Best Debt Management Tips

Best Debt Management Tips

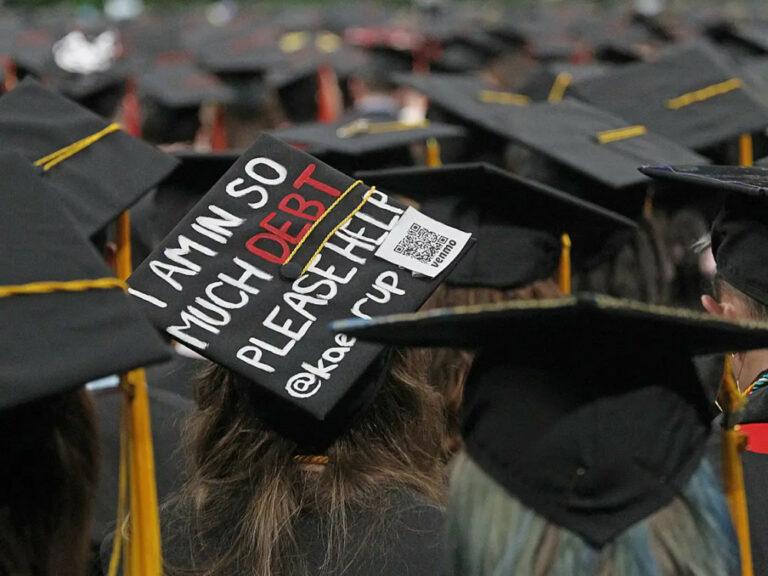

No one wants to be in debt. But with so many choices available and so much money on the line, it’s important to have a plan for managing your money. Debt is a big problem for a lot of people. It can be hard to manage your money, especially if you have a lot of it. Did you know that debt can be a really big problem? Have you ever been in a situation where you couldn’t afford your rent, your car, or your food?

Want to Start Making Money Online?

Try My #1 Recommendation Program!

Well, debt is definitely a problem for many people. And it’s not just about money. Debt can also impact our physical health. For example, if we have too much debt, we may start to over-eat, and this can lead to weight gain and other health problems. So how do you manage your debt so that it doesn’t become a big issue for you and your family?

Do you know how to manage your debt? Do you have a plan for paying off your loan? If not, now is the time to start. It’s important that you have a handle on your finances so that you can improve your overall financial well-being. And if you want to achieve success in managing your debt, you need to start with debt management tips.

Everyone with even a little bit of debt has to manage their debt. If you just have a little debt, you have to keep up your payments and make sure it doesn’t get out of control. On the other hand, when you have a large amount of debt, you have to put more effort into paying off your debt while juggling payments on the debts you’re not currently paying.

- Are you having trouble paying your bills?

- Are you getting dunning notices from creditors?

- Are your accounts being turned over to debt collectors?

- Are you worried about losing your home or your car?

You are not alone. Many people face a financial crisis at some point in their lives. Whether the crisis is caused by personal or family illness, the loss of a job, or overspending, it can seem overwhelming. But often, it can be overcome. Your financial situation doesn’t have to go from bad to worse.

If you or someone you know is in financial hot water, consider these options: self-help using realistic budgeting and other techniques; debt relief services, like credit counselling or debt settlement from a reputable organization; debt consolidation; or bankruptcy. How do you know which will work best for you? It depends on your level of debt, your level of discipline, and your prospects for the future.

If you’re looking for a better way to manage your debt, with a goal of eliminating most or all of it, you’ve already taken a step in the right direction. As you prepare to move forward, remember that some debt isn’t bad—a mortgage can help you achieve the goal of owning a home and may help you build wealth if your home appreciates in value. Too much, however, or the wrong kinds, such as high-interest credit card debt, can hamper your ability to pursue other financial goals.

How many of us make major purchases in our everyday lives without thinking twice? The answer could vary from person to person, but more often than not, we do think a bit before making a big purchase. There are also a few situations in life, wherein we may not possess the adequate amount of capital that’s required for big-ticket life events. This could lead to individuals raising debts to meet their financial objectives. Debt, then, has quite a significant role to play in that individual’s life.

The ability to manage debt is just as important as financing events. Management of debt doesn’t seem too big of a task when you take on just a small amount of debt. But as our needs grow with time, the burden of debt also progressively grows if we do not keep a check on it. In such a situation, a systematic and organized mechanism needs to be designed to effectively manage the debt burden.

What Is Debt?

Debt is a financial instrument that is used to finance a purchase. It can be a cash loan, a mortgage, or an Equity Loan. Debt could also be an obligation owed to someone else, such as in the form of services or goods.

Debt is a type of loan. It’s a financial obligation that an individual owes to another individual or entity. Debt can come in the form of cash, goods, services, or money owed on a purchase. Debts can also be incurred by individuals in the form of credit card debt, car loans, or mortgages.

Want to Find Out How To Start Your Home-Based Business?

Try My #1 Recommendation Platform!

The Basics Of Debt Management

In order to effectively manage debt, it is important to understand the basics of debt management. This includes understanding your debt, figuring out your payment plan, and managing your debt by means of a payment plan. Additionally, a debtor’s credit score needs to be considered when making a payment plan.

There are a few key points that need to be kept in mind when it comes to debt management. First, individuals must have the necessary capital to purchase goods or services. Second, it is important that the debt is properly managed and reduced as much as possible.

This could include making regular payments on debt, taking out loans in a timely manner, and not overspending. Third, debt management should be carried out in a systematic manner so that all debts are counted and treated in a consistent manner. This will help reduce stress and anxiety that could lead to defaults.

What Are The Benefits Of Managing Debt?

There are a few benefits to managing debt which include:

- Increased wealth: When we have debt, it not only affects our financial state but also our physical and emotional well-being. The more money we have that can be put towards our debts, the better.

- More affordable rent: Owning a house or a car is a big purchase. When you owe money on those things, your rent becomes much cheaper.

- Reduced stress: Managing your debt is one of the most important steps in reducing stress and improving your overall wellbeing. It allows you to live a more relaxed life with less worry and anxiety.

There are a few benefits of managing debt that can be discussed.

- First, it can help you stay within your financial means. When debt is properly managed, it allows individuals to live within their means and not strain too much to meet financial objectives.

- Secondly, managing debt can help you avoid defaulting on your payments. When a borrower defaults on their debt, it becomes difficult for them to get help from the government or other creditors. This could lead to them being forced to sell their home or worse.

- Thirdly, managing debt can help you save money. When debts are properly managed, individuals tend to save more money because they don’t have to pay back as much money as they originally borrowed.

- Finally, managing debt can also help you improve your credit score.

Know How Much You Owe

One of the most important things you can do in order to manage your debt is to know exactly how much you owe. This information will help you make intelligent and strategic decisions about how to pay off your debts and what refinancing options are available to you. By knowing this information, you can also better understand your financial situation and make informed choices about which products and services to pursue.

One of the most important things you can do in order to manage your debt is to know how much you owe. This will help you understand where you stand in terms of your debt and the amount of money that needs to be paid off. Secondly, it will help you determine what steps need to be taken in order to pay off that debt as quickly as possible. Thirdly, by knowing this information, you can make informed decisions when it comes to financial planning.

Pay Your Bills On Time Each Month

It’s not impossible to pay your bills on time, but it will definitely require more effort and organizational skills than usual. In order to ensure that you do, you need to keep a tab on your expenses and make sure that you have enough money set aside each month in order to cover your current liabilities. This way, you won’t find yourself in a predicament where you can’t meet your bills because you don’t have the funds available.

One of the most important things you can do to manage your debt is to pay your bills on time each month. This will help you stay on track with your financial obligations and avoid any surprises down the road. Paying your bills on time will also help you maintain a healthy balance in your bank account, as this will reduce the amount of interest that you owe.

When it comes to Debt Reduction Tips, there are a few things that you should keep in mind. First and foremost, it’s important to set realistic goals for yourself and try to stick to them as much as possible. Secondly, be proactive about managing your money by saving and investing as much money as possible. And finally, be mindful of the ways that you can improve your credit score so that you don’t have to file for bankruptcy in the future.

Are You Tired Of Scams?

Try The Most-Trusted Training Platform To Make Money Online!

Create A Monthly Bill Payment Calendar

One of the best ways to manage debt is by creating a monthly bill payment calendar. This would help you keep track of your financial obligations and would also help you identify any potential money-related problems. By keeping a record of your monthly payments, you would be able to better understand how much money you owe each month. Additionally, this would help you get a better idea about your budget and where you can cut back on expenses.

Creating a monthly bill payment calendar can be helpful in ensuring that you always have the money available to meet your financial obligations. This will help you keep track of your money and make sure that you have enough money to cover your bills each month. Additionally, it’s important to have this information readily available so that you can make quick and effective decisions when it comes to paying your bills.

Make At Least The Minimum Payment

One of the most important things to remember when it comes to managing debt is to make at least the minimum payment on your debts. This simply means that you should be making a minimum payment on all your debts, even if you have high-interest debts. A debt that has a high-interest rate will be more difficult to pay off, and it will require longer terms of repayment.

In addition, this will also increase the chances of getting into debt again in the future. If you do not make a minimum payment on your debts, you will slowly but surely lose control over them. This could lead to a number of difficult consequences for both yourself and your bank account. You may find it difficult to get credit or borrow money in the future and find it necessary to seek outside financial help.

One of the most important steps in a debt management plan is to make sure that you make at least the minimum payment on your debts. This will ensure that you are able to maintain a good credit rating and take care of your financial obligations. Keep in mind that making minimum payments on your debts can also help you get out of debt faster.

Decide Which Debts To Pay Off First

One of the most important things that need to be done when it comes to debt management is to decide which debts to pay off first. This will help you manage and control your expenses and also provide more financial stability in the long run.

It is essential to have a clear-cut plan in place to pay off debts first and foremost. This way, you would be able to focus on other more important areas of your life. It’s also beneficial not to have any heavy debt hanging over your head when it comes time to manage your finances. When it comes to debt, it is better to be disciplined and use a plan that has been worked out by professionals.

Build An Emergency Fund To Fall Back On

One of the most important decisions we can make is to build an emergency fund. A properly constructed emergency fund can provide you with enough resources in the event that something unexpected happens. Not only will this be helpful in case of a natural disaster, but it can also be helpful if you lose your job or have unexpected expenses.

It's important to build an emergency fund so that you have a cushion in case of any unexpected expenses. When it comes to debt, it's also important to take into consideration your credit score and make sure that your loan is within your means.

One of the most common mistakes people make when it comes to their debt is not having an emergency fund. A large part of your ability to manage your debt will hinge on your emergency fund. If you lose your job, can't afford to pay your rent, or have sudden unexpected expenses – any of these could lead to a major financial crisis, you'll want to have an emergency fund in place. In fact, many businesses require employees to have at least $2,500 saved up in order for them to be considered for promotion.

How To Manage Your Debt In A Healthy Way

There is no one-size-fits-all answer to this question, but there are certain tips that can be followed in order to manage your debt in a healthy way.

First and foremost, it’s important to understand that debt is not a bad thing. In fact, debt can actually be an asset when used correctly. You should use your debt wisely and make sure you are taking advantage of the opportunities that come with being in debt. To do this, it’s important to keep track of your spending and income.

This will allow you to see which items are costing more than they should and which ones are providing you with the necessary financial cushion. Additionally, it’s important to make sure you aren’t using your debt as a tool to pay for unnecessary expenses.

There are a few key points that you need to keep in mind when trying to manage your debt.

- The first and foremost is that you should never forget the importance of being thrifty. You should always be mindful of how much money you’re spending and make sure that you’re not wasting any unnecessary funds.

- Secondly, it’s important to take on a responsible financial plan. This plan should include setting realistic goals, tracking your progress, and making necessary adjustments as needed.

- Finally, it's important to have regular communication with your creditors. This will ensure that you're keeping up with their every move and that you're getting the best terms for your debt.

How To Make Smart Financial Decisions

There are a few key things that you can do when it comes to making smart financial decisions. You should first determine your financial objectives. This will allow you to focus on the most important aspects of your debt management. Secondly, you should make sure that you have enough money saved up to cover your debts in case of an emergency. Lastly, you should have a budget in place that will help you manage your finances and keep track of your expenses.

One of the most important things you can do when it comes to managing your debt is to understand the different types of debt. There are two main types of debt: long-term and short-term debt. Long-term debt is typically associated with more important investments, such as mortgages and car loans. Short-term debt, on the other hand, is often related to everyday items, such as rent or student loans.

When it comes to making smart financial decisions, it’s important to remember that a balance must be struck between paying off debts quickly and paying off debts slowly. Paying off debts quickly will result in increased interest rates and an increased amount of money spent on interest payments. On the other hand, paying off debts slowly will allow you to maintain a healthy financial cushion which will help you save for future needs.

Want To Learn How To Create Your Own Website And Online Business?

Try My #1 Recommendation Training And Hosting Platform!

Create A Budget And Stick To It

One of the most important things that you can do to manage your debt is to create a budget and stick to it. This will help you keep track of your financial position and make necessary decisions. By following a budget, you’ll also be able to identify possibilities for reducing or eliminating debt. You can also use this system to determine what kind of repayment plan is best for you. By following a budget, you’ll be able to better understand your financial situation and will be in a better position to choose the right repayment plan for you.

Take Control Over Your Life By Creating A Lifestyle Plan

One of the most important things that you can do to manage your debt is to create a lifestyle plan. A healthy diet, regular exercise, and plenty of sleep are all important for maintaining good health. When it comes to managing debt, having a healthy lifestyle is one of the most crucial things that you can do.

This will help you to keep your finances in order and reduce the amount of debt that you have. Another important factor to consider when it comes to managing debt is your credit score. Poor credit ratings can lead to a difficult financial situation because lenders will not offer loans or extensions at low-interest rates. A good credit rating is essential for obtaining loans and other financial items such as car insurance, mortgages, and home improvements.

Conclusion

Debt management is not a one-time event. It’s an ongoing process that will require regular effort and consistency in order to maintain your financial stability. If you are not able to manage your debt correctly, it will cause you serious problems down the road. Debt management is one of the most important aspects of running a successful business. By following these steps, you can reduce your risk of becoming financially stressed and stressed out debtors will be less likely to ask for financial help in the future.

I trust you enjoyed this article on the Best Debt Management Tips. Would you please stay tuned for more articles to come? Take care!

JeannetteZ

Want to Learn How to Build Your Own Home-Based Online Business & Start Making Money Online From Your Comfortable Couch?

Try Wealthy Affiliate!

Your Opinion Is Important To Me

Thoughts? Ideas? Questions? I would love to hear from you. Please leave me your questions, experiences, remarks, and suggestions about the Best Debt Management Tips, in the comments below. You can also contact me by email at Jeannette@WorkFromAnywhereInTheWorld.com.

You may also enjoy the following articles:

Top Communication Skills You Should Have in 2022

The Importance Of Diversification + Pros & Cons

How To Prepare For A Job Interview

How To Make Money Work For You

Best Tips For Staying Productive When Working From Home