity, buying undervalued stocks and shorting overvalued ones.

Others use macroeconomic trends, arbitrage, distressed securities, or quantitative models. The strategy choice determines how the hedge fund generates profits, whether through capital appreciation, short-term trades, or market inefficiency exploitation. Funds often switch or adjust strategies based on performance and economic conditions.

3. Using Leverage To Amplify Returns

Hedge funds frequently use leverage, borrowing capital to increase their market exposure and potential profits. By investing more than the available capital, they can magnify gains when trades succeed.

However, leverage also increases risks, as losses can be amplified significantly. Hedge fund managers carefully calculate leverage ratios to balance profit potential and risk management, often utilizing derivatives and additional financial instruments to hedge against potential downturns.

4. Short Selling To Profit From Declining Markets

One key tactic hedge funds use is short selling, in which they borrow and sell stocks at current market prices, expecting to repurchase them at a lower price. If the stock price declines, the hedge fund profits from the difference.

However, if the stock price rises instead, losses can be substantial. Short selling allows hedge funds to generate earnings in bearish markets and hedge against downturns in their long positions.

Wealthy Affiliate – Mini Review (2025)

If you’ve ever thought about turning your blog, passion, or niche into an online business,

Wealthy Affiliate (WA) is one of the most beginner-friendly platforms I’ve used.

It combines step-by-step training, website hosting, SEO research tools,

and an active community all in one place.

What I like most: you can start free (no credit card needed),

explore lessons, test the tools, and connect with other entrepreneurs

before upgrading. WA isn’t a “get rich quick” scheme — it’s a platform where success comes

from consistent effort and applying what you learn.

5. Hedging Risks With Derivatives And Diversification

Hedge funds actively use derivatives such as options, futures, and swaps to hedge against market risks. These instruments allow funds to protect against sudden price swings or economic shocks.

Additionally, diversification across multiple asset classes, industries, and geographic regions helps reduce exposure to any single risk.

A well-hedged portfolio minimizes downside losses while maintaining exposure to profitable opportunities, ensuring stability even in volatile market conditions.

6. Charging Performance-Based Fees

Hedge funds earn money through management and performance fees. Typically, they follow a “2 and 20” model, charging a 2% annual management fee on total assets and a 20% performance fee on profits exceeding a specific benchmark.

Some hedge funds implement a “high-water mark,” ensuring fund managers only receive performance fees when the fund reaches new peak values.

This fee structure incentivizes aggressive trading and high returns but can be costly for investors if performance fluctuates.

7. Locking In Investor Capital

Unlike mutual funds, hedge funds often impose lock-up periods that prevent investors from withdrawing funds for months or years. This ensures stability, allowing fund managers to execute long-term strategies without sudden cash outflows.

Redemption terms vary, with some funds allowing quarterly or annual withdrawals. These restrictions help hedge funds maintain their investment positions without pressure from investor withdrawals during market downturns. However, limited liquidity can be a drawback for investors who need quick access to their funds.

8. Adapting To Market Conditions And Regulatory Changes

Hedge funds continuously monitor economic trends, central bank policies, and geopolitical events to adjust their strategies. They use real-time data, algorithmic trading, and fundamental analysis to stay ahead of market movements.

Additionally, they must comply with evolving financial regulations impacting their operational flexibility. While hedge funds enjoy fewer restrictions than mutual funds, increased oversight from regulatory bodies ensures transparency and protects investors. Adapting to changing conditions is crucial for maintaining profitability and long-term success.

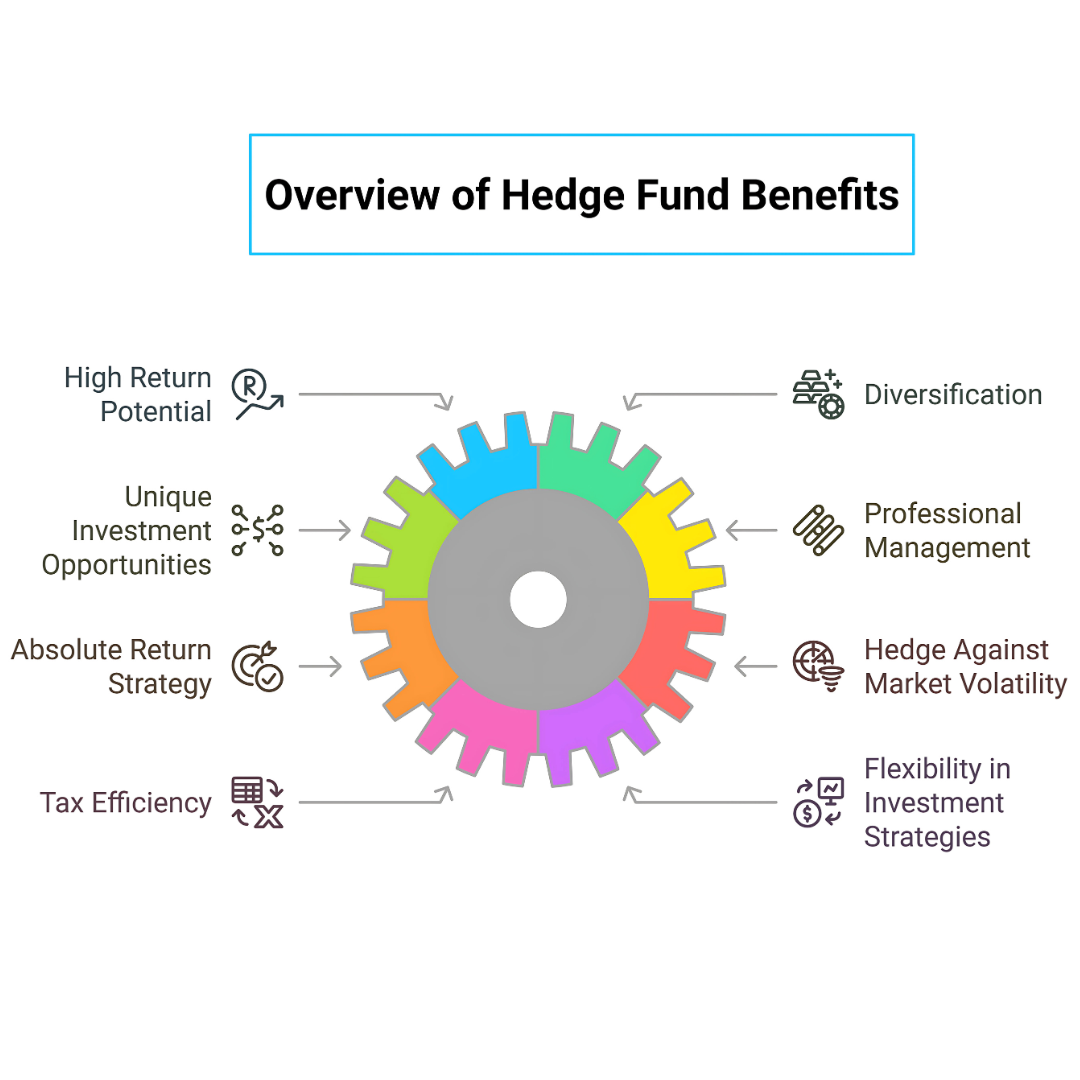

Benefits Of Hedge Funds

1. High Return Potential

Hedge funds are known for their high return potential, using advanced strategies like leverage, short-selling, and arbitrage.

These techniques allow them to generate profits in rising and falling markets, aiming to outperform traditional investments like stocks and bonds.

Hedge funds offer the chance to earn substantial returns even during market downturns, making them an appealing choice for investors seeking growth beyond conventional market trends and assets.

2. Diversification

Hedge funds, investment vehicles, focus on alternative assets such as real estate, commodities, and private equity.

These assets often do not correlate with traditional stock and bond markets, helping to reduce portfolio risk and enhance diversification for investors seeking broader exposure beyond conventional investments.

By adding hedge funds to an investment strategy, investors spread exposure across multiple asset classes, improving long-term returns while smoothing volatility, especially during uncertain market conditions, and enhancing overall portfolio performance.

3. Access To Unique Investment Opportunities

Hedge funds can access exclusive investment opportunities unavailable to individual investors or traditional funds, such as private deals, start-ups, and venture capital. They also pursue complex strategies like mergers, acquisitions, and distressed asset purchases.

These investments open doors to potentially lucrative markets, enhancing portfolio diversity. Hedge fund investors gain broader options, which may lead to increased returns compared to traditional investments that retail investors typically cannot access.

4. Professional Management

Experienced professionals with specialized knowledge and expertise maintain hedge funds. These managers leverage sophisticated tools and research to make informed decisions. They actively adjust strategies based on market conditions to minimize risk while seeking high returns.

Investors benefit from this professional oversight, as fund managers aim to maximize returns while navigating market fluctuations, offering expertise that individual investors may not have access to for managing complex investment strategies.

5. Absolute Return Strategy

Hedge funds aim to generate absolute returns, focusing on delivering positive performance regardless of market conditions.

Unlike traditional funds, which often rely on bull markets, hedge funds profit in rising and falling markets using strategies like short-selling, derivatives, and market-neutral tactics.

This strategy is particularly appealing during market volatility or downturns. It can provide steady returns even when broader markets are struggling, making it attractive to risk-conscious investors.

6. Hedge Against Market Volatility

A hedge fund is an investment vehicle that lessens the impact of market volatility on a portfolio. Hedge funds employ risk-minimizing strategies, such as long-short equity, taking long positions in undervalued assets and short positions in overvalued ones.

These tactics lower overall risk, allowing investors to better weather market fluctuations, preserve capital during downturns, and provide stability in uncertain or volatile market environments.

7. Tax Efficiency

Hedge funds offer tax advantages by structuring investments to minimize taxable events, such as capital gains. Some use strategies such as tax-loss harvesting or investing in tax-exempt securities to reduce tax liabilities.

Hedge funds are typically set up as pass-through entities, meaning investors are taxed only on their share of income, not on the fund itself. This structure enhances tax efficiency, helping investors retain more of their returns by reducing tax obligations.

8. Flexibility In Investment Strategies

Hedge funds offer flexibility by investing in diverse asset classes, including stocks, bonds, commodities, and real estate. They also utilize strategies such as leverage, derivatives trading, and arbitrage.

This adaptability enables hedge funds to respond quickly to market changes, capitalize on opportunities across sectors, and adjust strategies as conditions evolve. As a result, investors can expect improved returns even in fluctuating market environments.

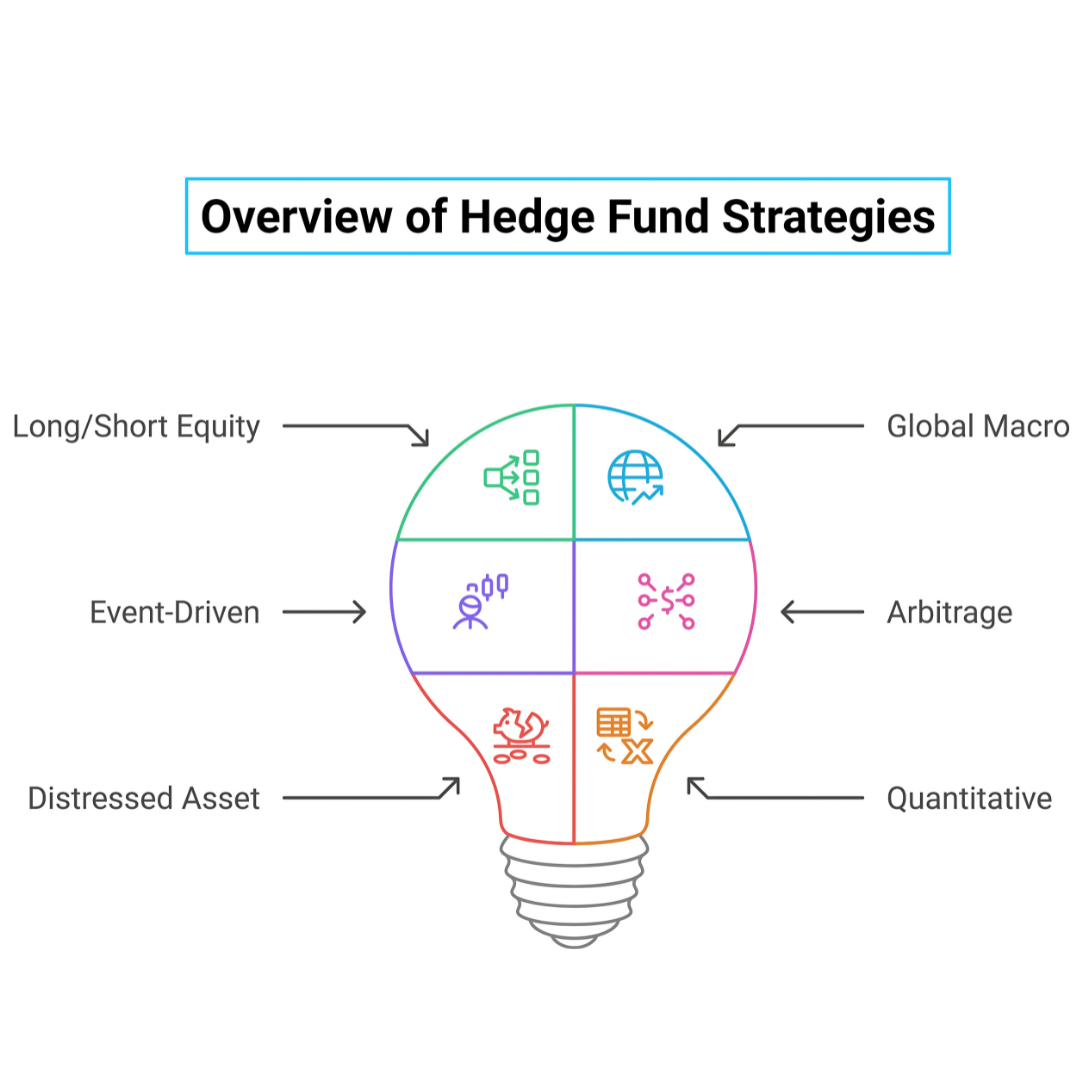

Hedge Fund Strategies

1. Long/Short Equity Strategy

The long/short equity strategy involves buying undervalued stocks (long positions) and shorting overvalued ones (short positions). Hedge funds aim to profit from the appreciation of long positions and depreciation of shorted stocks.

This strategy helps generate returns in both rising and falling markets, reducing market exposure while capitalizing on price discrepancies, thus effectively lowering overall portfolio risk by balancing long and short positions.

2. Global Macro Strategy

Global macro hedge funds make investment decisions based on global economic trends, such as interest rate changes, political events, and financial reports.

These funds invest in currencies, commodities, stocks, and bonds, aiming to profit from shifts in macroeconomic conditions.

By anticipating economic or geopolitical changes, global macro funds seek to generate returns through well-timed investments that respond to evolving global market dynamics and trends.

3. Event-Driven Strategy

Event-driven hedge funds profit from price movements caused by mergers, acquisitions, or bankruptcies. They take positions in companies affected by these events, anticipating market reactions.

These funds seek to generate returns regardless of broader market conditions by strategically investing in such situations.

They may invest in a company acquired at a premium price or short a company facing bankruptcy. This strategy offers opportunities for high returns, especially during volatile market periods.

4. Arbitrage Strategy

Arbitrage strategies exploit price discrepancies between similar assets in different markets. One common form is merger arbitrage, where hedge funds buy shares of a target company and short the acquirer’s stock.

Another is convertible arbitrage, involving purchasing a company’s convertible bonds while shorting its stock. These strategies aim to generate risk-free profits by capitalizing on market inefficiencies, often with minimal exposure to broader market fluctuations.

5. Distressed Asset Strategy

Hedge funds using distressed asset strategies invest in companies facing financial difficulties, such as bankruptcy or severe debt. The approach involves purchasing undervalued assets at discounted prices, hoping for recovery or restructuring.

These funds often invest in distressed bonds, loans, or equity, with the potential for high returns if the company recovers or assets are sold at a profit, capitalizing on financial distress situations.

6. Quantitative (Quant) Strategy

Quantitative hedge funds use computer models, algorithms, and data analysis to identify investment opportunities. They detect market patterns and inefficiencies using statistical techniques and advanced mathematical models.

The strategy involves high-frequency trading, statistical arbitrage, and exploiting minor market discrepancies. Quant funds can trade at breakneck speed and in large volumes, making data-driven decisions to generate profits based on predictable market trends or patterns.

Conclusion

In conclusion, what is a Hedge Fund? It is a sophisticated investment vehicle that aims to deliver high returns through diverse strategies while managing risk.

Primarily designed for accredited investors, hedge funds offer opportunities for wealth growth but come with significant risks.

Investors can efficiently diversify their portfolios and make well-informed judgments by knowing their structure, tactics, and possible rewards.

I trust you enjoyed this article on What Is A Hedge Fund? A Comprehensive Guide. Please stay tuned for more insightful blogs on affiliate marketing, online business, and working from anywhere in the world.

Take care!

— JeannetteZ 🌍✨

💬 Your Opinion Is Important To Me

Do you have thoughts, ideas, or questions? I’d love to hear from you. Please leave your comments below or email me directly at Jeannette@WorkFromAnywhereInTheWorld.com.

📚 More Work From Anywhere Reads

🚀 Ready to Build a Business You Can Run from Home

Or from Anywhere in the World?

Imagine creating income on your terms — from home, a cozy café, or wherever life takes you.

With the right tools, training, and community support, it’s entirely possible.

Start your own online business for free — no credit card needed.

Disclosure

This post may contain affiliate links. As an Amazon Associate and participant in other affiliate programs, I earn from qualifying purchases at no extra cost to you. Please read my full affiliate disclosure.